Crypto Market Pulse - July 1, 2024

LAST WEEK RECAP:

- U.S. PCE was flat MoM and 2.6% YoY, both in line with estimates.

- Mt. Gox announced plans to start BTC and BCH repayments in July.

- VanEck and 21Shares filed for Solana ETF.

- SEC sues Consensys, alleging MetaMask is an unregistered securities broker.

- Crypto was not discussed in the first U.S. presidential debate, but Trump will likely speak at the Bitcoin 2024 Conference in Nashville.

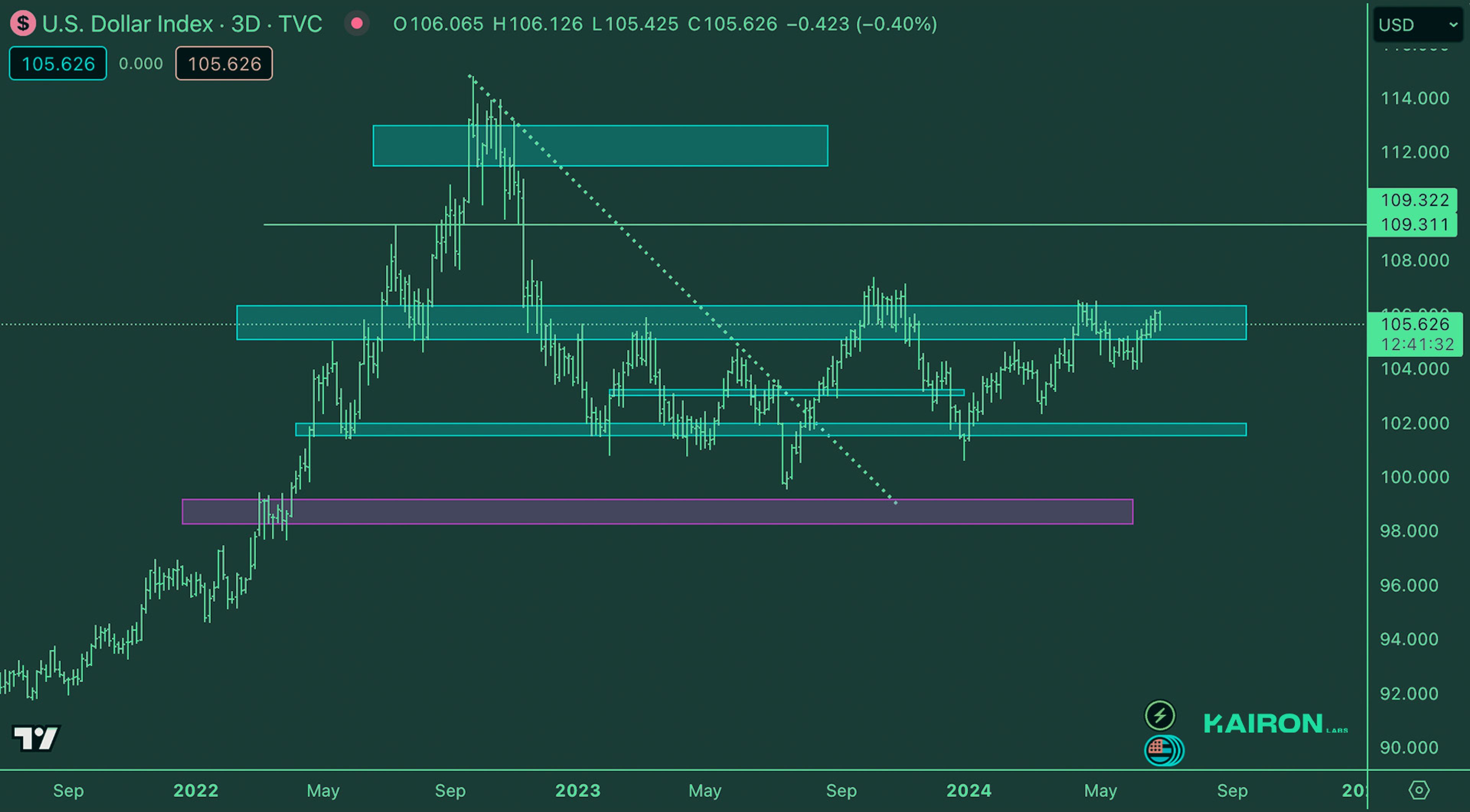

LEGACY MARKETS – DXY

DXY is still showing strength, mainly due to the weakness of other currencies. For crypto to recover, a pullback to the lower range of 100-106 will be needed.

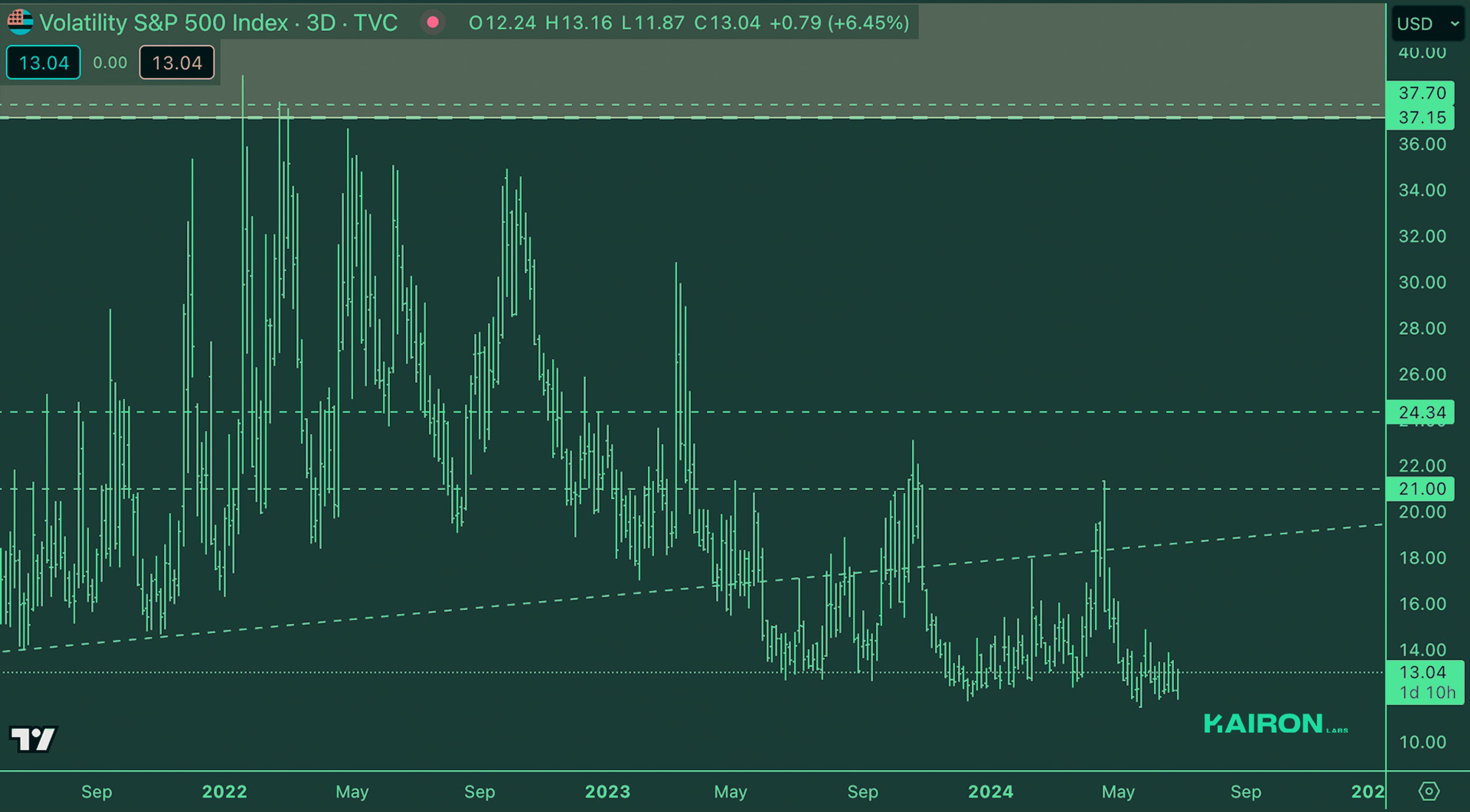

LEGACY MARKETS – VIX

VIX increased slightly above 13 again, showing some increasing fear in the market, but the general level is still low enough to be supportive.

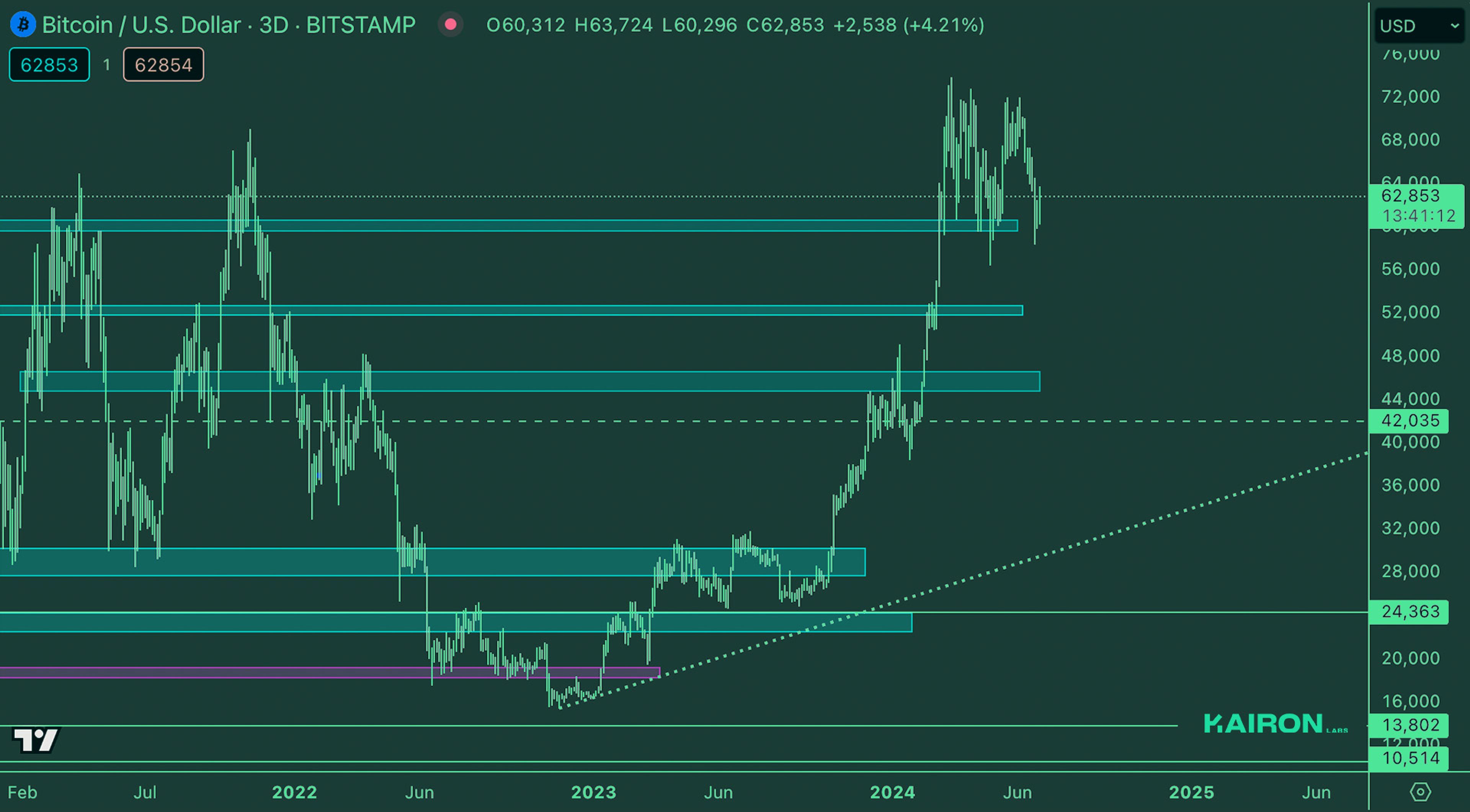

BTC WEEKLY VIEW

BTC bounced from a range low. However, it is still uncertain, as the German government is moving coins to centralized exchanges.

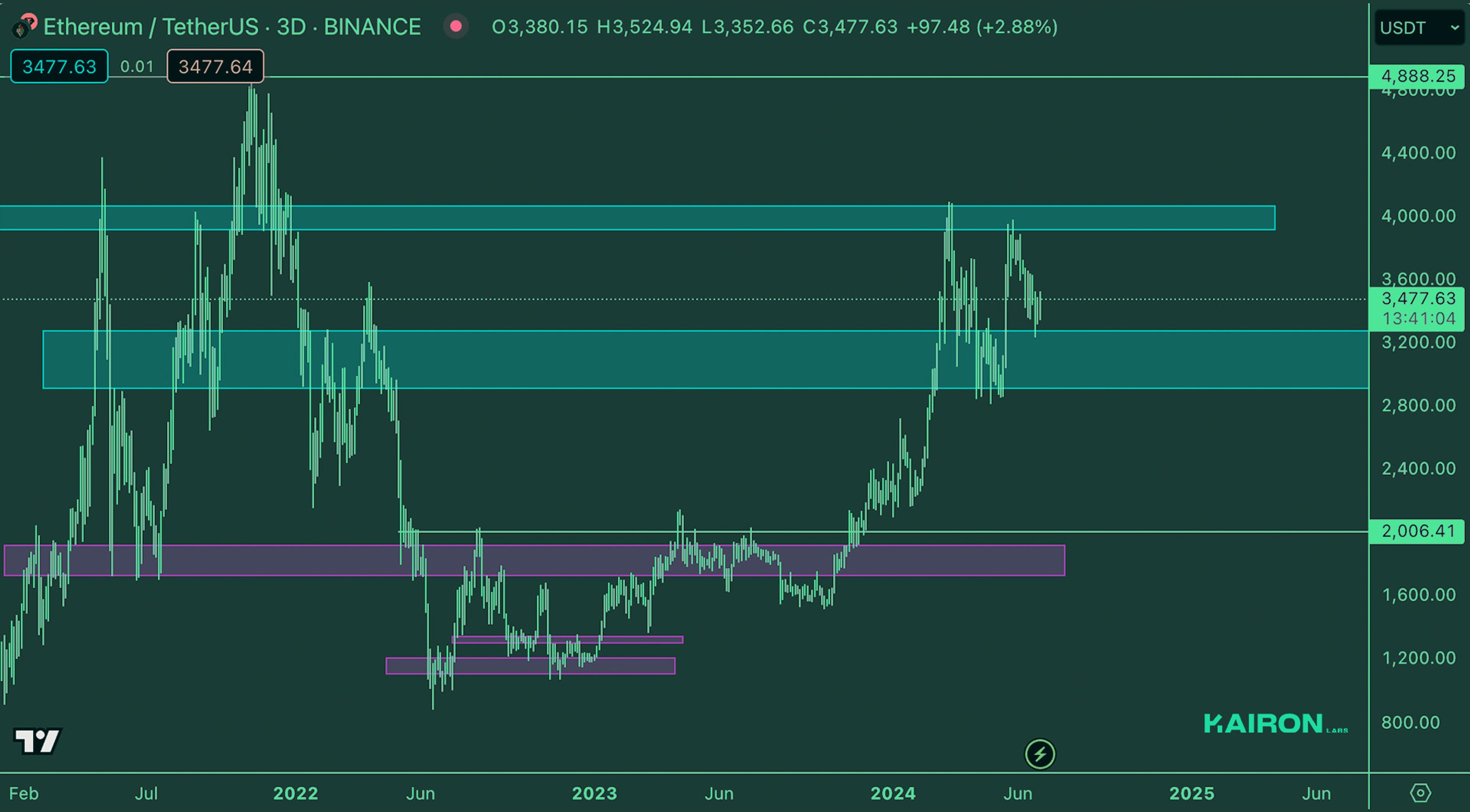

ETH WEEKLY VIEW

ETH is still holding above the 2800-3200 support zone and has been showing relative strength. The ETH ETF is likely to start trading in early July. The market focus will be on the upcoming ETF inflow.

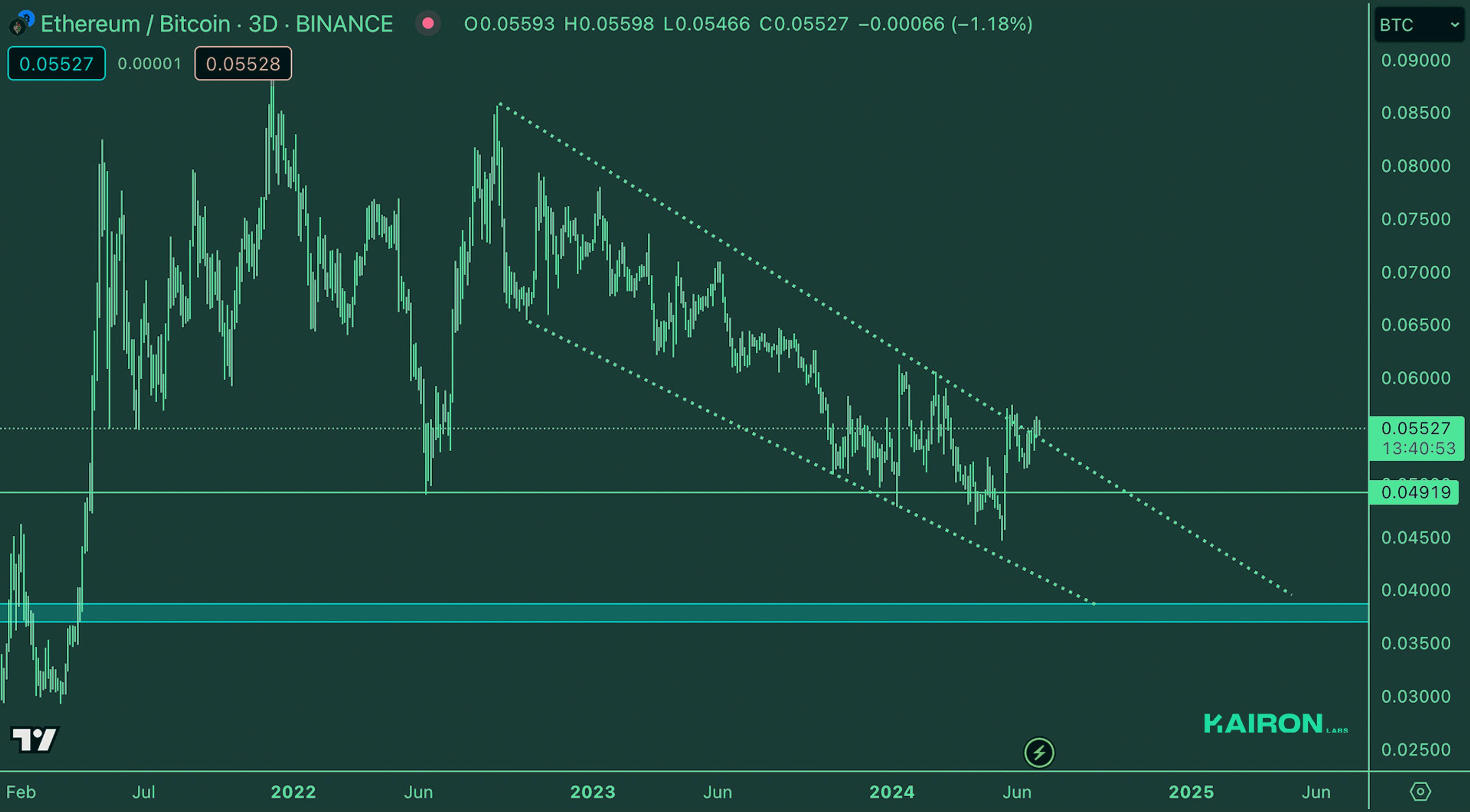

ETH/BTC

ETH/BTC has technically broken out of the downtrend. With BTC likely being muted by the German government selling and the ETH ETF likely going live soon, it makes sense for ETH/BTC to trend upwards further.

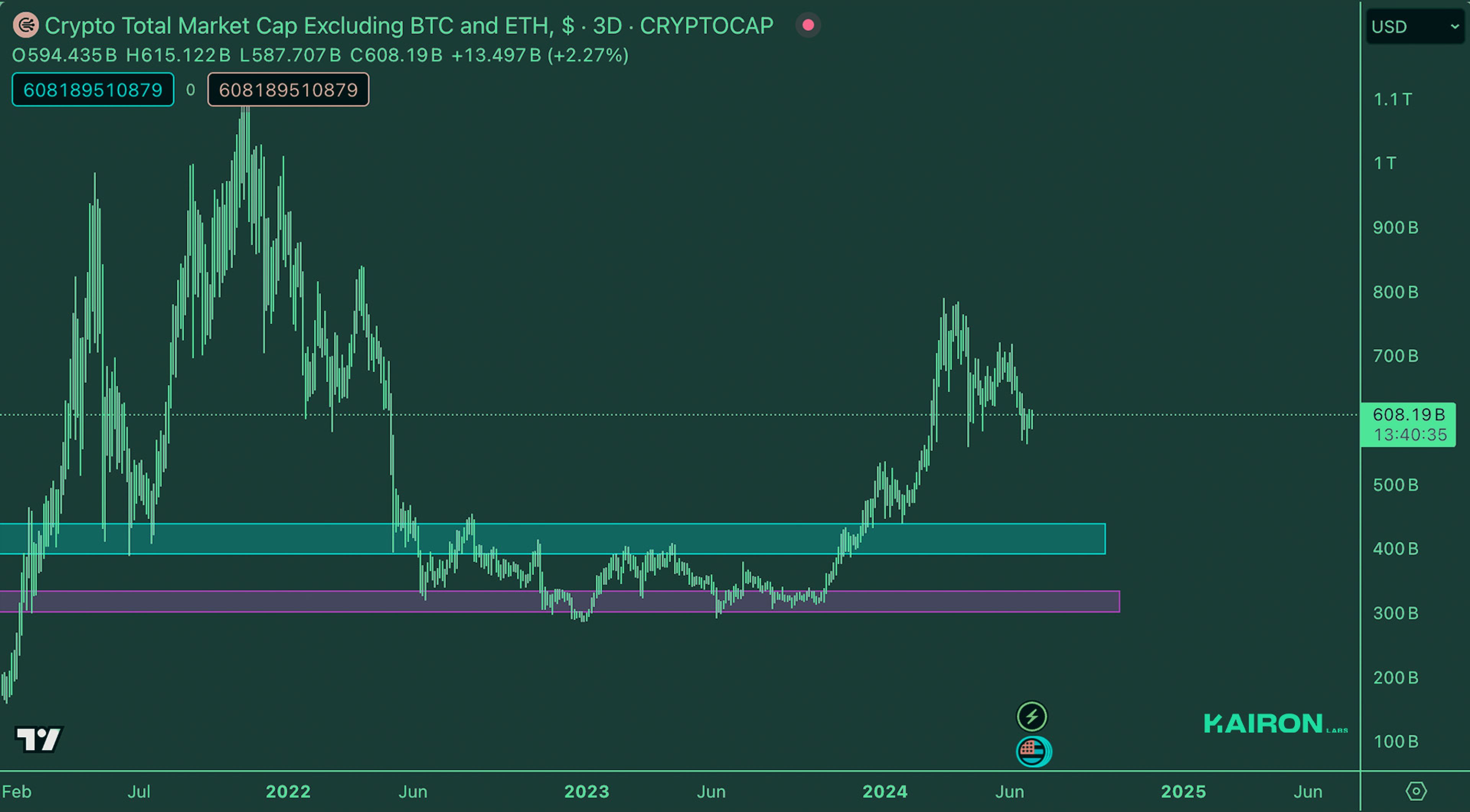

TOTAL3 USD MARKET STRENGTH

Alts have started finding some support, with BTC bouncing on range lows. If the bull cycle continues as usual, this is probably one of the best entry points of the year.

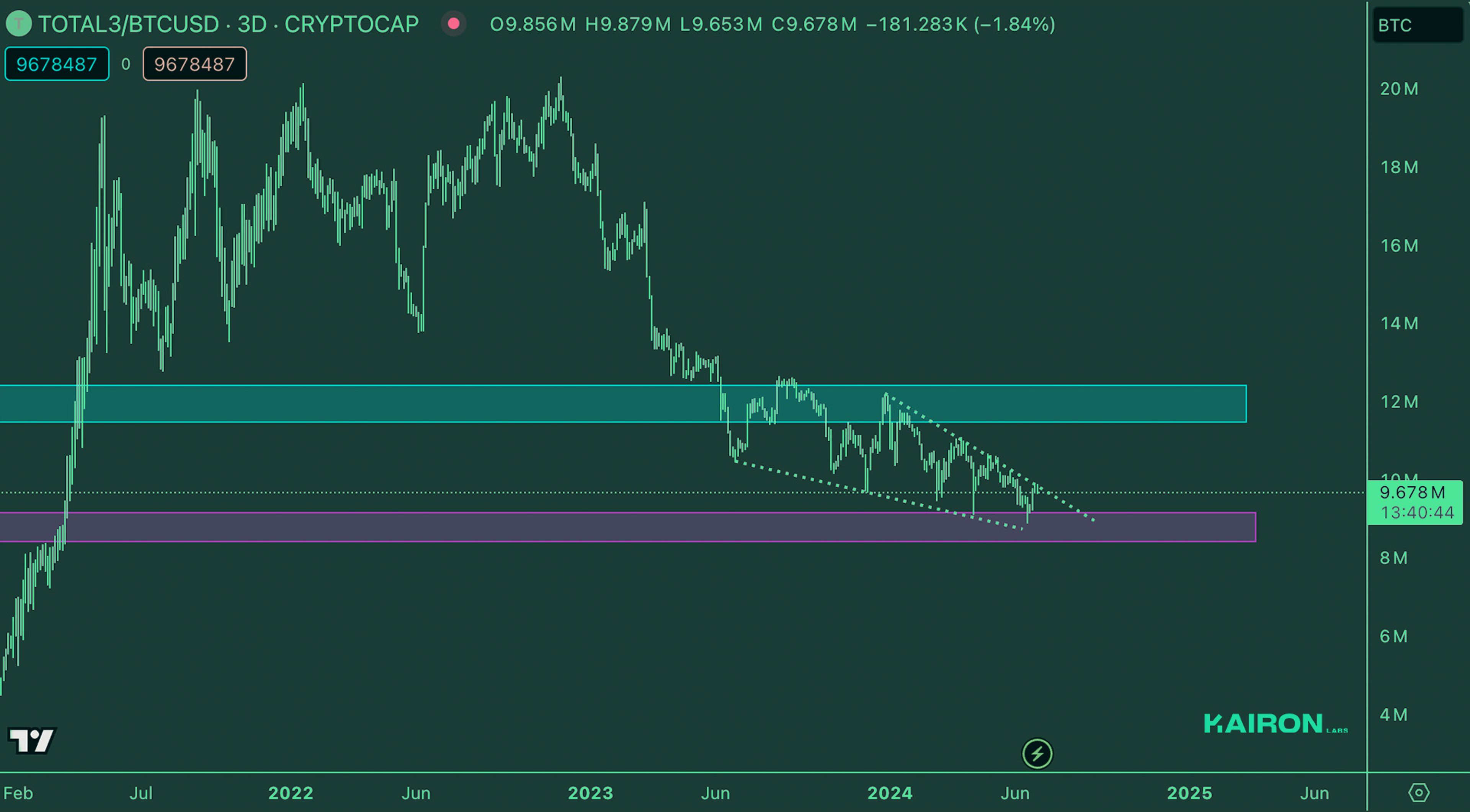

TOTAL3 BTC MARKET STRENGTH

TOTAL3/BTC finally started pushing upwards again. With the range here becoming more compressed, a big move on ALT/BTC is poised to happen sooner rather than later.

SUMMARY

- U.S. core PCE increased 0.1% MoM and 2.6% YoY, both in line with estimates. The annual rate is the lowest rate since March 2021.

- With BTC under pressure from all the possible sell angles, ALT/BTC seems poised to start moving soon.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

This post was prepared by Kairon Labs Trader Patrick Li and Joshua Van de Kerckhove

Edited by: Carla Ramos

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide