Understanding Market-Making Models in Crypto

Crypto market making is the heart of digital asset trading, in which market makers facilitate the buying and selling of digital assets by providing continuous buy and sell orders. They ensure good liquidity, a critical aspect in the decentralized and fragmented characteristics of the crypto market. But what are the popular market-making strategies that make liquidity happen? Let’s talk about it.

Evolution of Market-Making Models in Crypto

Digital assets come in unique shapes and challenges that make it necessary for market-making models to evolve. This was originally a painstaking process, with individuals manually adjusting order prices based on market conditions.

The market shifts and matures through time. Tech adapts to meet ever-changing demands. With the increase in trading volumes, automated market-making (AMM) systems and algorithmic trading became prevalent in this sector of finance. This tech advancement allows market makers to execute trades at high speeds and respond to market changes in real time—further accelerated by blockchain developments, smart contracts, and DeFi.

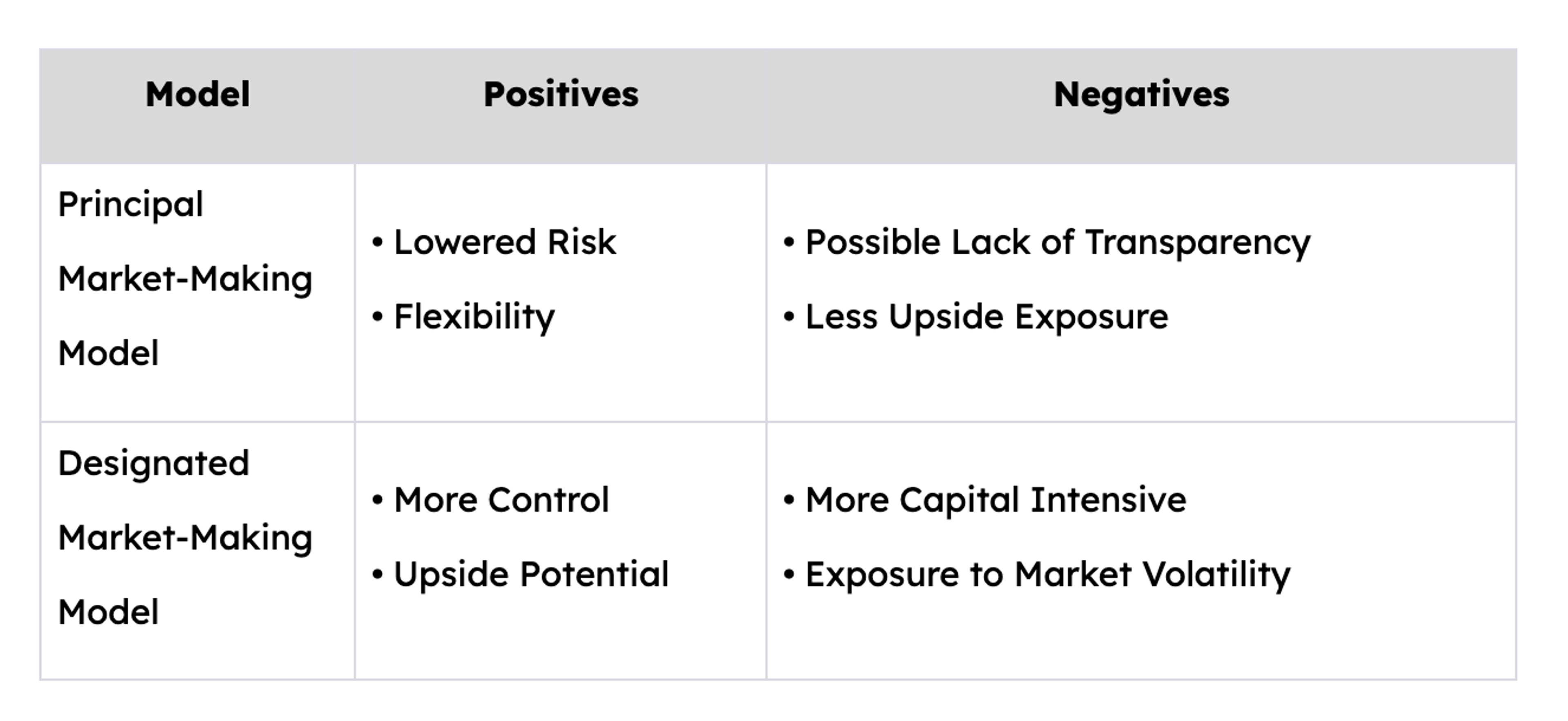

Designated Market-Making Model vs. Principal Market-Making Model

Further down the road, we have two primarily used market-making models in the crypto space: the Designated Market Making Model and the Principal Market Making Model. Let’s take a look at the difference in this educational video:

These market-making models effectively mitigate slippage and enhance market depth. The difference lies in their risk profiles and levels of engagement for token issuers. With unique characteristics, token issuers can compare the two and decide which aligns with their trading objectives.

Liquidity: The Role of Crypto Market Makers

What do market makers and these models bring to the table? Liquidity.

Liquidity is king in any financial market, and the crypto space is no exception. Market makers enhance liquidity by narrowing bid-ask spreads—the differences between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). This spread reduction makes it easier for traders to buy or sell assets at fair prices, ultimately attracting more participants.

Liquidity is especially critical for institutional investors and large traders, as it allows them to move in and out of positions without significantly impacting the market price.

We’ve established how market makers keep the market flow using carefully strategized models. What are the implications of an illiquid project without market makers?

- Wider Spreads: Without a market maker’s involvement, spreads widen, increasing the expense for investors and affecting market efficiency.

- Increased Price Volatility: Illiquid projects become more prone to unpredictable price movements, dissuading potential investors.

- Potential Difficulty in Trade Execution: Thin order books and limited liquidity can create challenges in promptly matching orders, leading to difficulties entering or exiting positions.

Good market-making that utilizes the right strategies and ethical solutions go hand-in-hand in contributing to the overall stability of the crypto market.

Here's a helpful infographic that might come in handy:

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide