Crypto Bullruns Past and Present

Crypto bull runs historically succeed in bitcoin halving, and as we saw the halving happen this April 20, 2024, the excitement for a potentially massive bull run also moved the market. What can we expect from this upcoming bull run? How will it differ from the bull runs of the past?

Last March 2024, we opened this discussion on a Twitter space featuring special guests who know a thing or two about historical bull runs. Today, we summarize this discussion in a blog, including a few other market updates as of November 14, 2024.

Crypto Bull Runs in History

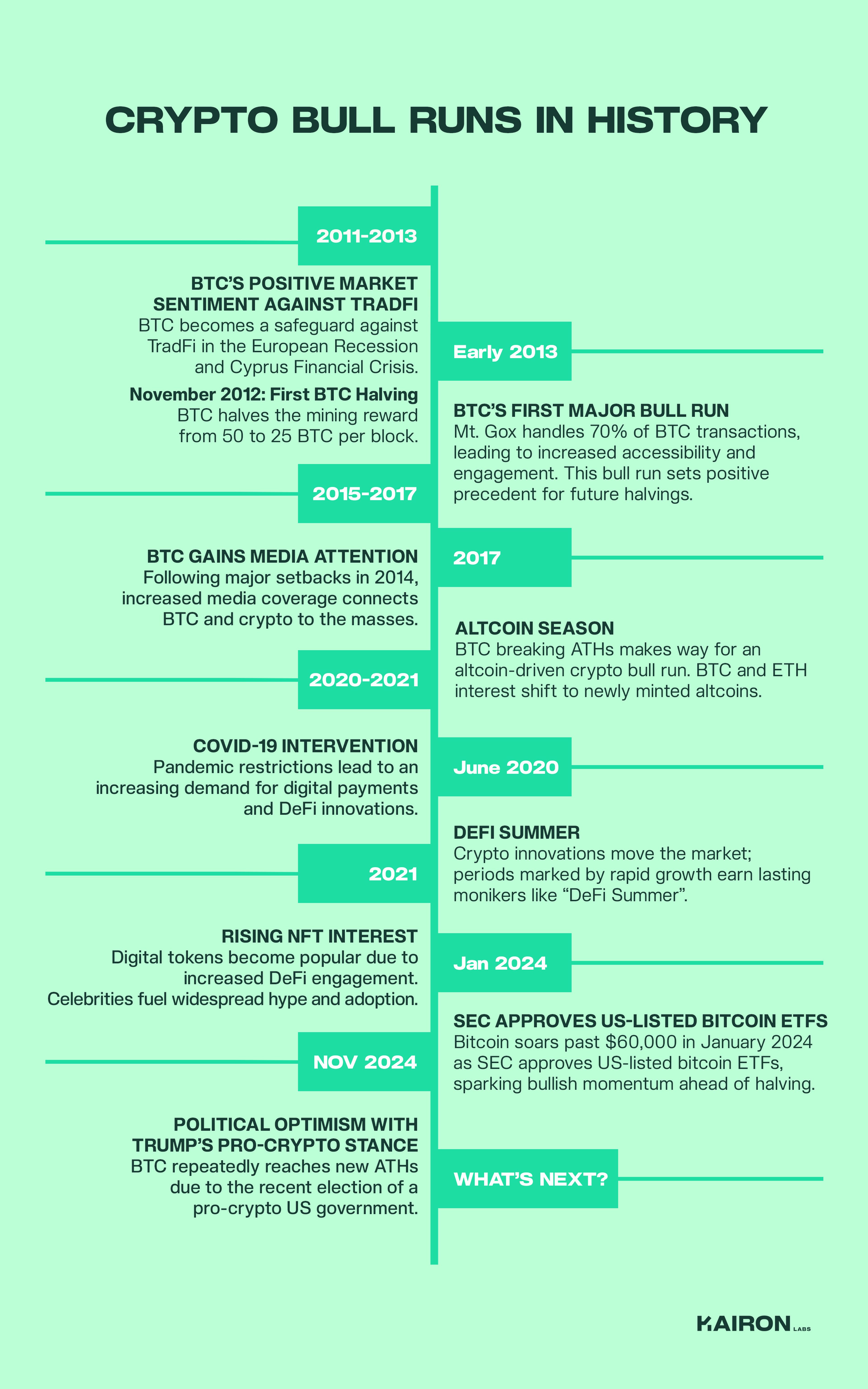

Cryptocurrency has witnessed numerous bull runs throughout its history, which most traders call part of the "cycle theory," where unique catalysts and market dynamics mark the beginning or end of each cycle. Here is the chronology of these bull runs before and after the 2024 halving event this April 2024.

2012-2013

BTC as a Safeguard Against Geopolitical and Economic Crises

Amidst economic uncertainties buoyed by the European Recession and Cypriot Financial Crisis, 2011 - 2013 saw Bitcoin as a safeguard. The market considered Bitcoin's potential as a hedge against Tradfi instruments, which the market found unreliable amid increased geopolitical tensions.

November 2012: BTC First Halving

On November 28, 2012, Bitcoin experienced its first halving, reducing the mining reward from 50 to 25 BTC per block. This event was met with uncertainty, as the price of Bitcoin hovered at $12.20, and many worried about potential declines in network performance due to reduced profitability. Following the halving, some miners turned off their rigs to cut costs, temporarily lowering the network's hash rate and difficulty.

Early 2013: BTC's First Major Bull Run

Bitcoin’s price trajectory shifted significantly in 2013 as exchanges like Mt. Gox, which handled about 70% of all Bitcoin transactions by the end of 2014, facilitated broader user access to crypto. This accessibility drove increased adoption and engagement within the community.

As more people joined, Bitcoin’s price surged, climbing from just $13 at the beginning of 2013 to over $1,000 by November of that year. This rapid price rise marked a turning point for Bitcoin.

This milestone indicated that halvings tend to boost the network’s strength and support long-term price growth, which established a bullish precedent for future halvings.

This bull run took a drastic turn after Mt. Gox kicked off a series of troubles within the space: a major hack revealing the loss of over 850,000 BTC, 750,000 of which belonged to Mt. Gox customers. Hackers target more exchanges shortly after, and market sentiment towards BTC and crypto plummets.

2017 and 2020-2021 Bull Run BTC Analyses

2016-2017

BTC Gains Media Attention

Following the turbulence of previous years, including Mt. Gox and the Silk Road closure in October 2013, Bitcoin experienced a resurgence from 2015 to 2017, driven by mainstream media coverage and growing adoption. The price surged from $200 to $670, marking a watershed moment in Bitcoin's journey to mainstream recognition.

In September 2017, Bitcoin held steady at around $4,000 before climbing to $5,000 and $6,000 by mid-October. By Nov. 2, it surpassed $7,000 and continued its rapid ascent, breaking $8,000, then $10,000, and reaching over $19,000 by mid-December.

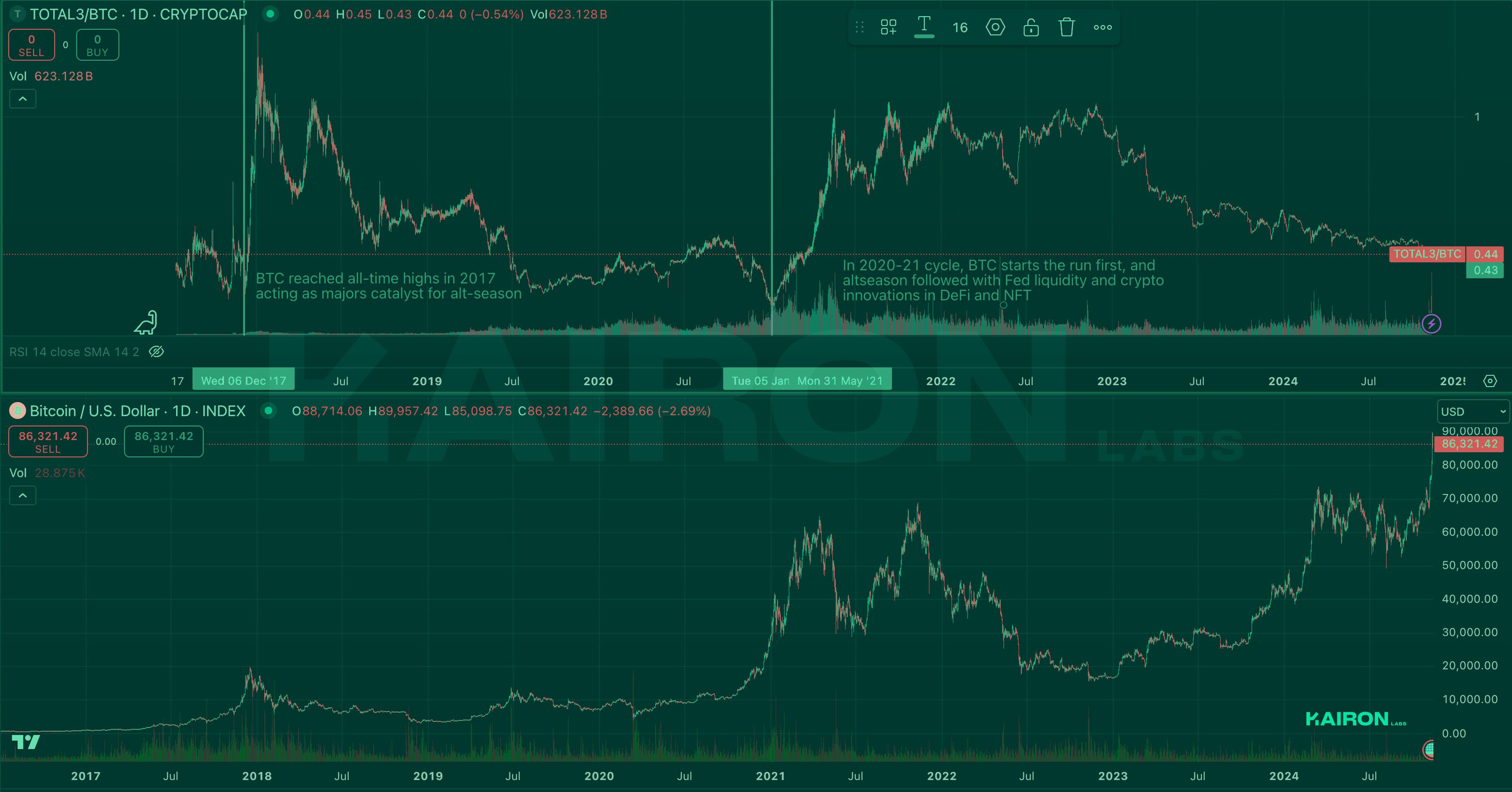

2017: Masses Shift to Altcoins

BTC breaking its all-time highs served as the main catalyst for the altcoin-driven crypto bull run in 2017. Market participants, no longer limited to tech-savvy, big-time investors, flocked to major coins like BTC and ETH and newly minted altcoins, which became more mass-driven due to meme-adjacent origins.

2020-2021

COVID Intervention and the Birth of DeFi

During the COVID-19 pandemic, cryptocurrencies experienced unprecedented growth, and there was a surging demand for digital payments and DeFi solutions. To battle the ongoing unrest from extended lockdowns, governments started providing subsidies to families, which prompted people to have additional capital to invest in cryptocurrencies.

By April 2020, Bitcoin rose above $7,000, reaching over $11,000 in July and $12,000 in August. Bitcoin reached nearly $20,000 in November 2020, fueled by Federal Reserve liquidity and optimism surrounding a COVID-19 vaccine. This bull run, while meteoric, was followed by the crypto winter of 2022, highlighting the cyclical nature of the crypto market.

June 2020: DeFi Summer

Increased digital engagement led to major crypto innovations that moved the market. Periods marked by rapid growth earn lasting monikers like “DeFi Summer.”

2021: Rising NFT Interest

Non-fungible token (NFT) interest surged in 2021, largely due to increased digital engagement driven by the COVID-19 pandemic. The shift to online platforms, particularly Twitter and Clubhouse, facilitated active NFT communities that generated even more hype and adoption.

By its peak, celebrities and artists like Beeple turned major profits with their minted digital tokens.

2024-2025

Bitcoin and Ethereum ETF

Bitcoin experienced a significant surge in early 2024, crossing the $60,000 mark, fueled by anticipation surrounding the upcoming halving event and the SEC's approval of U.S.-listed Bitcoin ETFs. This milestone marked a convergence of traditional finance and cryptocurrencies, providing institutional investors a regulated avenue to participate in the Bitcoin market. The combination of regulatory approval and halving anticipation created an overall bullish sentiment.

November 2024: Political Optimism

The current cycle shows gradual liquidity improvements and anticipated Fed rate cuts, which boost market optimism, especially as Bitcoin repeatedly reaches new ATHs. Many attribute this momentum to recent political shifts, including Trump’s re-election and Elon Musk’s appointment as Head of DOGE (Department of Government Efficiency), signaling a pro-crypto stance.

Trump’s positive remarks on crypto at Bitcoin Nashville 2024 further fuel anticipation for a crypto-friendly economy. Additionally, the influence of crypto integration with AI and meme coins is expected to drive a strong new altcoin season.

What's Next?

In past crypto bull runs, altcoins typically started moving alongside BTC but then surged and often outpaced BTC once it reached a high level with strong momentum. In previous cycles, BTC has usually taken the lead, with its price growth boosting optimism across the entire crypto sector.

Initially, most altcoins (aside from large-cap coins) tend to lag behind BTC’s performance as the market waits for BTC’s bull run to build investor confidence and attract more liquidity.

At a certain point, however, catalysts arise that fuel broader altcoin movements. These catalysts mainly include:

- Significant shifts in monetary policy, such as a Fed rate cut

- BTC breaking previous all-time highs

- New narratives or applications within the crypto space.

For example, in the 2017 bull run, BTC breaking its all-time highs was the main catalyst for the altcoin season. In the 2020-2021 cycle, the Fed’s large liquidity injection due to COVID and the rise of crypto innovations like “DeFi summer” and NFTs acted as the primary catalysts for altcoin momentum.

The market wants to know how this upcoming bull market will play out, with institutional backing and novel sectors like GameFi, AI, and Meme taking the lead. Will the cyclical nature of bull runs still prevail in the next bull run? Or would it pioneer a new wave of bull runs that challenge history?

Bitcoin and cryptocurrencies run with the seasons, but innovation has been ever-present throughout history. Experts believe a crypto bull run is always on the horizon as long as the world innovates and advances. We’re not seeing the last of it anytime soon.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide