Crypto Market Pulse - March 17, 2025

LAST WEEK RECAP:

- US CPI (CPI YoY 2.8% vs 2.9%, MoM 0.2% vs 0.3%) and Core CPI (Core CPI YoY 3.1% vs 3.2%, MoM 0.2% vs 0.3%) were lower than expected.

- US PPI lower than expected (MoM 0% vs 0.3%, YoY 3.2% vs 3.3%).

- Bank of Canada cut rates by 25bps.

- Michigan consumer sentiment was lower than expected (57.9 vs 63.1), and 5-year inflation expectations increased (3.9% vs 3.5% previously).

- Fresh 25% tariffs on steel and aluminum took effect on 12th March, resulting in retaliation from the EU- which plans to impose 28bn in countermeasures next month.

- Trump initially threatened to raise tariffs to 50% for Canadian imports of metals but reconsidered after Canada suspended a new tax on US-bound electricity and the countries made plans for trade talks.

- MSTR announces $21 billion ATM offering of its series A preferred stock with proceeds primarily designated for additional Bitcoin purchases.

- Abu-Dhabi-based MGX and invests $2B in Binance, the first institutional investment in Binance’s history.

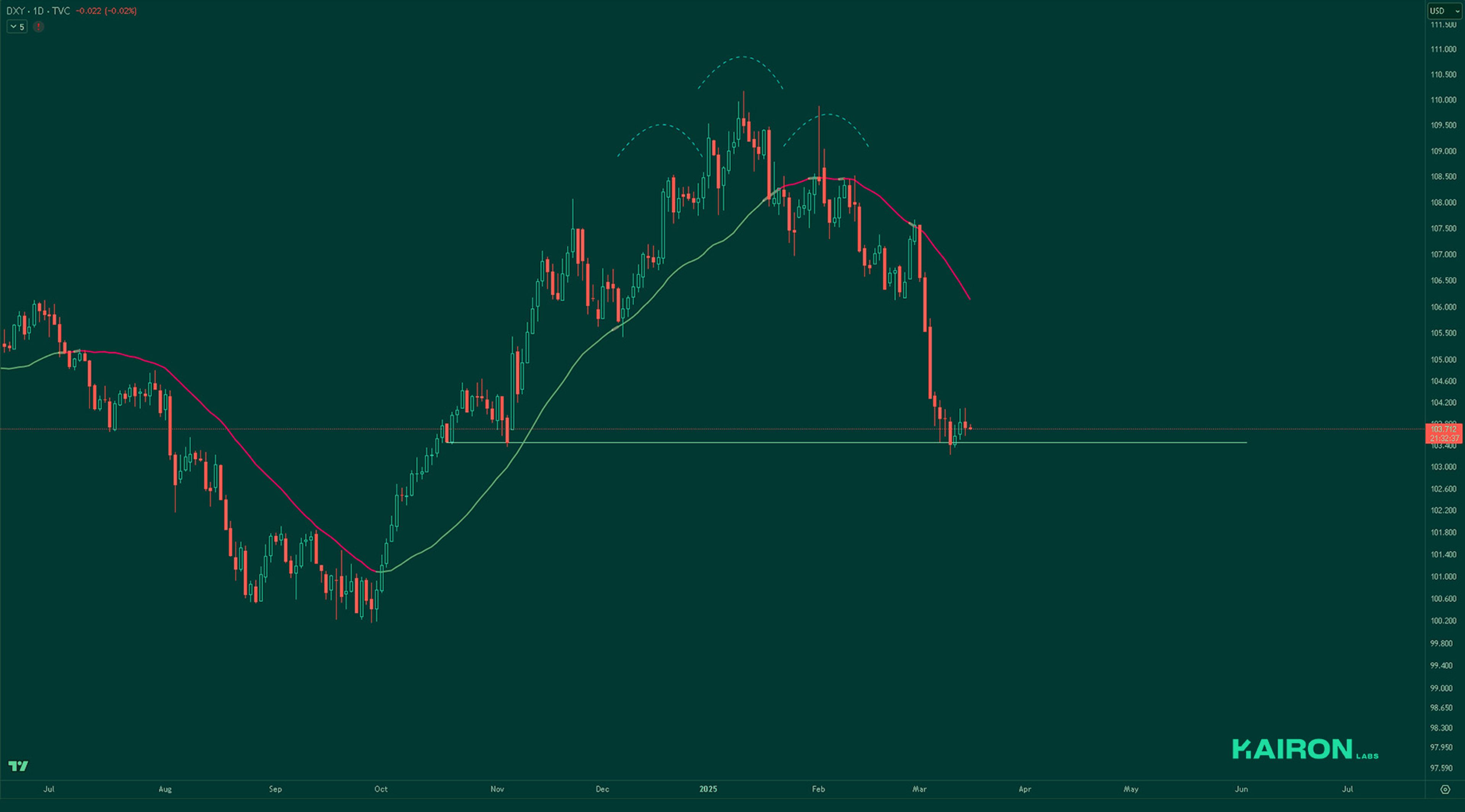

LEGACY MARKETS – DXY

DXY has found some support around 103.4, but the strength of this support may not be very strong. Without a strong reversal, DXY may continue to decline toward the strong support around 102.

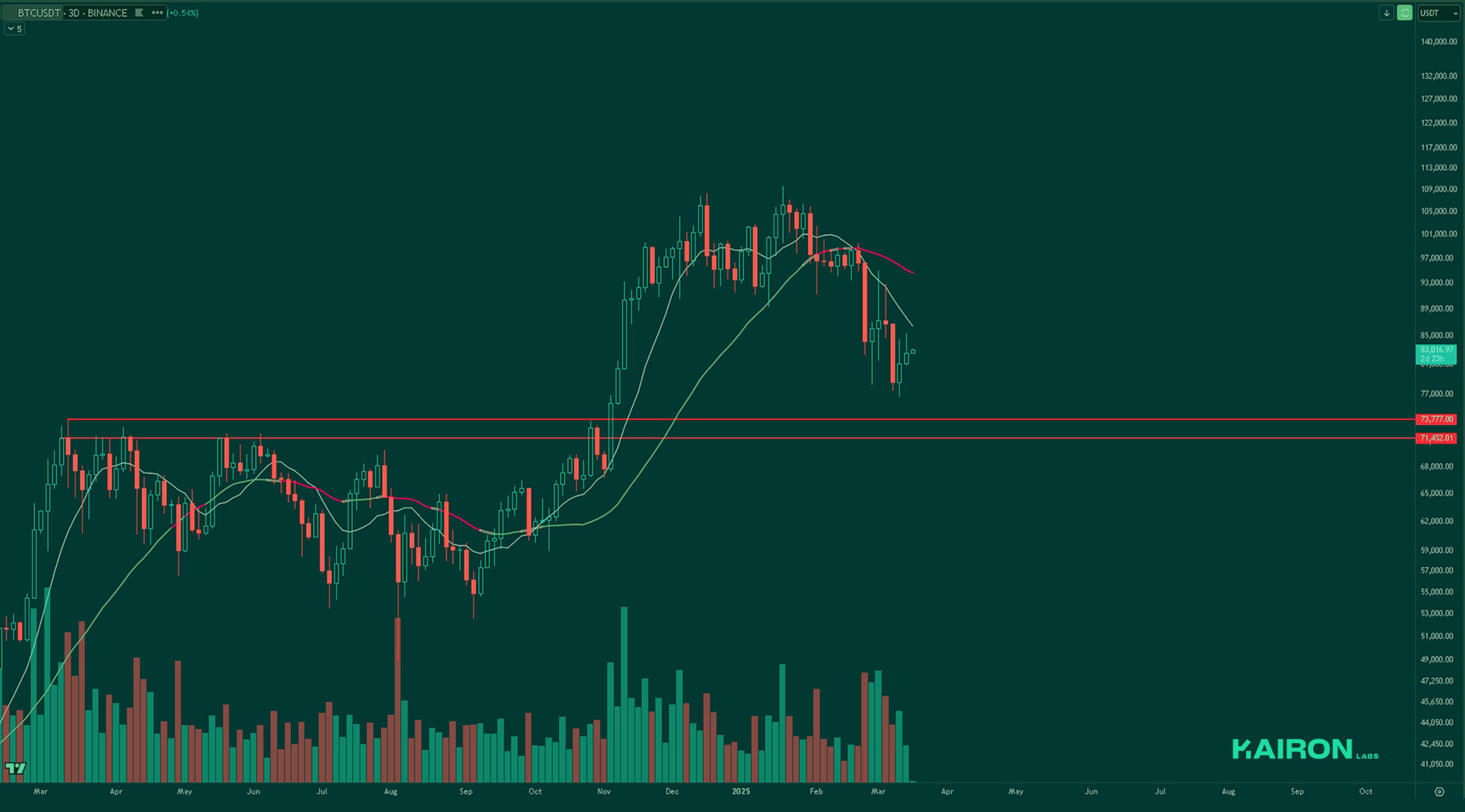

BTC WEEKLY VIEW

BTC has rebounded from last week's low, but it is still in a downtrend and remains below the short-term MA10 and MA30. The price may need more time to consolidate.

ETH WEEKLY VIEW

After breaking below 2100, ETH did not see a continuous rebound like BTC but instead moved in a more sideways consolidation. Overall, ETH’s price action remains relatively weaker.

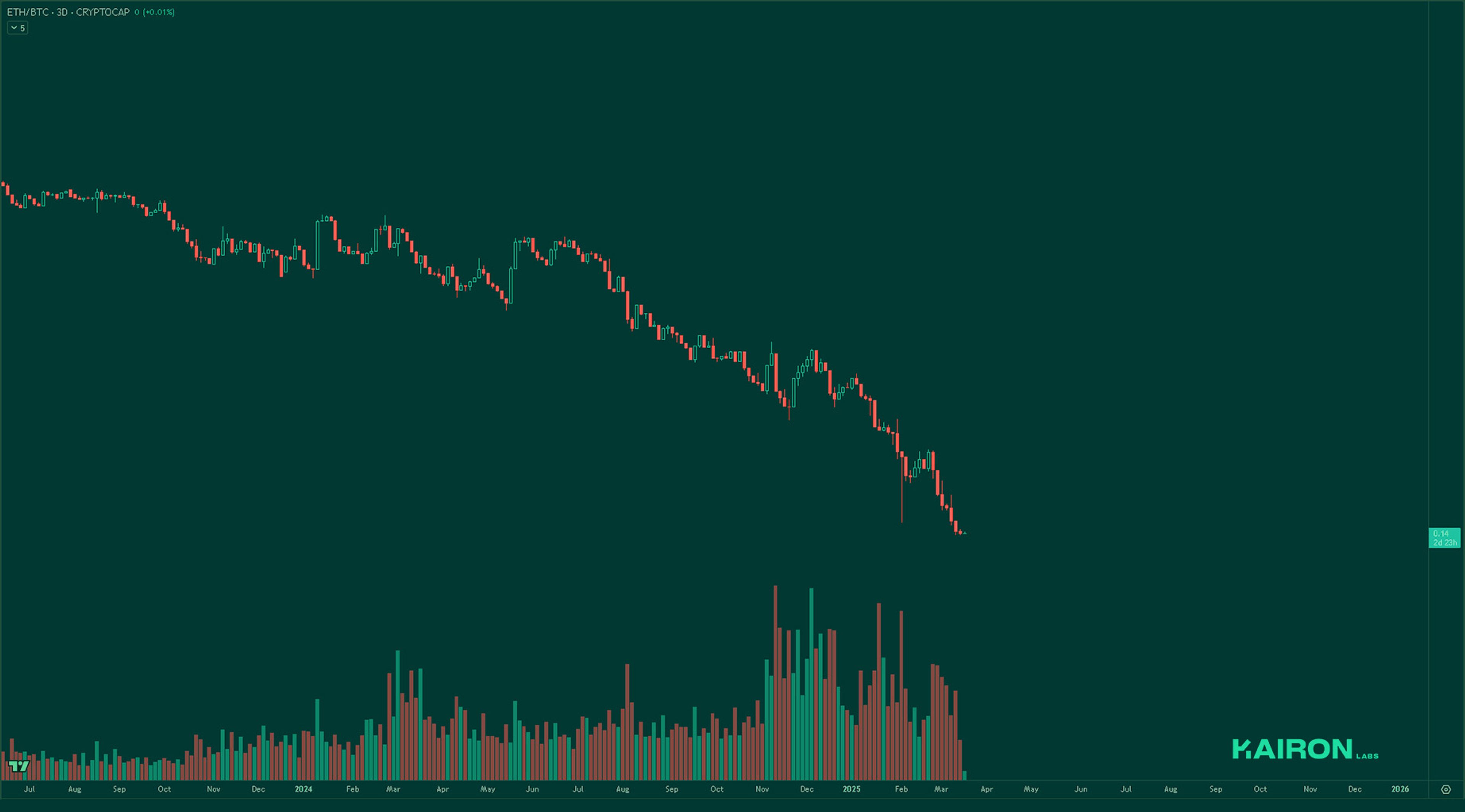

ETH/BTC

The continued decline of ETH/BTC is accompanied by decreasing trading volume. Without a clear reversal signal, no significant change is expected.

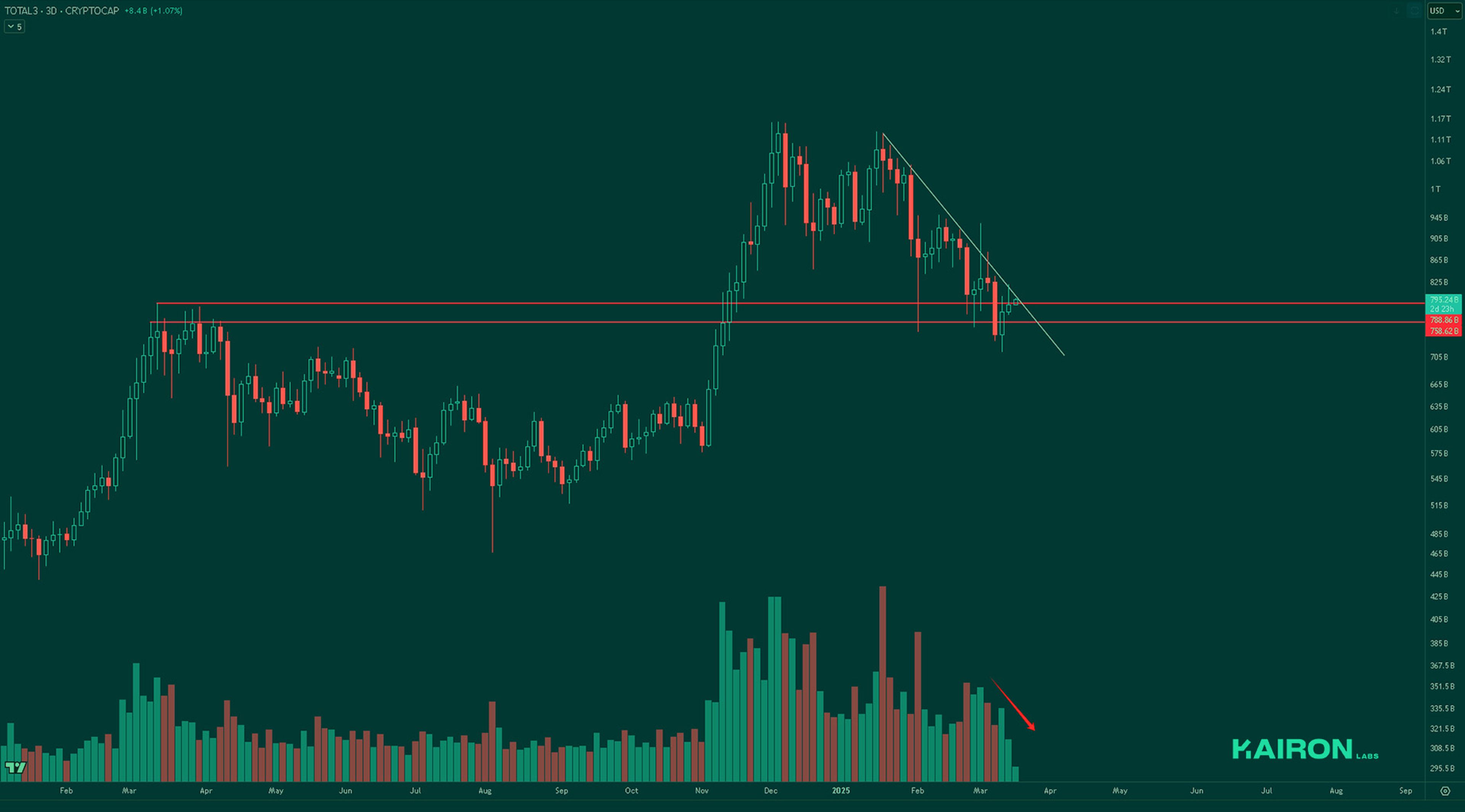

TOTAL3 USD MARKET STRENGTH

TOTAL3 is approaching the downward trendline in its rebound. Although trading volume has weakened during the recovery, if a surge in volume occurs near the trendline, altcoins could see a strong rally.

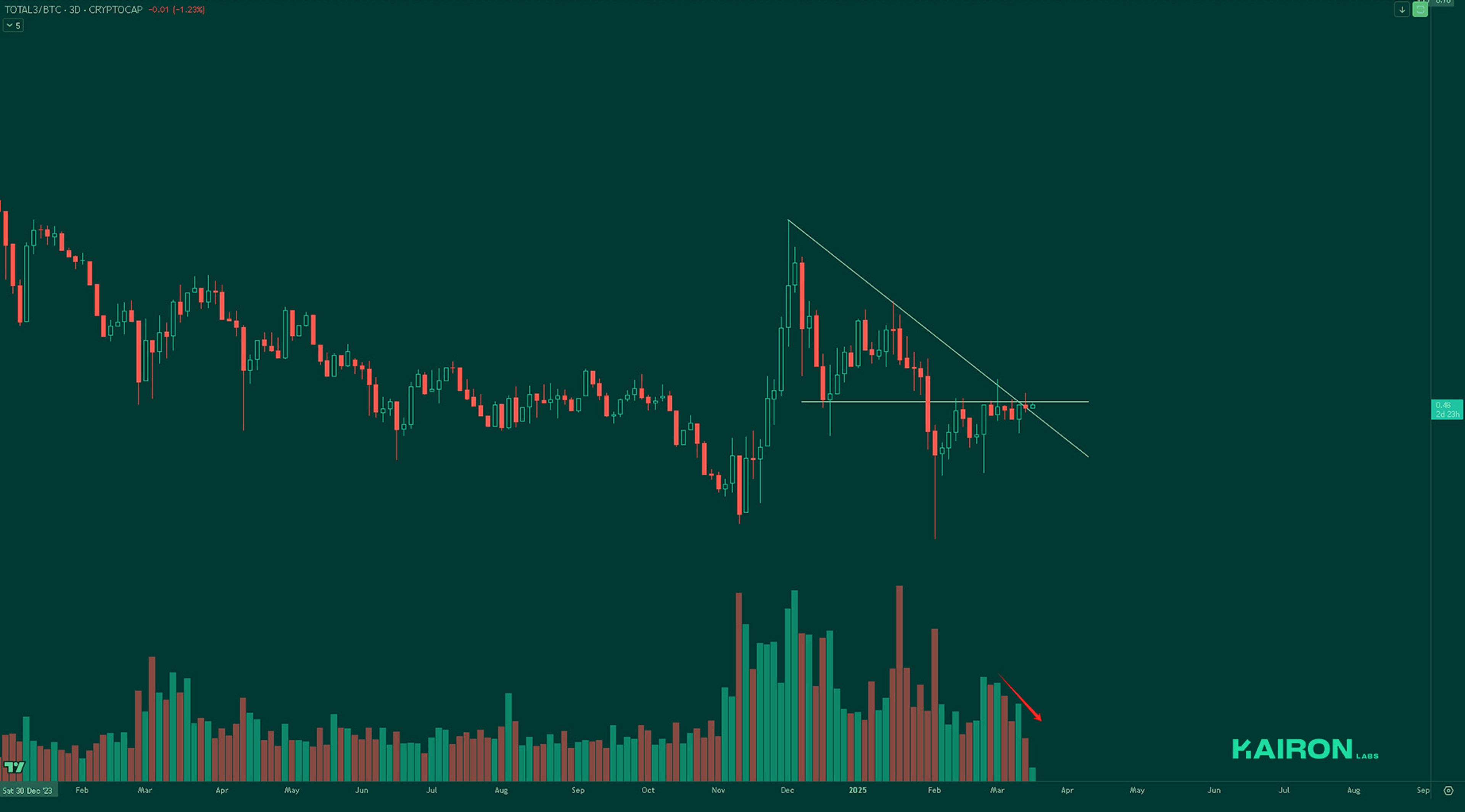

TOTAL3 BTC MARKET STRENGTH

TOTAL3/BTC is still hovering around last week's levels, but we should be close to seeing some movement soon.

SUMMARY

- BTC remained volatile, dropping to $76-77K early in the week amid tariff concerns but rebounding to $84-85K after weaker-than-expected CPI and PPI data.

- TOTAL3 (the total market capitalization excluding BTC and ETH, representing altcoins) is approaching a key downward trendline in its current rebound, which will likely be directly influenced by this week’s macro developments.

- Looking ahead, the FOMC meeting and Powell’s tone will be crucial in shaping market direction, while ongoing trade tensions continue to pose risks.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

This post was prepared by Kairon Labs Trader Patrick Li and Travis Su.

Edited by: Marianne Dasal

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide