Crypto Market Pulse - November 5, 2024

LAST WEEK RECAP:

- U.S. non-farm payrolls increased 12K in October, much less than the expected 110K due to storms and strikes. The unemployment rate remains at 4.1%, the same as estimated.

- U.S. PCE increased 0.2% MoM and 2.1% YoY in October, the same as estimated.

- U.S. Core PCE increased 0.3% MoM, same as estimated, The annual rate is 2.7%, slightly higher than 2.6% expected.

- MicroStrategy plans to raise $42B over the next 3 years to buy more BTC.

- Coinbase reported weaker-than-expected third-quarter results mainly due to lowered trading in the crypto market.

- U.S BTC ETF recorded $870M inflow last Tuesday, marks the 3rd largest daily inflow.

- Florida’s Chief Financial Officer says the state holds over $800M in crypto-related investments.

- Tether reported a $2.5B quarterly profit, a year-to-date profit of $7.7B

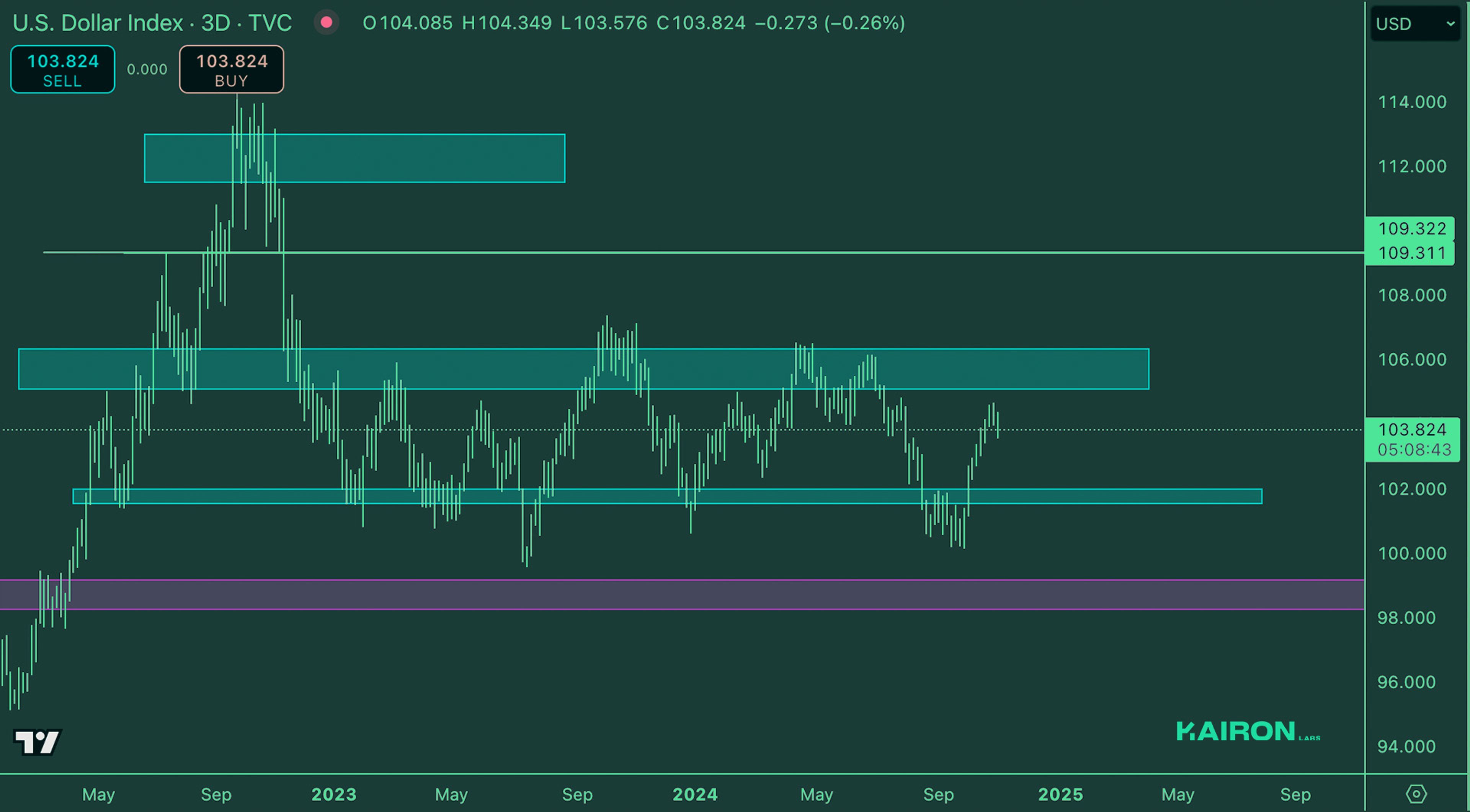

LEGACY MARKETS – DXY

DXY is consolidating on mid-range. With elections this week, the market is likely to see further-ranging price action.

LEGACY MARKETS – VIX

VIX has seen some upward movements. It's likely for hedging into elections.

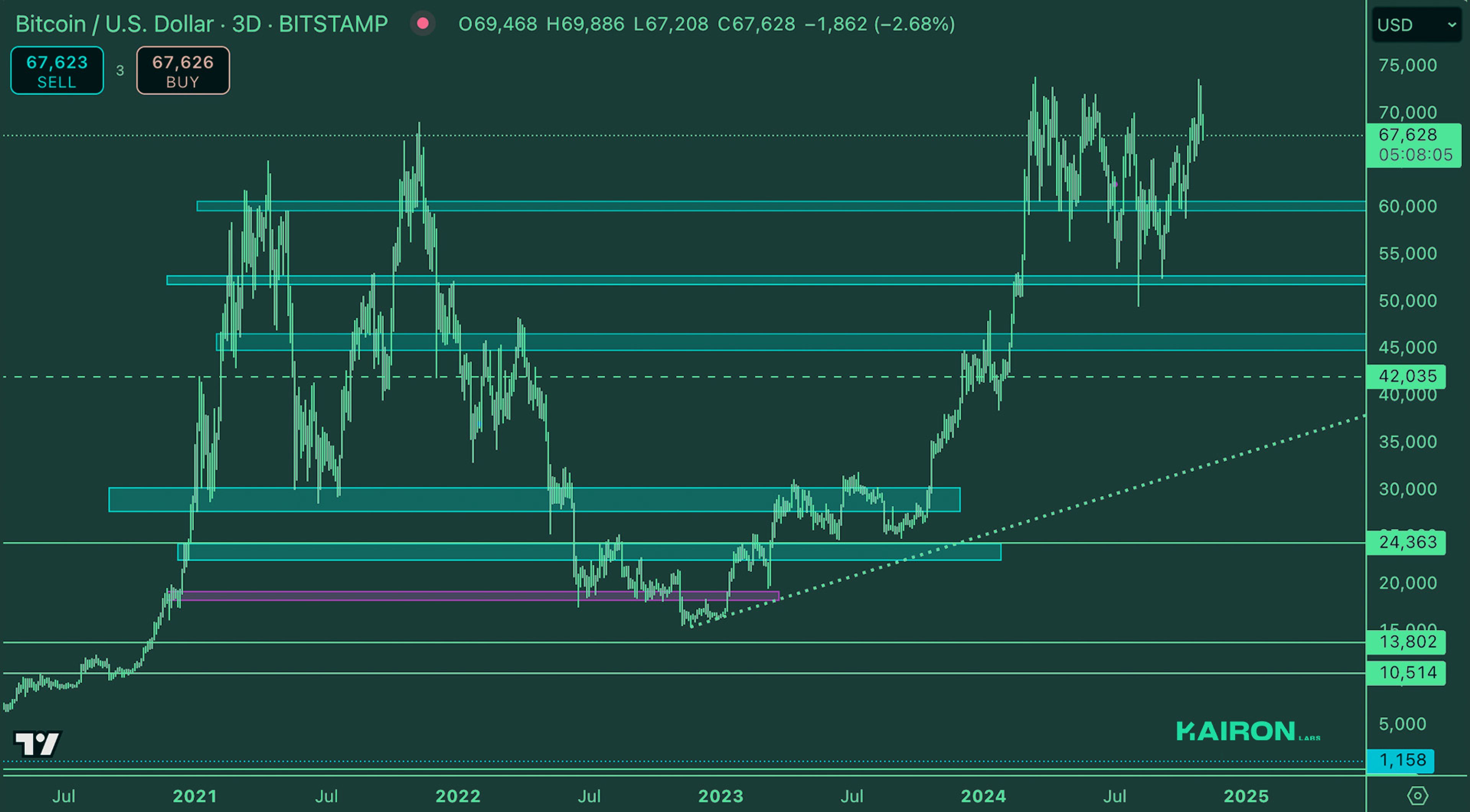

BTC WEEKLY VIEW

BTC is still consolidating near ATHs. We started seeing a bit of bleedback down going into the elections. For now, it will likely continue until the uncertainty of the outcome is over.

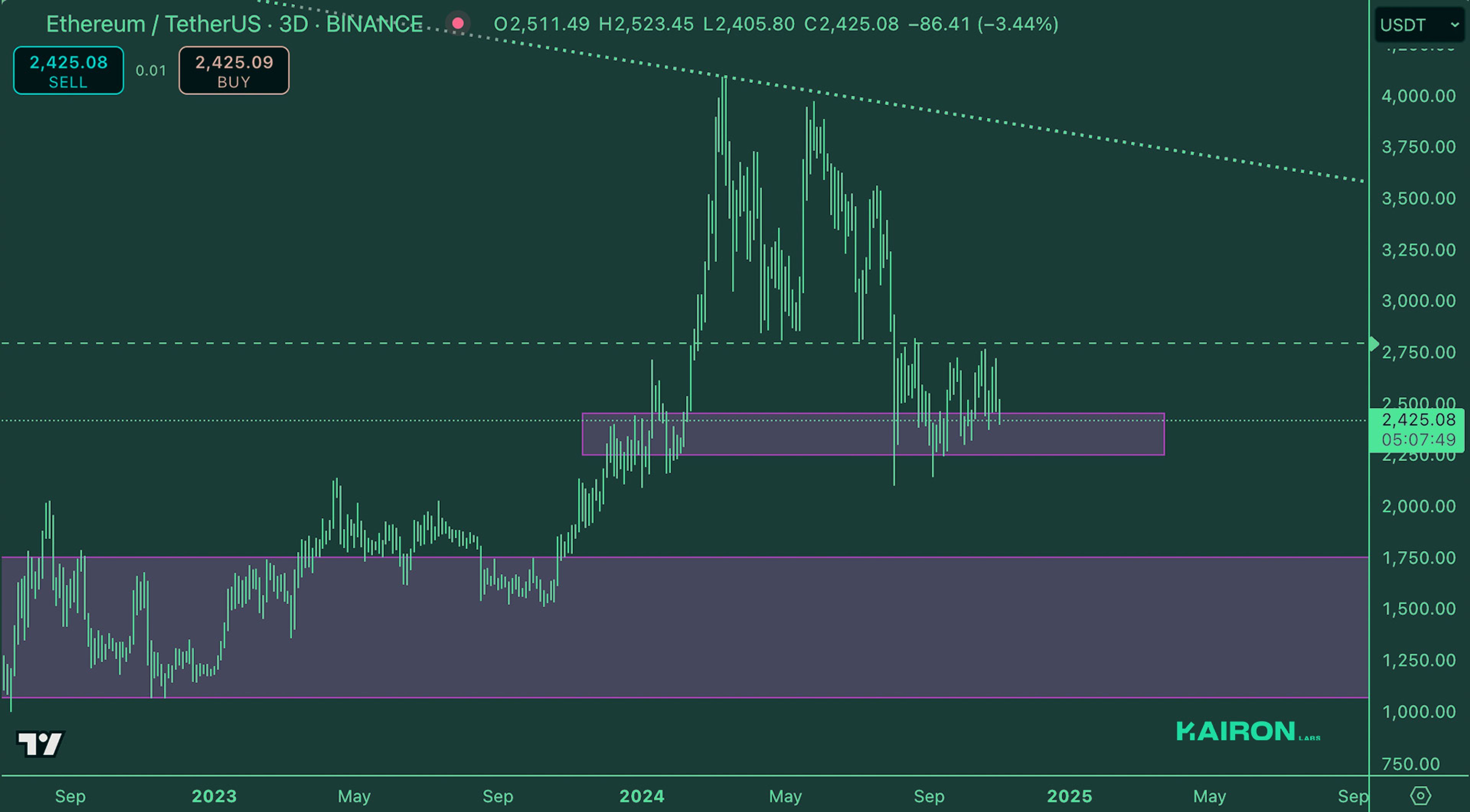

ETH WEEKLY VIEW

ETH is still in the 2.4-2.7 range, and ETH/BTC is still struggling to find any relative strength.

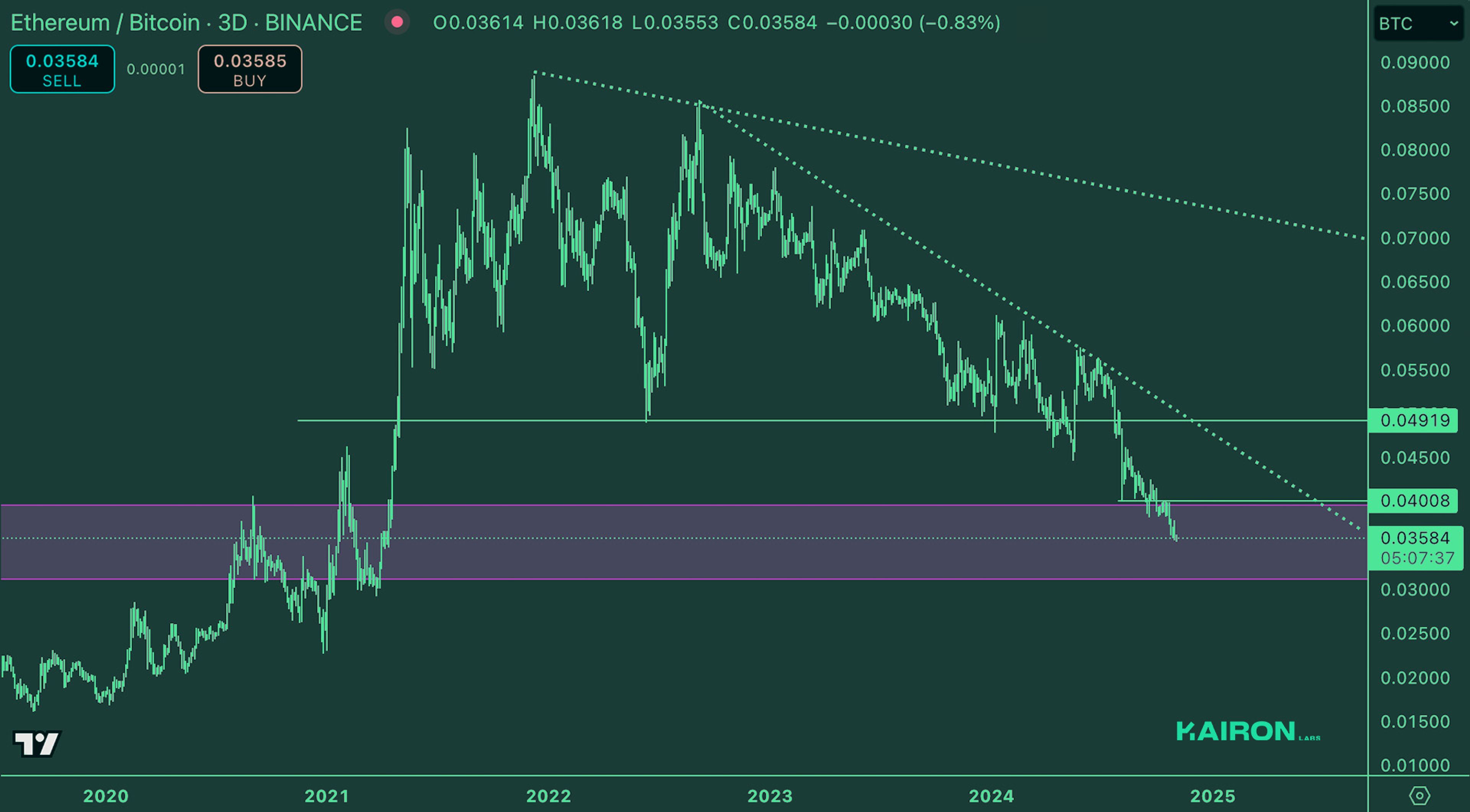

ETH/BTC

ETH/BTC is still in a heavy downtrend and struggling to find any relative strength over BTC.

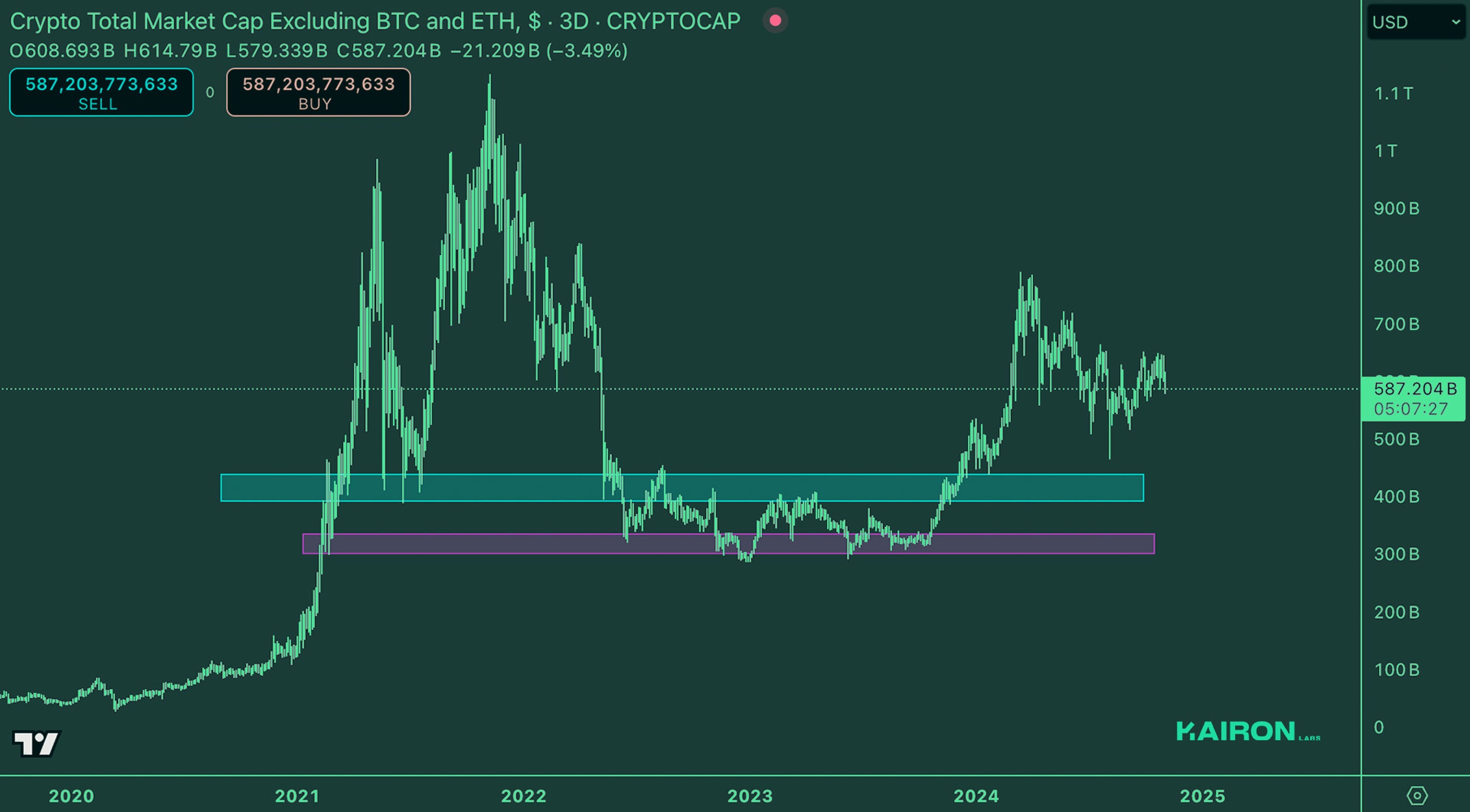

TOTAL3 USD MARKET STRENGTH

Alts are still very sensitive to any kind of BTC down move. Ideally, this will start receding, and the ALT/BTC ratio will start to gain some serious strength. However, for now, it’s not the case just yet.

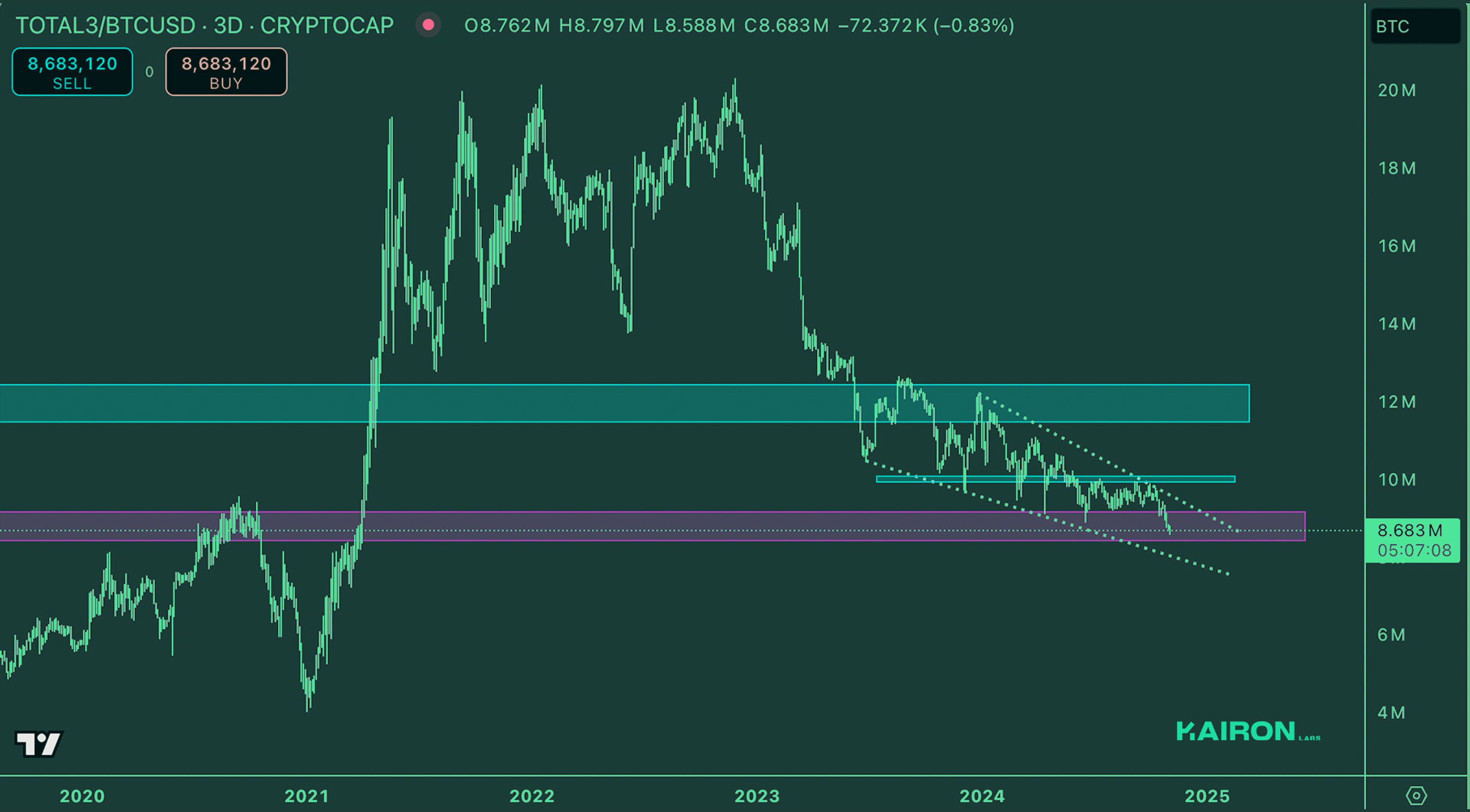

TOTAL3 BTC MARKET STRENGTH

TOTAL3/BTC broke lows while BTC.D touched the 60% mark. For now, it’s still a waiting game until ALT/BTC starts picking up.

SUMMARY

- The market is trading nervously into the elections. With it bleeding into the results, it’s likely to see a bounce after the results come in, with hedges coming off and people buying back exposure they derisked.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

This post was prepared by Kairon Labs Trader Patrick Li and Joshua Van de Kerckhove.

Edited by: Marianne Dasal

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide