Crypto Market Pulse - October 14, 2025

LAST WEEK RECAP:

This week delivered one of the largest structural resets of the year. On Oct 10, Trump’s 100 percent China tariff announcement triggered a market-wide deleveraging flush, clearing over $18-19B in leveraged positions within hours. BTC crashed from ~$125K to ~$105K before rebounding above $114K as spot buyers and ETF inflows quickly absorbed the liquidation wave. The episode underscored the market’s growing maturity: forced selling was absorbed by real demand rather than cascading further into panic.

Post-liquidation, the system reset cleanly. Derivatives markets normalized as leverage metrics compressed, delta skew fell, and funding stabilized near neutral. On-chain flows showed heavy stablecoin deposits into exchanges, confirming that sidelined capital stepped in as forced positions unwound. This mix of structural cleanup and institutional support turned what looked like a black swan into a healthy market reset.

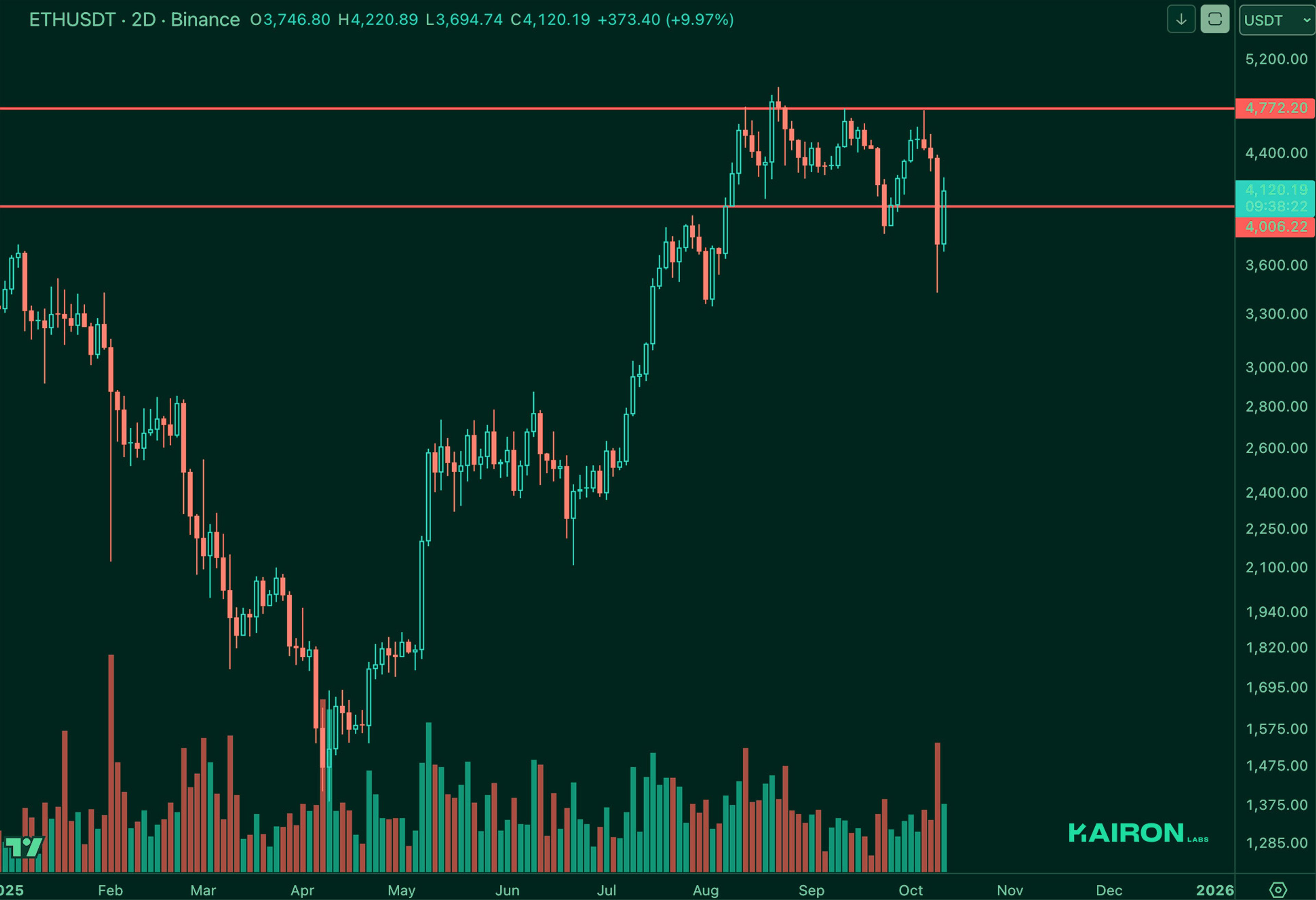

Alts continued to underperform, with majors such as ETH, SOL, and AVAX still trading 5-15 percent below pre-crash levels as liquidity concentrated in BTC. The rotation into depth and stability signals that institutions remain focused on BTC exposure and hedged structures rather than speculative alt positions.

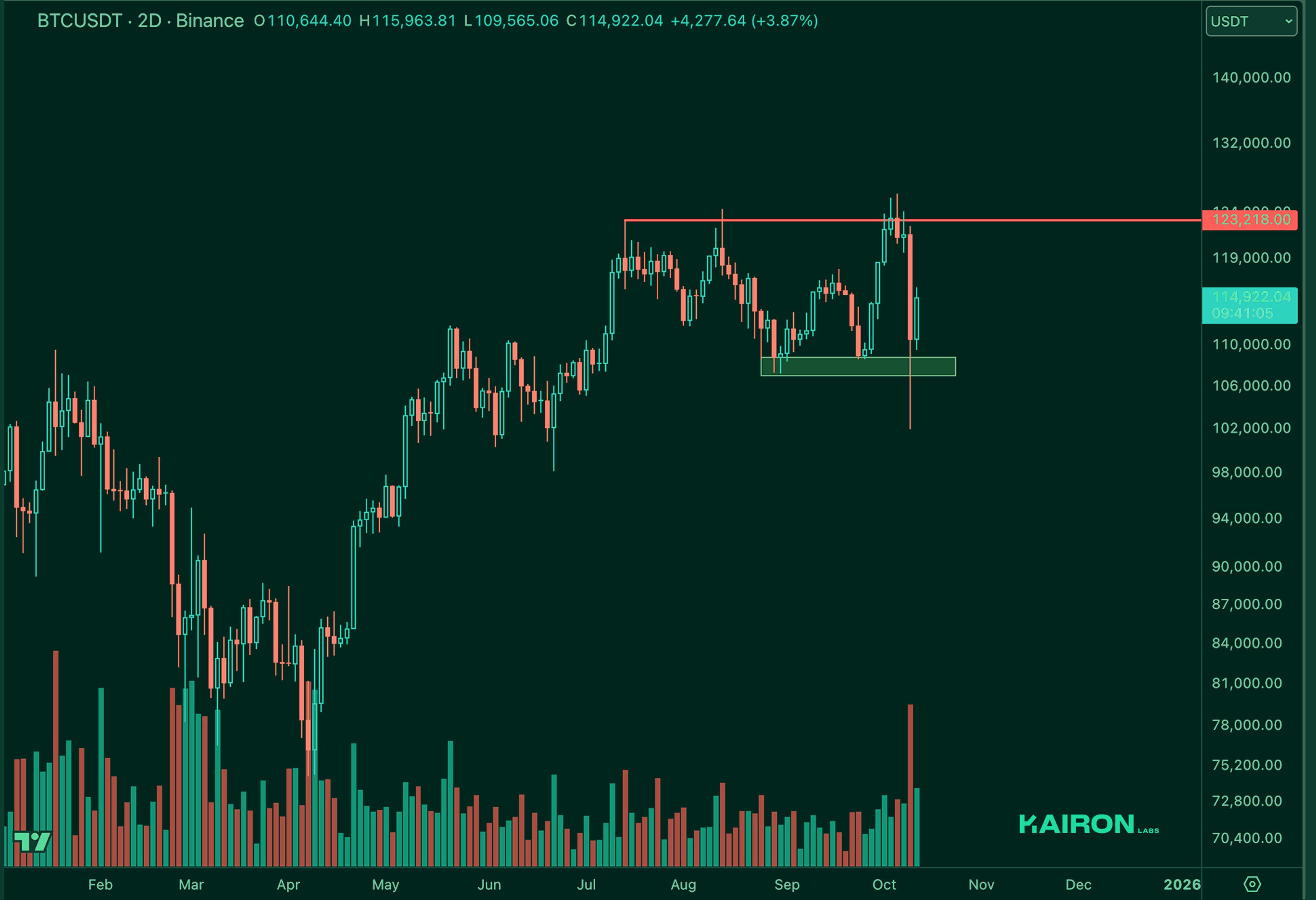

Looking ahead, focus turns to the US CPI and PPI next week. Softer prints could reinforce recovery momentum, while any upside surprise may retest short-term support near $110K. With leverage flushed and ETF demand intact, the market now enters mid-October on cleaner positioning and a stronger structural footing.

- BTC faced a major black swan event on Oct 10, after Trump announced 100 percent China tariffs, triggering a massive deleveraging flush with ~$18-19B in liquidations before a sharp rebound from $105K to ~$114K

- Spot BTC ETFs absorbed the sell-off, adding roughly $1B net inflows during Oct 10-12 and confirming sustained institutional demand

- Derivatives reset post-liquidation, with delta skew easing from >12 percent and funding normalizing as leverage was cleaned out

- Stablecoin inflows to CEXs hit a 2-month high on Oct 11, signaling strong dip-buying demand and renewed risk appetite

- Altcoins lagged as liquidity rotated toward BTC and majors, with most large caps down 5-15 percent from pre-shock levels and trading volumes shifting heavily to BTC pairs

- Fear & Greed Index recovered from 27 to 46 within 48 hours, reflecting rapid sentiment repair after forced deleveraging

- Macro backdrop: US 10Y yield steady near 4.1 percent, risk assets soft post-tariff shock, CN equities relatively stable

BTC WEEKLY VIEW

After reaching a new high last week, BTC hesitated at the top before suddenly plunging in a black-swan-style crash, erasing the entire prior rally. If the price fails to recover more than 50% of the drop within a short period, this decline could be considered valid. However, if it was an overreaction, we should expect to see a swift rebound back toward the previous highs. Therefore, instead of rushing in, it may be wiser to observe the strength of the rebound first.

ETH WEEKLY VIEW

ETH’s price action caught the market off guard as it failed to make a new high before the black swan event triggered a sharp reversal, effectively turning the attempted breakout into a classic bull trap. On a positive note, ETH has shown notably stronger resilience compared to BTC, with the rebound already retracing most of the previous decline. At this stage, the key focus is on how price behaves within the reclaimed consolidation range to assess whether the recovery can sustain or if selling pressure will start to reappear near the upper boundary.

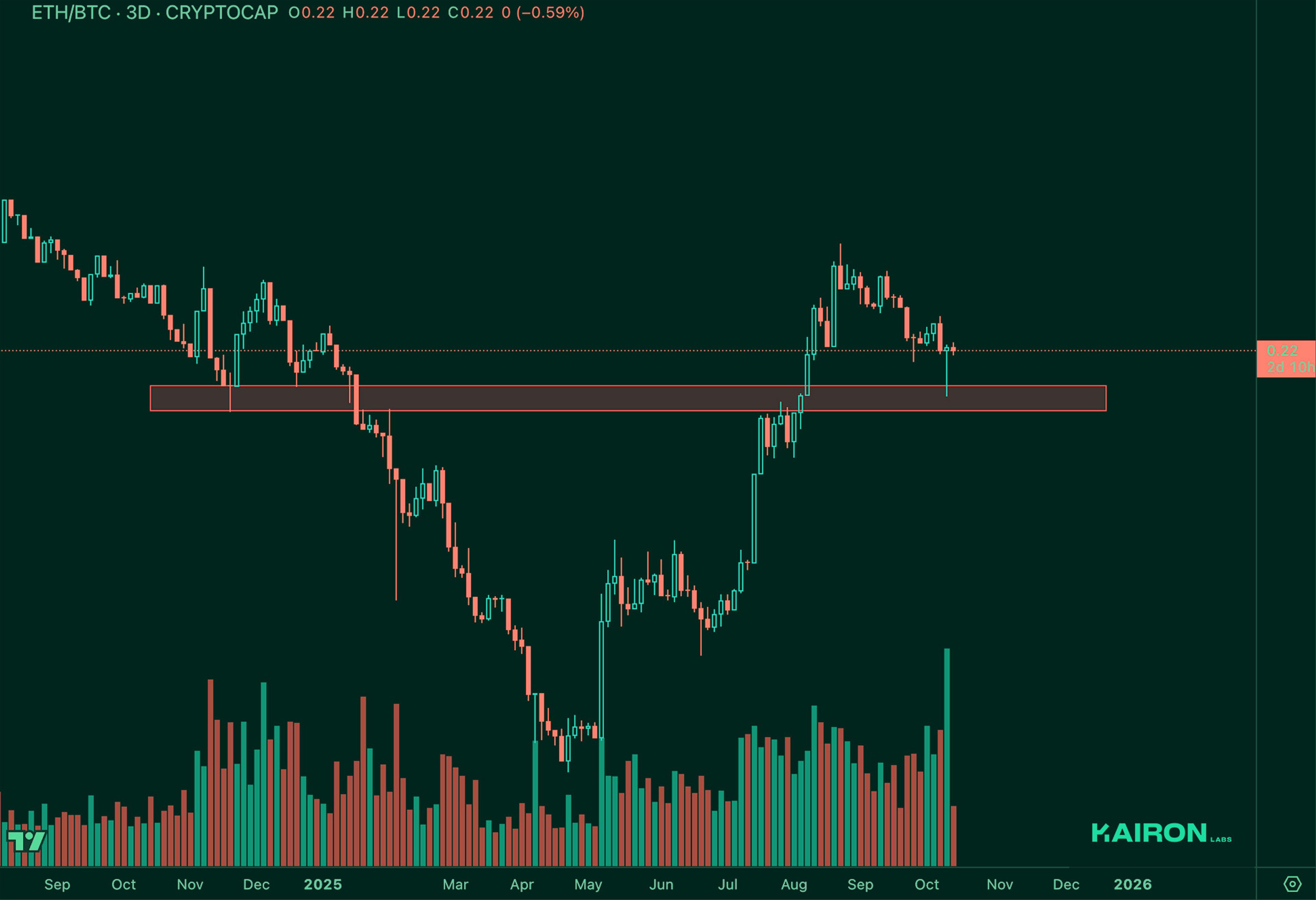

ETH/BTC

It is a clear support-turned-resistance zone, and ETH’s rebound has been noticeably stronger than BTC’s, showing better structural resilience in the recovery phase.

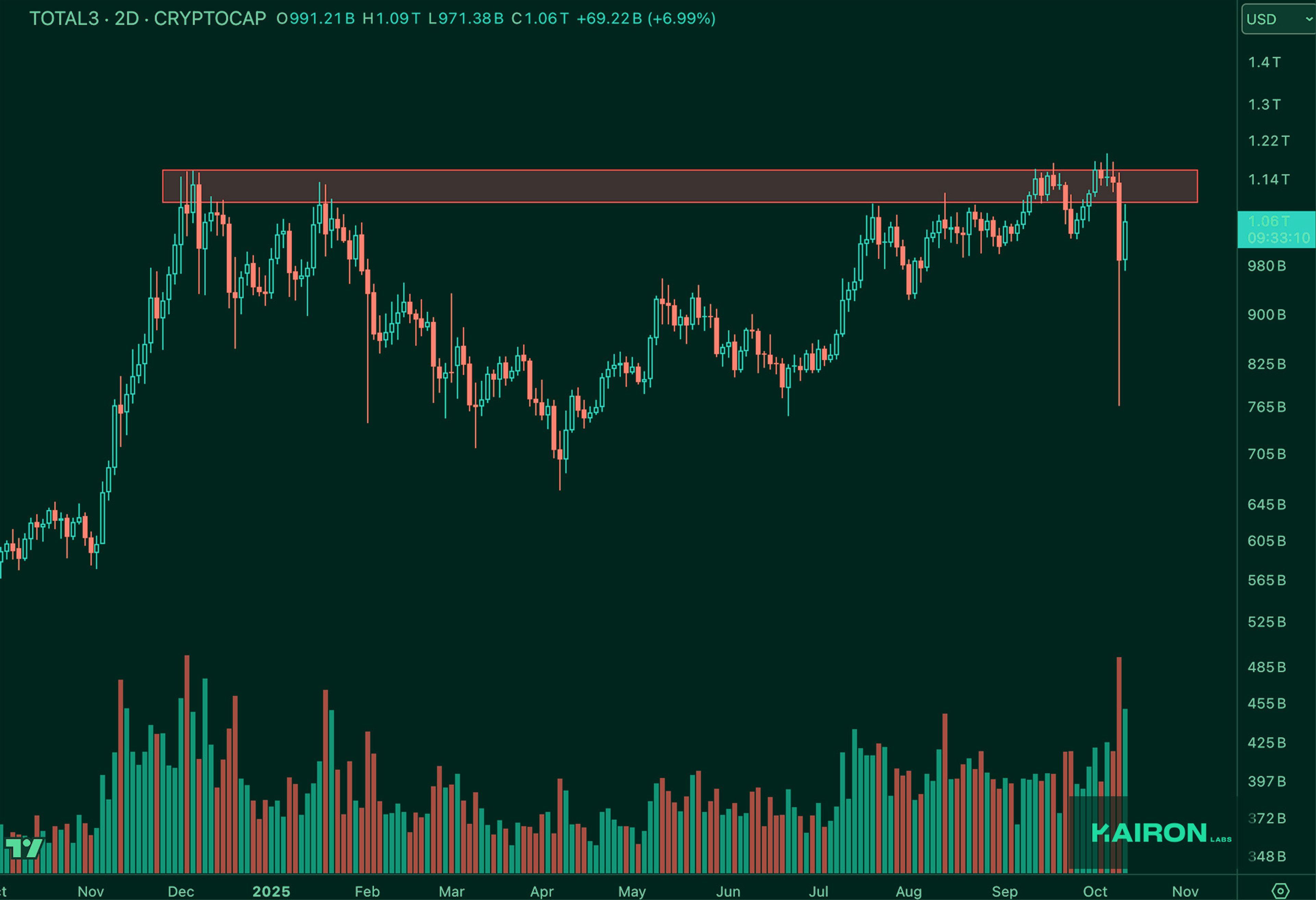

TOTAL3 USD MARKET STRENGTH

Due to the inherently high leverage nature of altcoins, TOTAL3 experienced the deepest decline but also the most pronounced rebound. Similar to BTC, it briefly paused around the supply zone before reversing downward. The key focus now is whether the price will continue to fall after retesting the supply zone or manage to reclaim and trade back within it.

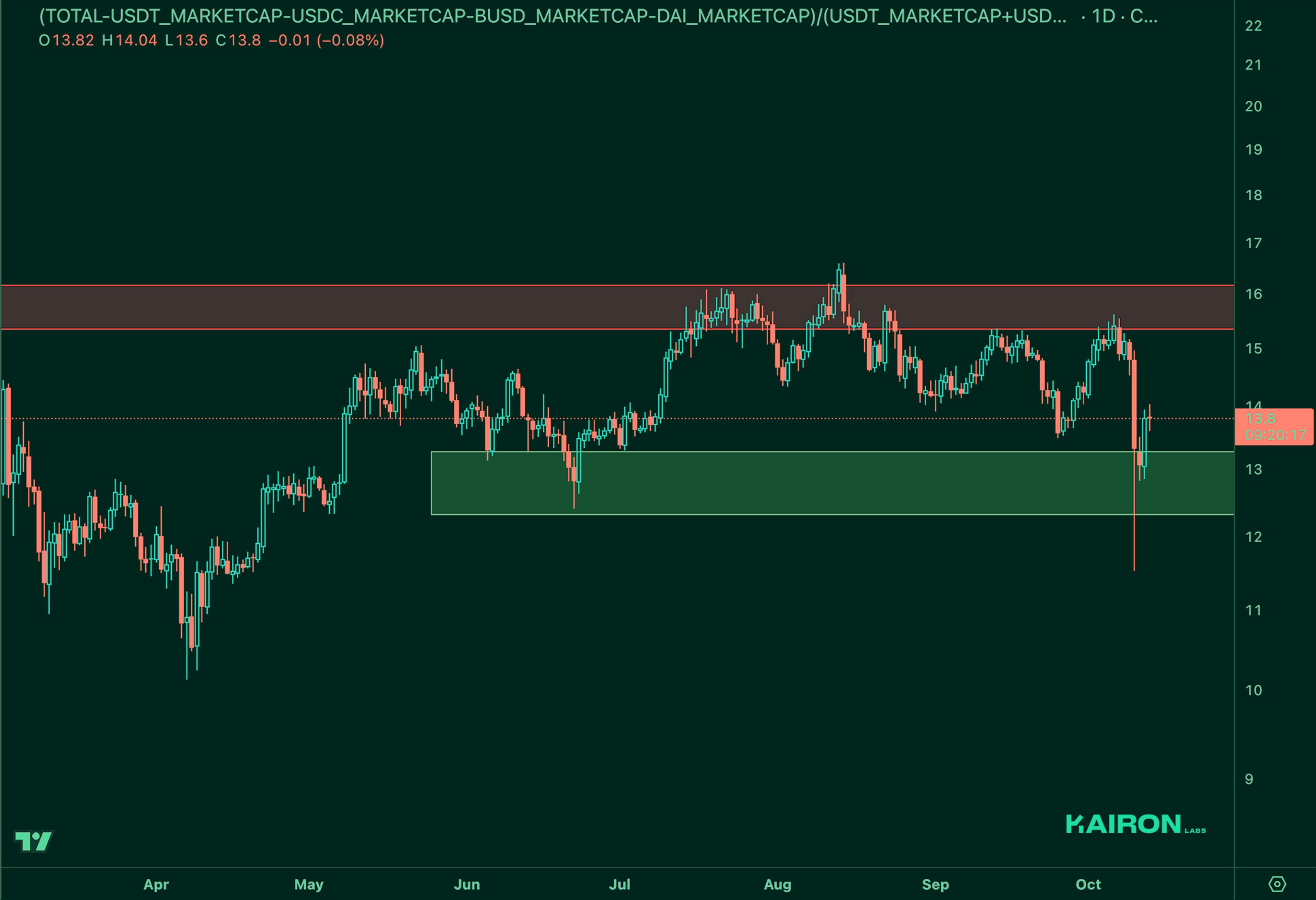

TOTAL3 BTC MARKET STRENGTH

The TOTAL3/BTC ratio has recovered to its relative strength level from before the black swan event, indicating that altcoins have regained much of their footing against BTC in the short term.

MARKET LEVERAGE RATIO

As we mentioned earlier, this sharp correction was primarily a broad market deleveraging event. Once the liquidation pressure subsides and market volatility normalizes, new capital tends to flow in aggressively to buy the dip. Therefore, even though the market just experienced a major flush-out, we anticipate a potential “auto return” phase where panic selling gives way to opportunistic inflows. However, the sustainability of this rebound will depend on how long fresh capital continues to enter the market and at what point these bottom buyers decide to take profit, as both factors will directly influence the strength and duration of the recovery.

SUMMARY

- Market-wide deleveraging reset: Trump’s 100% China tariff announcement on Oct 10 triggered a $18–19B liquidation event, sending BTC from ~$125K to ~$105K before recovering above $114K as spot and ETF inflows absorbed the shock.

- Healthy structural cleanup: Leverage metrics normalized, funding turned neutral, and stablecoin inflows signaled sidelined capital re-entering the market, turning a black swan event into a constructive reset.

- Rotation and outlook: Altcoins lagged as liquidity concentrated in BTC, while upcoming US CPI and PPI data will guide near-term momentum with the market now positioned on cleaner leverage and stronger foundations.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

This post was prepared by Kairon Labs Traders Patrick Li and Travis Su.

Edited by: Shirley Castro

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide