Crypto Market Pulse - September 3, 2024

LAST WEEK RECAP:

- U.S. Core PCE was 0.2% MoM, in line with estimates, the annual rate is 2.6%, slightly lower than 2.7% estimated.

- U.S. PCE increased 0.2% MoM and 2.5% YOY, which are the same as estimated.

- Nvidia shares fell despite second-quarter results slightly beating estimates, as the market expectation was high.

- Telegram founder Pavel Durov was released from police custody in France on Wednesday and transferred to court.

- Trump to announce plan making U.S. the ‘Crypto Capital’.

- OpenSea received Wells notice from SEC.

- Maker rebrands to SKY protocol, and DAI will be upgradeable to USDS.

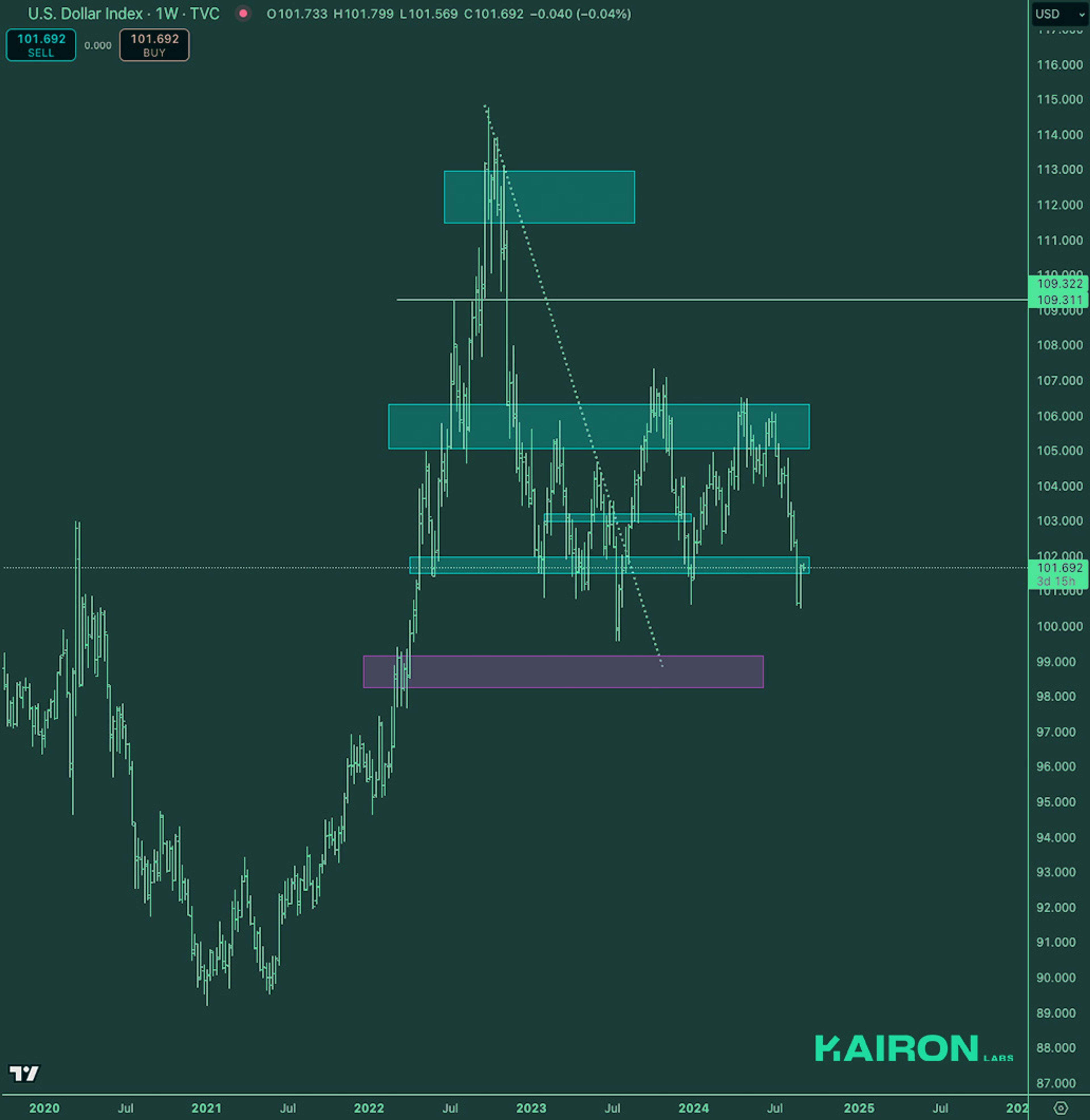

LEGACY MARKETS – DXY

DXY is still at a range low. The longer it consolidates on the lows, the better for crypto and equities. If it starts bouncing aggressively, it could put some pressure on crypto and equities.

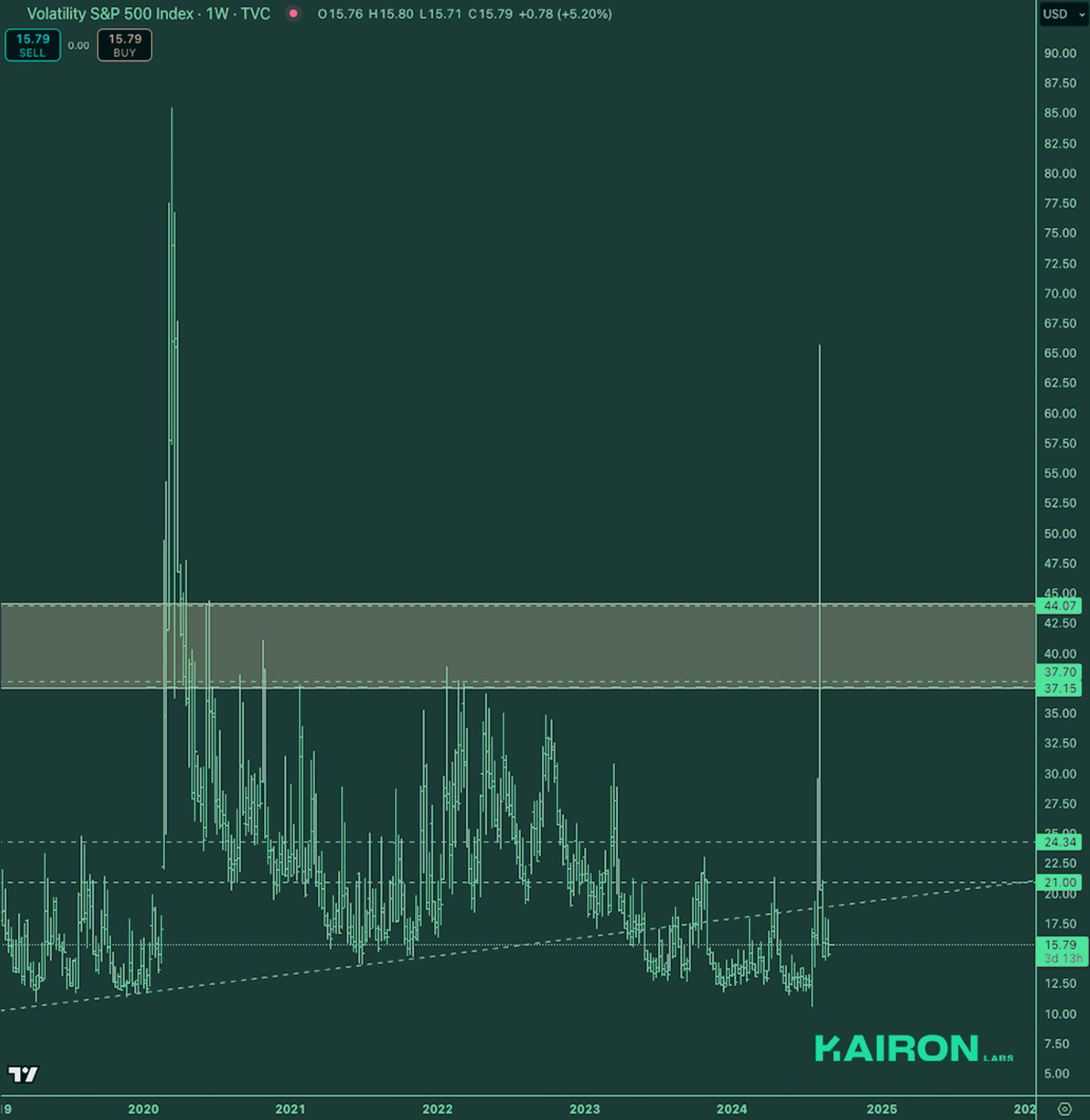

LEGACY MARKETS – VIX

VIX is still below 21, with some consolidation happening above the previous 12-14 range. This could still lead to small intermediate spikes. However, how much effect those will have after all the big liquidations is a question.

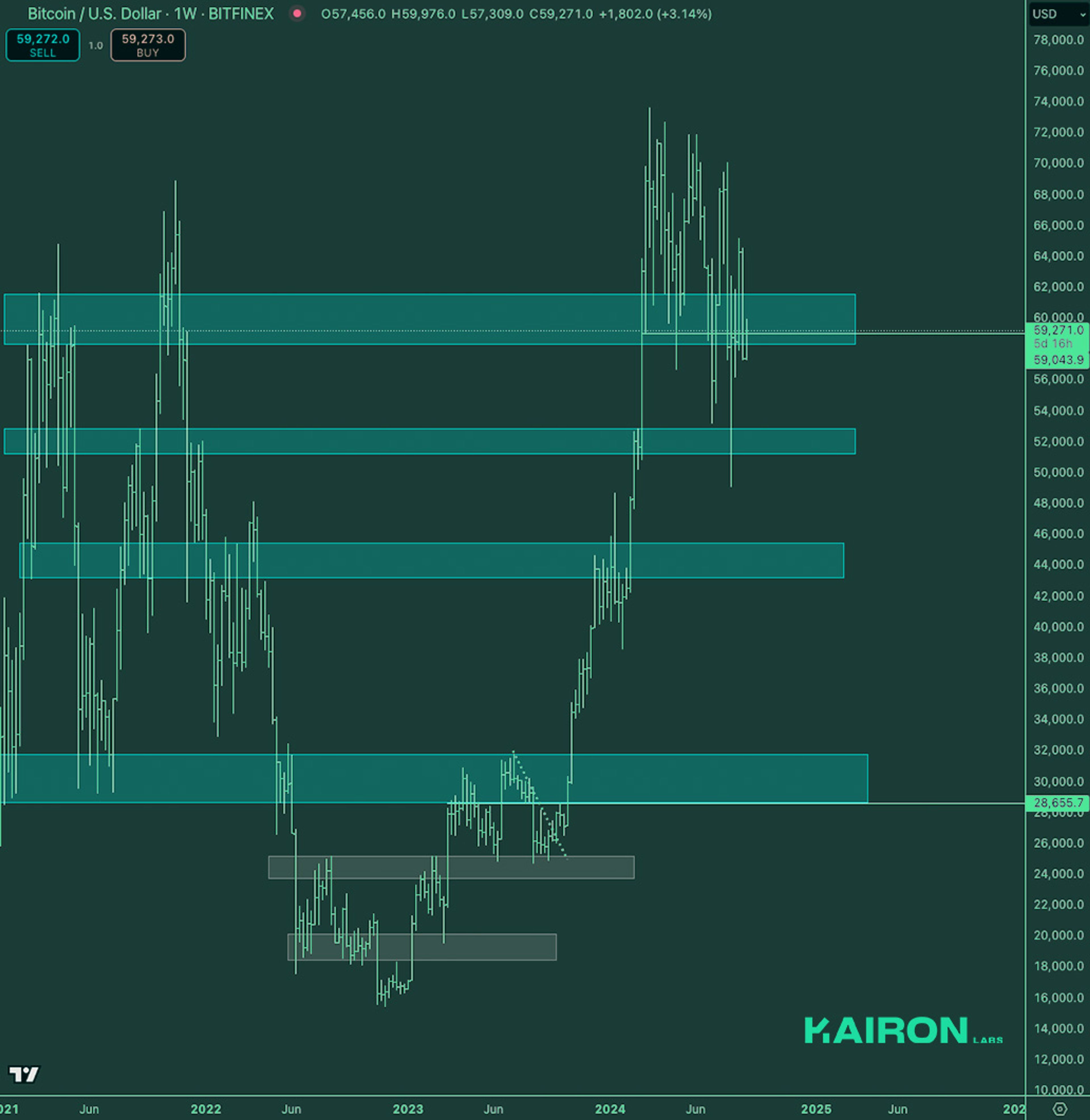

BTC WEEKLY VIEW

BTC closed the monthly over 59k, and after a brief opening below, the market is already trading over 59k again. 59k is now the pivot level. Below it opens up downside till 50-52k, above which we can see all-time highs.

ETH WEEKLY VIEW

ETH is still consolidating and is quite a bit behind BTC. This is also still reflected in the slow trading of the ETH/BTC ratio. After the significant drop, ALT/BTC and ETH/BTC are rotating.

ETH/BTC

ETH/BTC is consolidating after the tag of multi-year support. The ETH/BTC ratio is still trading “slow,” and the market is waiting for this to gain momentum.

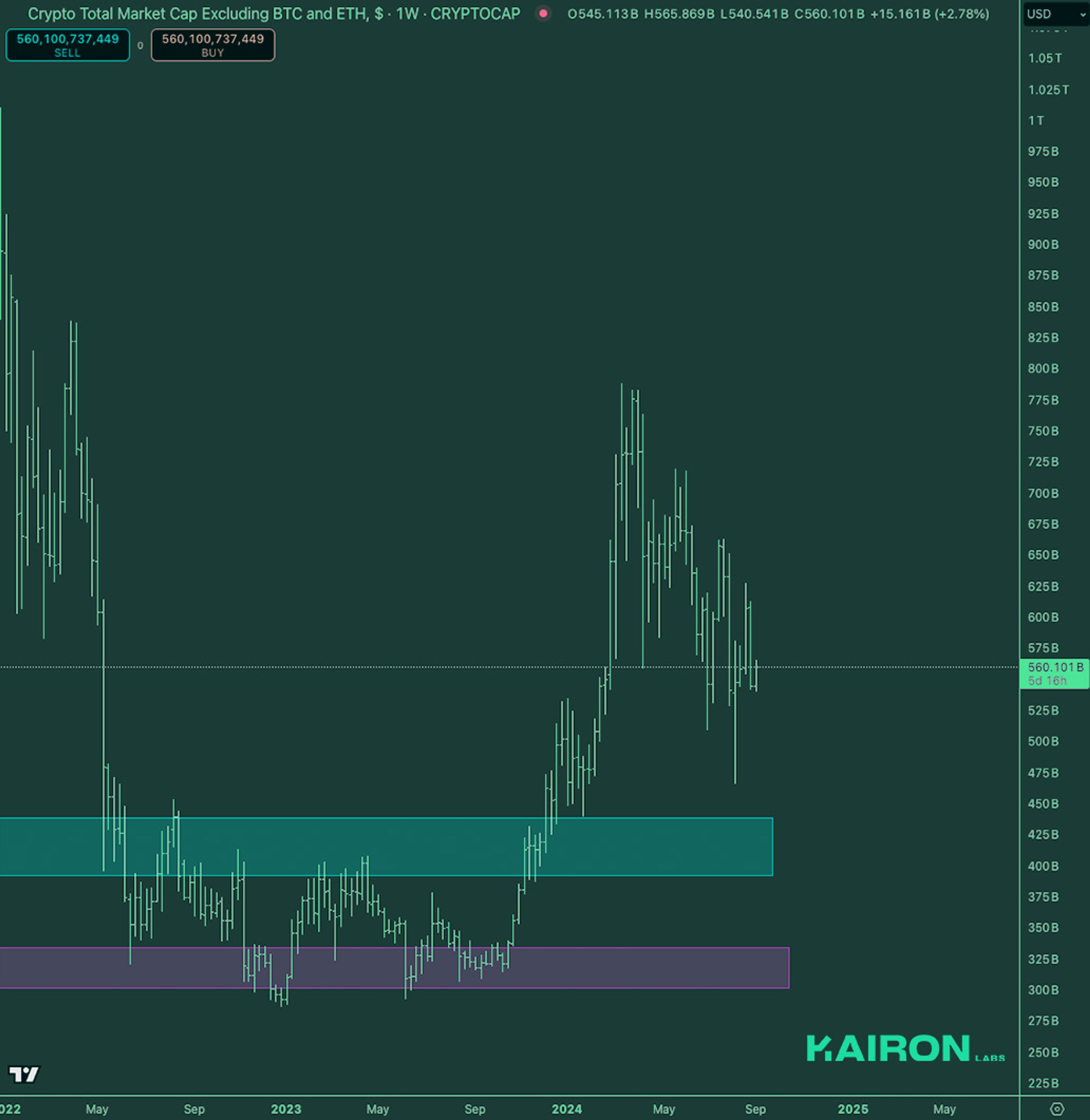

TOTAL3 USD MARKET STRENGTH

Alts are still mostly building base. However, there have already been big bounces across the board. If this structure completely vacates, the run-up should lead to an altcoin ATH in marketcap.

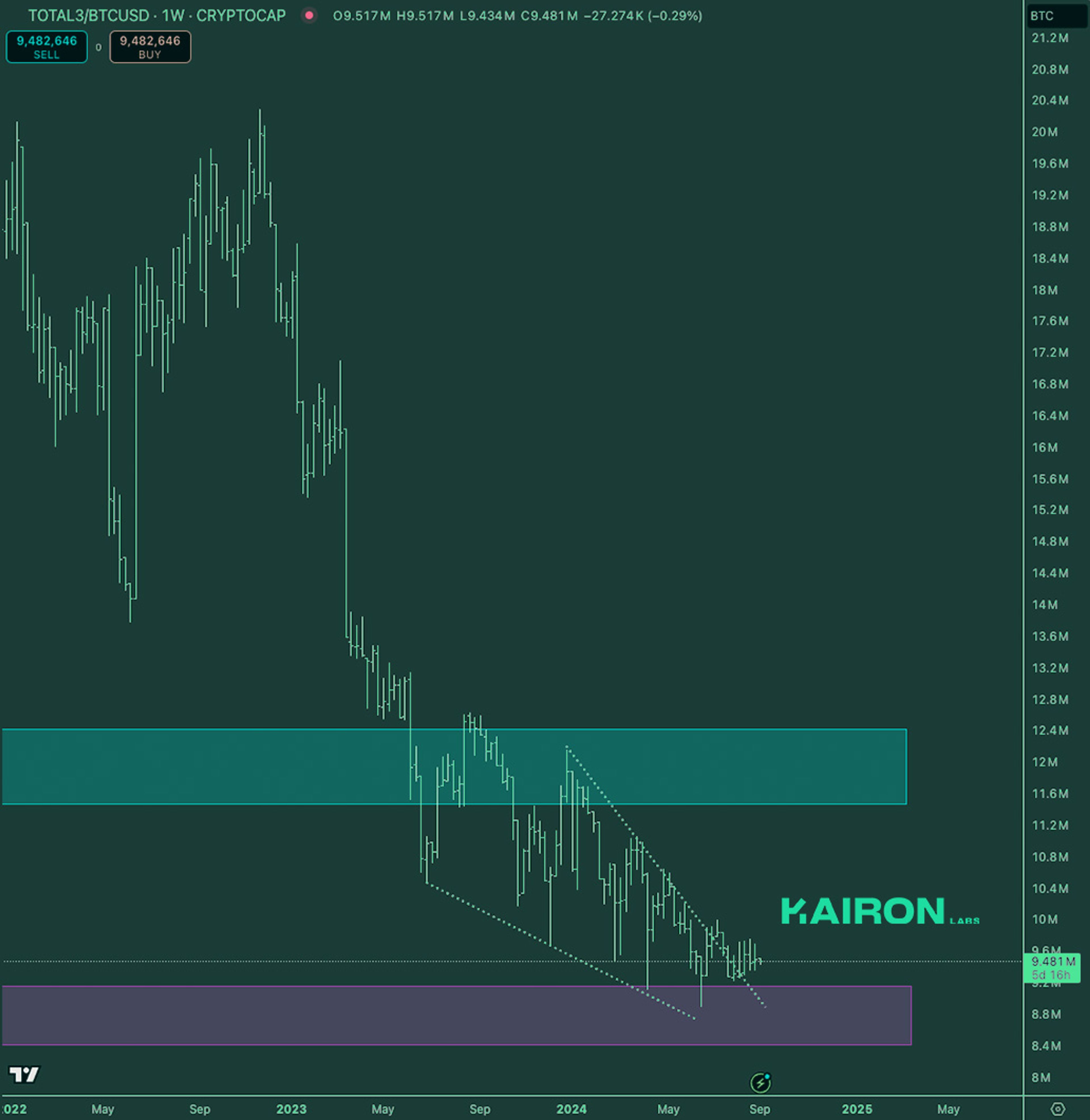

TOTAL3 BTC MARKET STRENGTH

TOTAL3/BTC is still flat but holding up well relative to BTC, which indicates underlying alt strength.

SUMMARY

- ALT/BTC ratios stayed stable during the significant drop, indicating underlying strength in the altcoin sector against BTC.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

This post was prepared by Kairon Labs Trader Patrick Li and Joshua Van de Kerckhove

Edited by: Marianne Dasal

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide