Liberation Day Tariffs: A Catalyst for Market Turmoil

The global financial landscape underwent significant upheaval in April 2025, marked by the onset of the "Liberation Day" tariffs and their cascading effects on markets, particularly Bitcoin (BTC) and the broader cryptocurrency sector.

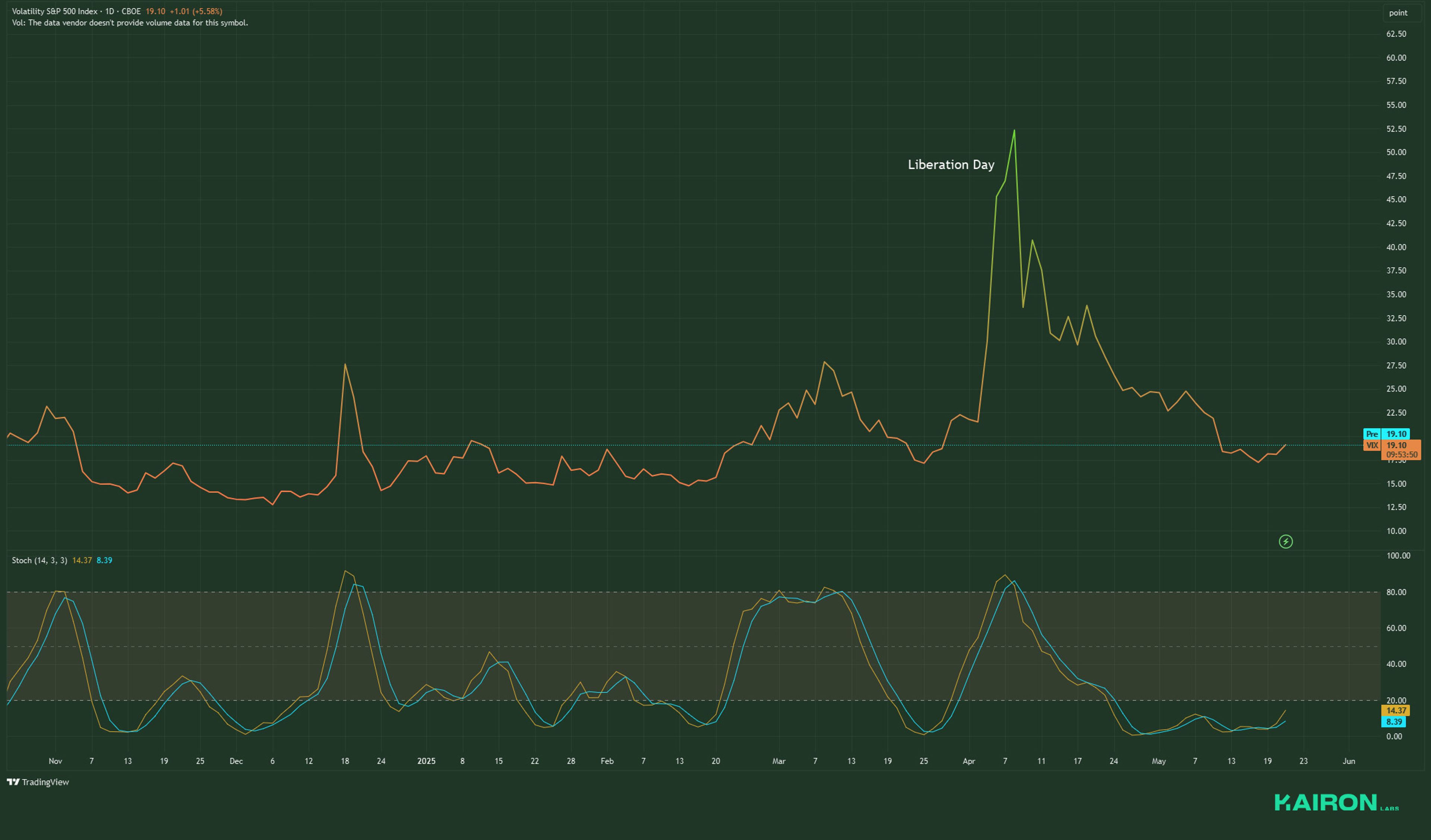

This article provides a comprehensive analysis of these events, integrating timelines of the CBOE Volatility Index (VIX) and BTC to visualize the impact.

Liberation Day Tariffs: A Catalyst for Market Turmoil

On April 2, 2025, US President Donald Trump announced sweeping "Liberation Day" tariffs, imposing a baseline 10% duty on all imports, with additional country-specific tariffs targeting approximately 60 nations. This aggressive trade policy aimed to rectify perceived unfair trade practices, but it immediately triggered global market instability.

Immediate Market Repercussions

- Stock Market Crash: The announcement led to the largest two-day loss in U.S. stock market history, with the Dow Jones Industrial Average plunging over 4,000 points and the S&P 500 dropping 10%.

Liberation Day Tariffs Impact on S&P

- VIX Surge: The CBOE Volatility Index (VIX) spiked to 45.31 on April 4, its highest level since the COVID-19 pandemic, reflecting heightened investor anxiety.

Liberation Day Tariffs Impact on VIX

- Global Response: China retaliated with a 34% tariff on U.S. goods, escalating to 125% on April 9. The European Union also imposed 25% retaliatory tariffs on €21 billion worth of U.S. imports.

Bitcoin's Volatile Journey Amid Trade Turbulence

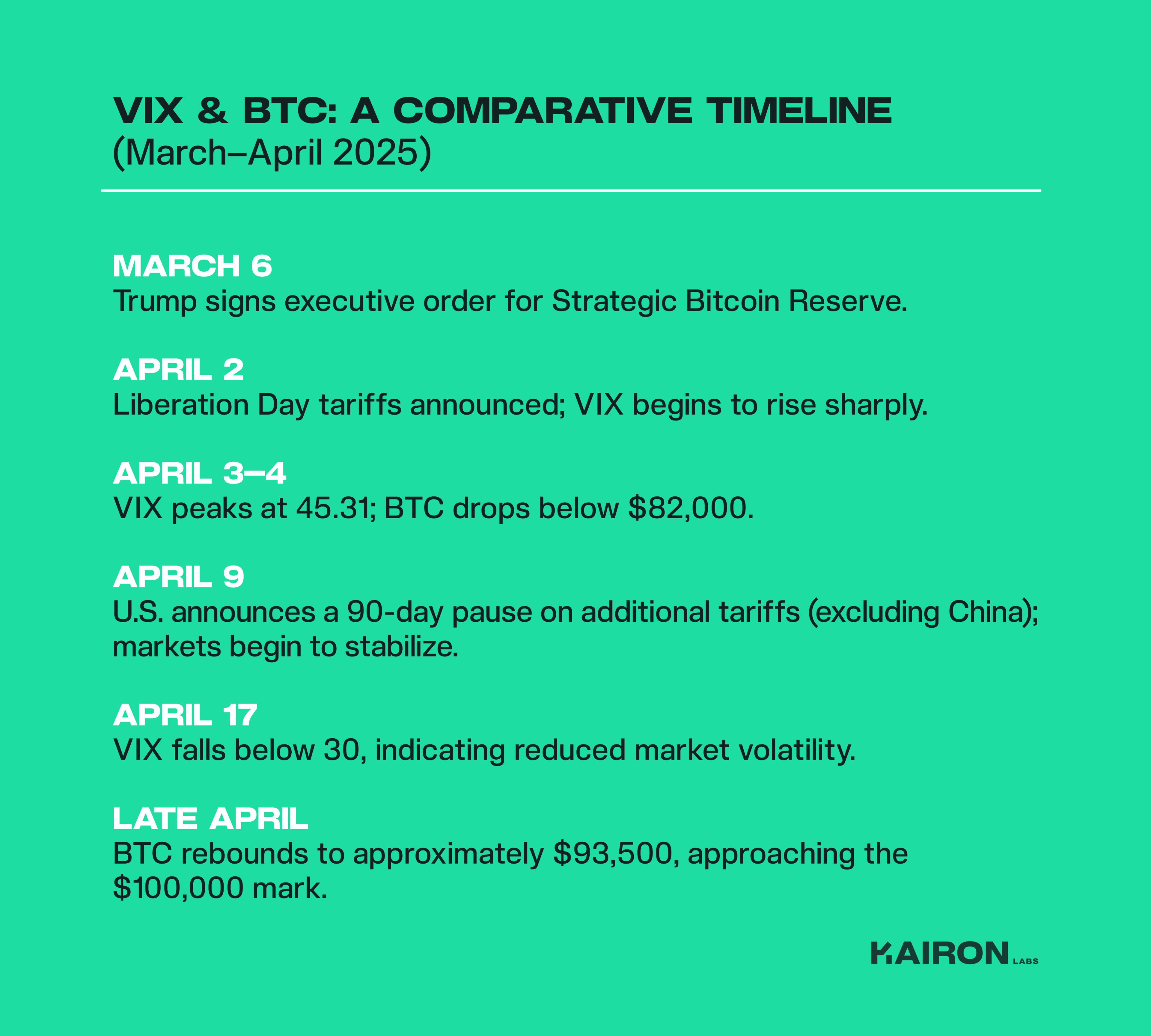

Pre-Tariff Period: Strategic Bitcoin Reserve

In March 2025, President Trump signed an executive order establishing a Strategic Bitcoin Reserve, utilizing approximately 200,000 BTC seized by the U.S. government. Initially, this move had a muted effect on BTC prices, as the reserve was funded through existing holdings rather than market purchases.

April Decline: Market Uncertainty

Following the tariff announcements, Bitcoin's price fell below $82,000 as investors moved away from riskier assets amid fears of an economic slowdown and persistent inflation. Derive's on-chain options market indicated a doubling in the probability of BTC dropping to $75,000 by the end of March, reflecting increased bearish sentiment.

Late April Recovery: Institutional Interest

By late April, Bitcoin rebounded nearly 25% from earlier lows, reaching approximately $93,500, driven by renewed investor optimism and institutional interest. Technical indicators showed BTC breaking out of a four-month falling wedge pattern and closing above the 200-day moving average, signaling potential for further gains.

VIX and BTC: A Comparative Timeline (March–April 2025)

Broader Implications for the Cryptocurrency Market

The events of April 2025 underscore the sensitivity of the cryptocurrency market to macroeconomic policies and geopolitical tensions. The initial decline in BTC highlighted its vulnerability to global financial instability, while the subsequent recovery demonstrated resilience and growing institutional adoption.

The establishment of the Strategic Bitcoin Reserve by the U.S. government may set a precedent for other nations, potentially leading to increased state-level involvement in cryptocurrency markets. This could further legitimize digital assets and integrate them more deeply into the global financial system.

As Kairon Labs expert trader Kenny Lee explains:

"The BTC price action following the Liberation Day tariff announcements was closely aligned with broader risk assets, highlighting that Bitcoin, for now, still trades as a risk-on asset rather than a safe haven. This suggests that while the 'digital gold' narrative remains aspirational, it hasn’t yet been fully realized in market behavior. However, the growing institutional adoption, limited supply, and its role in portfolios as a potential hedge against monetary debasement all point to a future where Bitcoin could increasingly fulfill that role. The path to digital gold status is still in progress — but the foundation is steadily being laid."

So what is the takeaway on this? Crypto did more than survive April 2025. It signaled its coming of age. Bitcoin shook off the tariffs then surged on real demand and state backing.

Track the VIX. Track policy moves. Stay ready.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide