Weekly Crypto Market Update - January 29, 2024

LAST WEEK RECAP:

- U.S. GDP has increased at a 3.3% annualized rate in the fourth quarter of 2023, higher than the expected 2%

- U.S. PCE increased 0.2% MoM and 2.6% YoY, matching expectations. Core PCE increased 0.2% MoM and 2.9% YoY, lower than the expected 3% YoY

- China’s central bank announced 50 bps cut in bank reserves, freeing $140B in liquidity

- SEC has delayed decisions on spot ETH ETF. The next key date is in May according to Bloomberg analyst James Seyffart

- Grayscale has transferred nearly 113K to exchanges for potential selling since the spot BTC ETF approval

- Tesla’s BTC holding remained unchanged in Q4

- Curve Finance announced the launch of the lending market, LlamaLend, which will utilize crvUSD

LEGACY MARKETS – DXY

No visible movement. DXY is still within the larger range of 106-100. As mentioned, it's currently expected to continue building more price structures within this range. It did see some upward movement within the range. This can put some pressure on stocks/crypto especially as indexes are trading near all-time highs.

LEGACY MARKETS – VIX

VIX is starting to build a floor level around 13-14. Together with oil seeing some strength last week, it makes sense that VIX starts trading a bit stronger if the oil and dollar garner more strength.

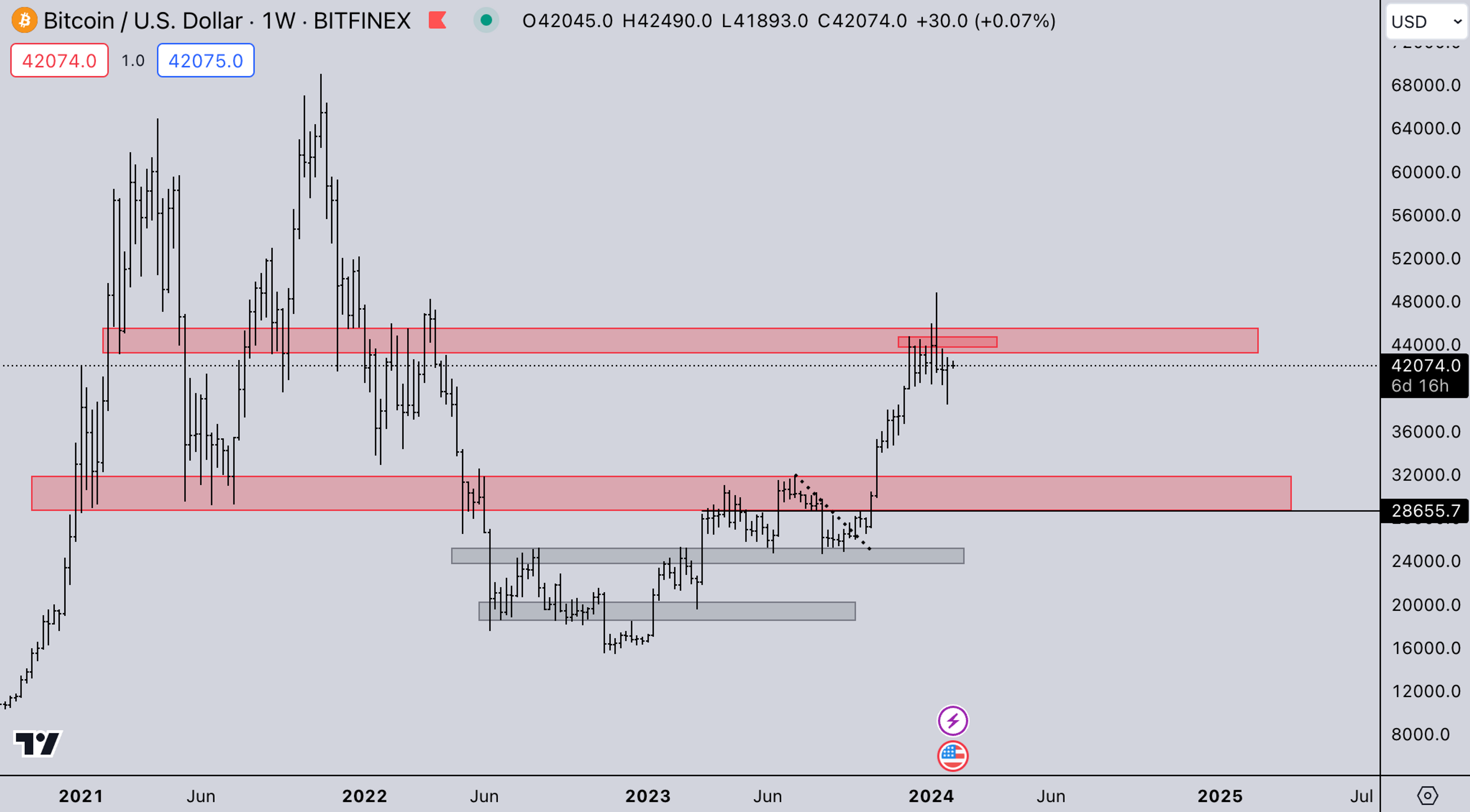

BTC WEEKLY VIEW

BTC is still at the top of the macro range quite impressively under 40k. For now, it seems more likely that BTC will range/chop at these prices for a while instead of a straight liquidation cascade down.

ETH WEEKLY VIEW

ETH lost a ton of relative strength last week and is now back in a ranging area between 2.1-2.4k. Also, the alt market is trading in tandem with ETH/BTC strength/weakness.

ETH/BTC

ETH/BTC reversed quite a bit since the ETF rotation rally. However, if there was ever a moment where ETH/BTC should catch a bid, it should be right here. We think if ETH/BTC bleeds down any further it’s probably going to correct down a lot more as this range has now been building for almost 3 years.

TOTAL3 USD MARKET STRENGTH

Alts have retraced quite a bit. But from a macro perspective, it’s still totally fine with price building more and more structure above the 2023 resistance. Last week, we had our first actual test of the 2023 resistance, and this got absorbed well.

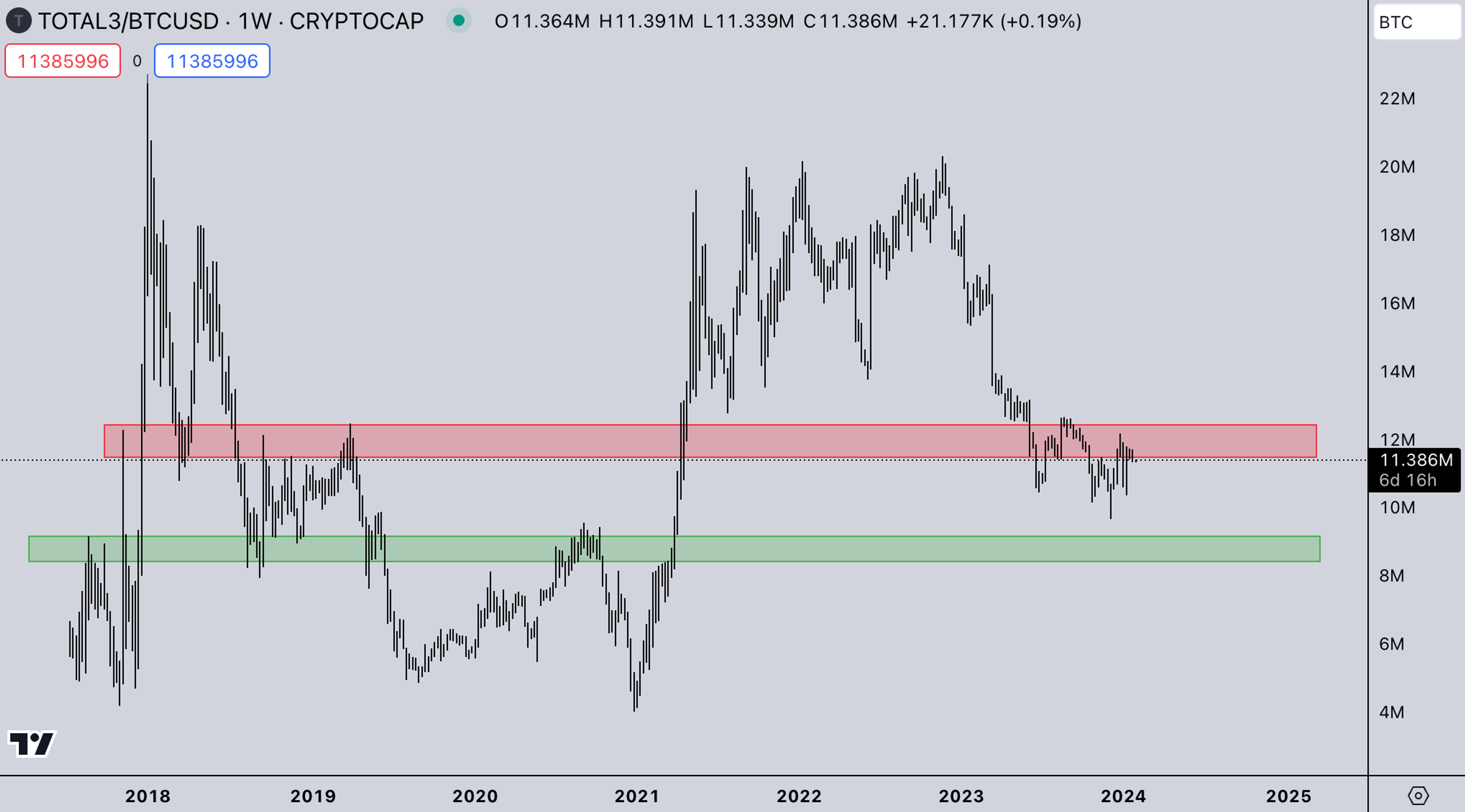

TOTAL3 BTC MARKET STRENGTH

No visible movement. As mentioned last week, if ALT/BTC would stay in range and ETH stalls, it would likely not be good for alts. A lot of them are down quite a bit with no real show of strength at the moment. This will likely stay the same until we get that volatility expansion on BTC.

SUMMARY

- BTC selling got absorbed quite aggressively under 40k. This should give it room to range further in the 40k area. And in tandem, this should give alts more time to put in some decent rallies if ETH/BTC can pick up relative strength again.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

This post is prepared by Kairon Labs Traders: Joshua van de Kerckhove, and Patrick Li

Edited by: Marianne Dasal

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide