Macro Market Update August 8th, 2022

Last Week Recap

- Pelosi visits Taiwan, increasing tension with China.

- The U.S. reported 528,000 jobs in July, much better than expected which shows the strength of the job market

- Chinese Miner says Ethereum POW Fork Is ‘Coming Soon’

- Sudoswap picking up the trading volume, and LooksRare announcing V2.

- Coinbase spikes massively on BlackRock partnership

- Nomad hacked due to smart contract config error and lost $190M, Slope mobile wallet is linked to around 7.8K Solana wallet hack

- Michael Saylor stepped down from MicroStrategy CEO to focus more on Bitcoin

- Gucci accepting ApeCoin payments in the U.S.

- W3BCLOUD to Go Public via SPAC

Legacy Markets

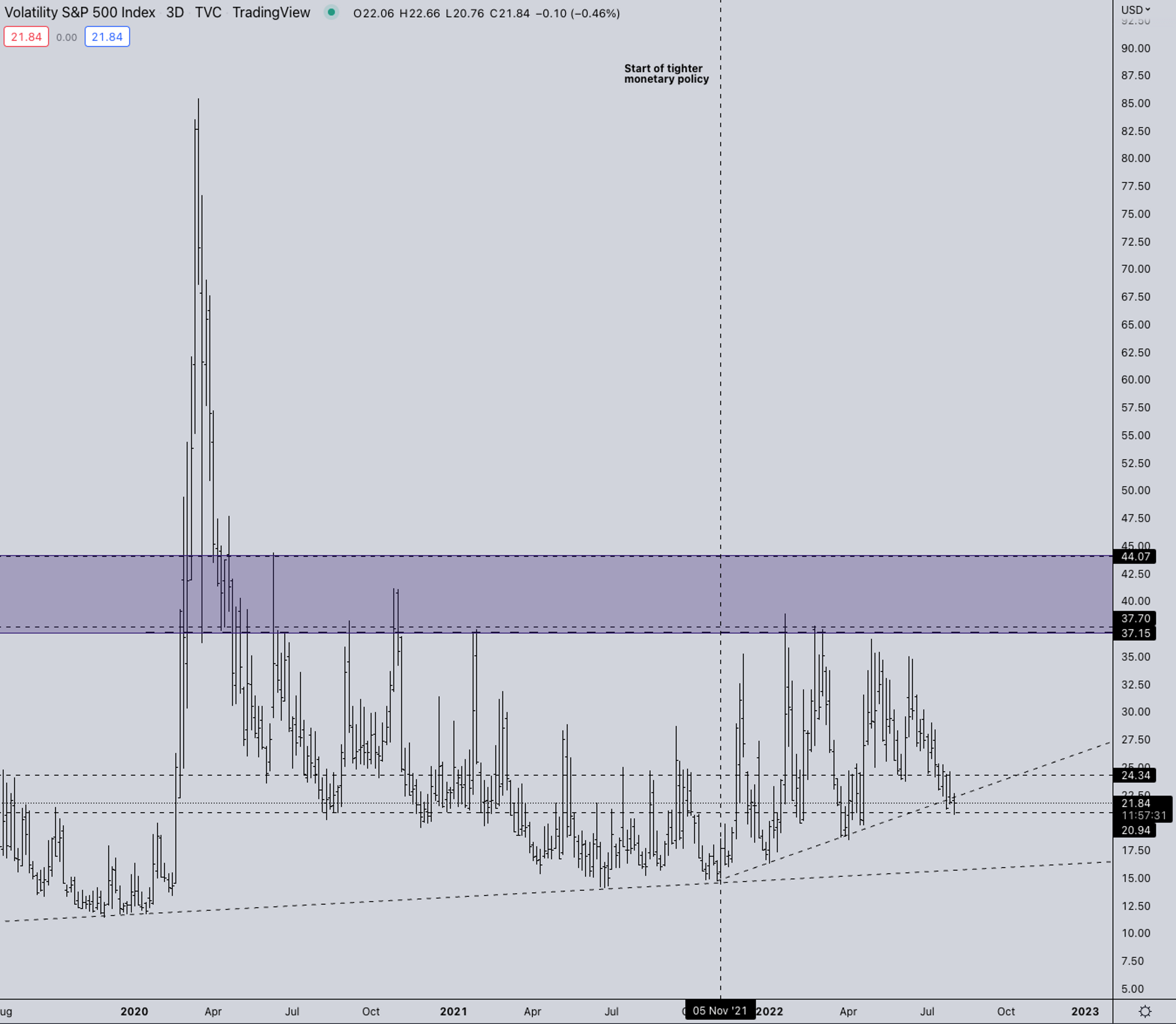

VIX has been closing in on 21 for the first time since April this year. Not only does a lower VIX generally mean lower volatility but as VIX drops, so does the correlation between assets. Last week we saw the first signs of this decoupling with equities dropping back and crypto staying relatively stable.

Open Interest & Funding Rates

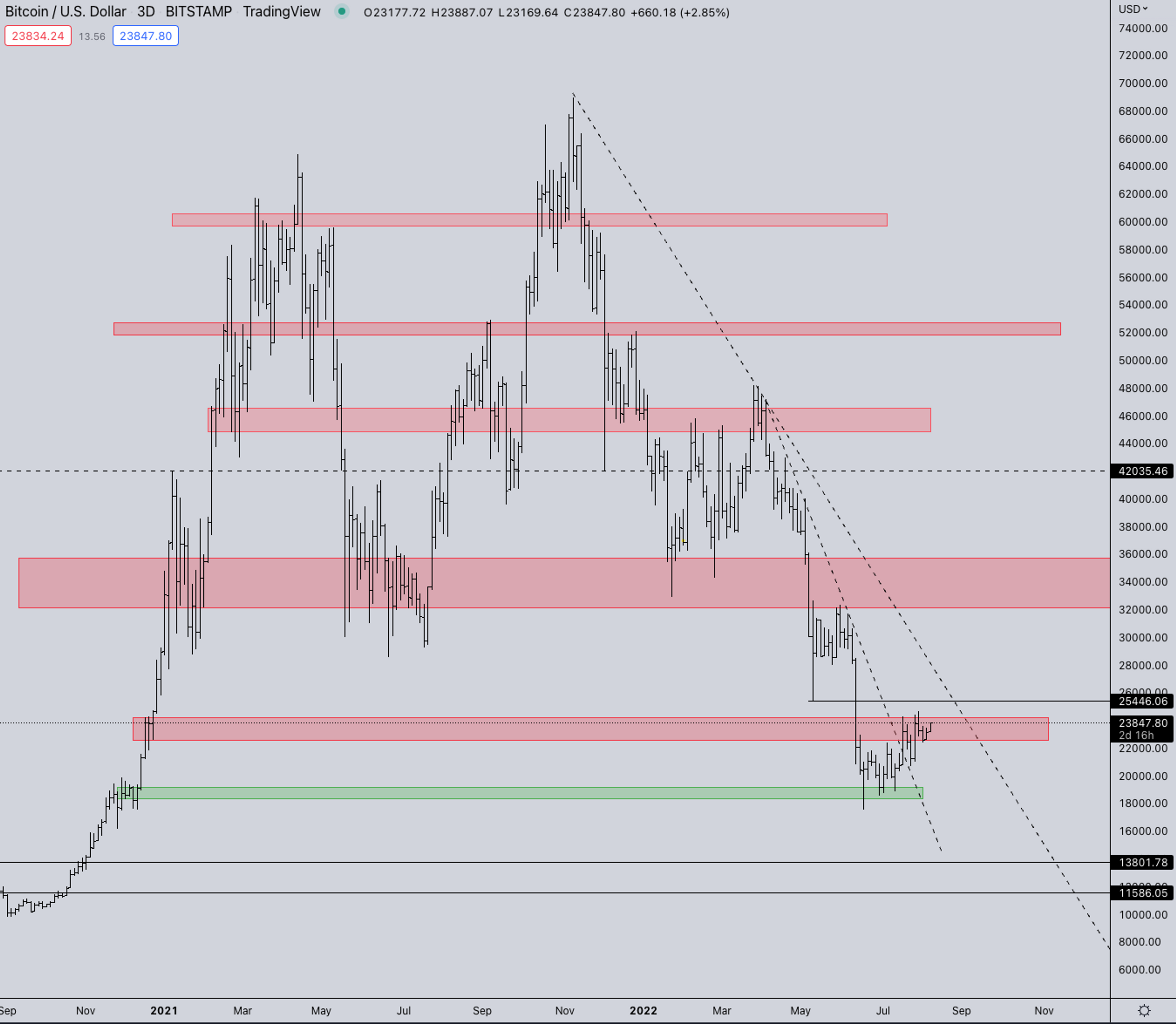

BTC Weekly View

BTC is currently clearing the resistance zone around ±24k. Most likely, it’ll also test the LUNA crash lows around 25k on dollar exchanges and 26.7k on USDT pairings (Because of the USDT: USD depeg).

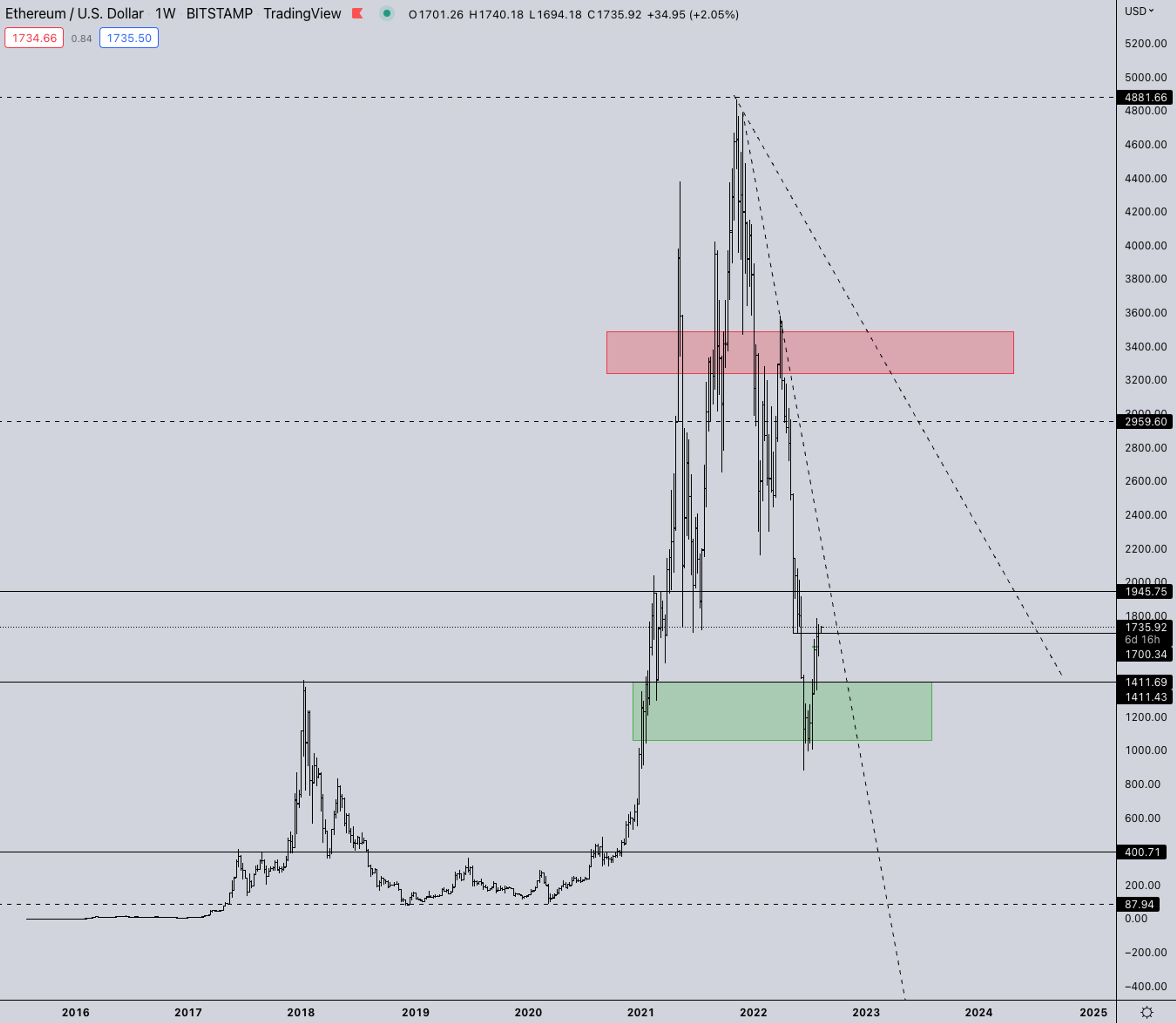

ETH Weekly View

ETH actually closed back in the LUNA crash range on Sunday. This still is a highly congested zone that can give quite some knee-jerk reactions up and down. But with the short-term trend up, a run into 2-2.6k leading to the merge isn’t out of the question.

ETH/BTC

ETHBTC is still the underlying strength in the market. Goerli testnet merge should be this week. If things go smoothly ETH will most likely get another push-up. Couple that with a probable chance of CPI being significantly lower than last month makes a perfect mix for continued crypto strength throughout August.

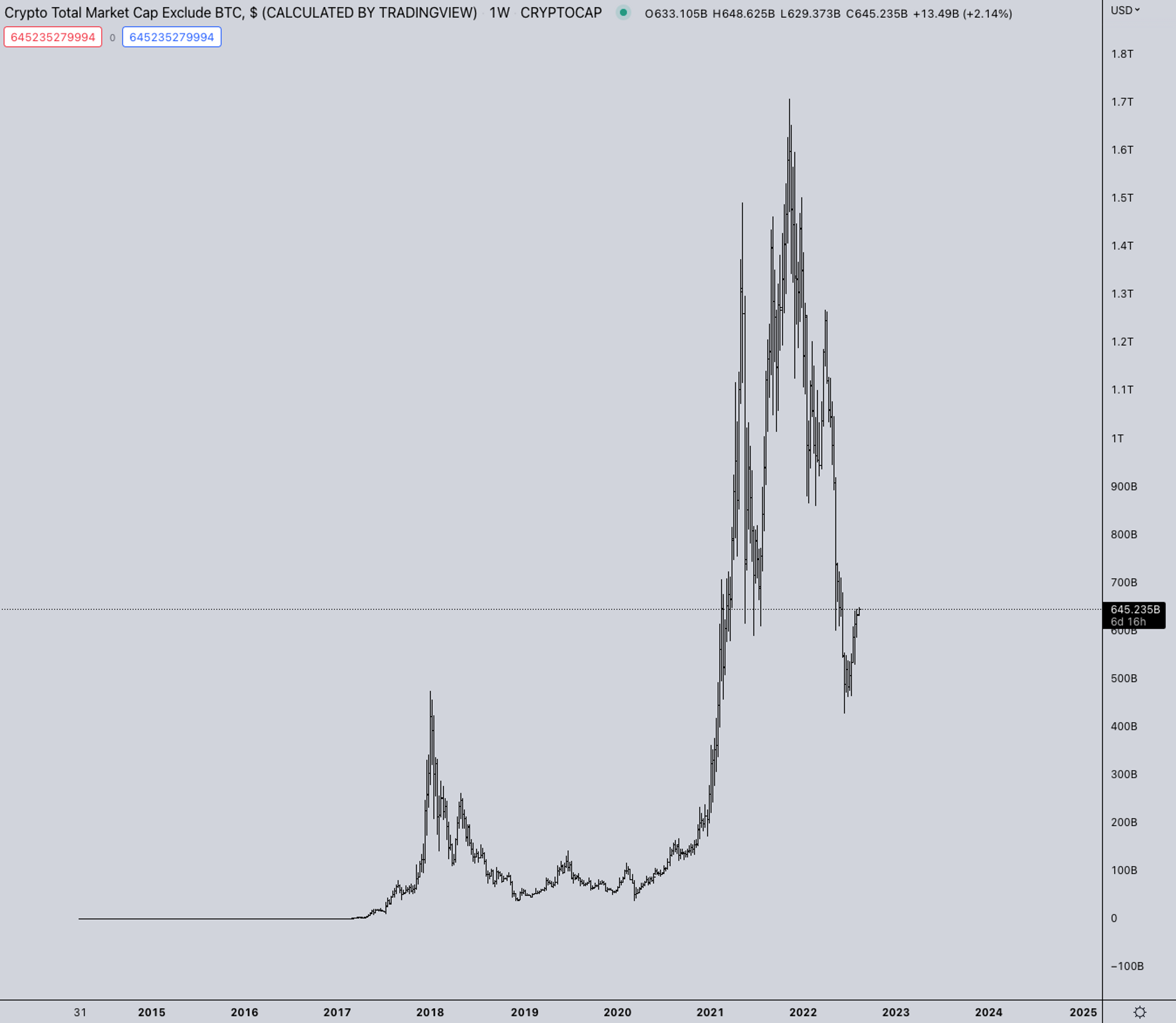

TOTAL2 - USD Market Strength

TOTAL2 has also re-entered the crash lows. Across the board, in majors, there is strength vs BTC (LTC, ZEC,SOL, BNB,...). These majors primarily carry TOTAL2. But this is still the TOTAL2 dollar pairing which has quite a long road ahead before getting back to USD all-time highs. The more interesting chart is the TOTAL2/BTC ratio.

TOTAL2BTC - BTC Market Strength

As mentioned in the previous TOTAL2 part. TOTAL2/BTC is where the real bull market is forming. With it inching closing into ATHs every week. The price structure is more than 18 months of consolidation. An upward break could lead to quite some extended time in the ALTBTC rallies.

SH*TPERP/ALTPERP

Fun observation last week is the first time in quite a while that on-chain coins started ticking up again in several ecosystems. On ETH, there was a massive spike in FOLD, trading almost 10x from the bottom. This pump on particular ones can instill confidence in on-chain speculators and snowball into lower cap coins rallying as belief becomes stronger again.*SH*TPERP/ALTPERP is a measure of speculative risk. When SH*TPERP outperforms ALTPERP, it shows a measure of speculation in the market, showing how much risk people are willing to take at a certain time.

Summary

- ALTBTC is where the market strength still is

- On-chain lower cap coins regaining strength

- The market is positioning for the ETH merge with the long spot ETH short futures trade.

- Coinbase earnings call on Tuesday

- U.S. Inflation Peak is expected on Wednesday, but the focus will be on how fast it can retreat.

DISCLAIMERThe information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Most Anticipated Retrodrops and Airdrops in 2024

Understanding Market-Making Models in Crypto

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide