Stability In Volatility: Why Crypto Market Makers Matter

Market volatility is a constant companion in crypto, and it’s enough to keep traders and investors on the edge of their seats. Let’s delve into the heart of the matter—what makes up the rollercoaster nature of blockchain-based markets and how participants achieve stability.

We also shine the spotlight on crypto market makers, the invisible heroes that provide that very stability in the volatile world of digital assets.

Causes of Market Volatility

Crypto market volatility stems from a myriad of factors, including:

- regulatory developments

- technological upgrades

- macroeconomic trends

- and even social media chatter

Regulatory Developments

News of regulatory developments, whether proposing new frameworks or imposing restrictions, can send ripples through the market. Traders and investors keenly watch for legislative cues that would shape the legitimacy of cryptocurrencies on a global scale.

Technological Upgrades

Innovation is a double-edged sword. While these upgrades are often promising, they also introduce an element of uncertainty. These can trigger market reactions as stakeholders assess the potential benefits or risks associated with these developments.

Macroeconomic Trends

Of course, global forces are also at play when it comes to crypto market dynamics. Blockchains are not isolated from the broader economic landscape. Inflation rates, interest rates, and geopolitical events, also cast their shadows on the crypto market.

Social Media Chatter

Social media platforms and other digital communities serve as a powerful amplifier for market sentiment. Tweets, Reddit discussions, and online forums can swiftly alter perceptions, triggering a cascade of buy or sell actions.

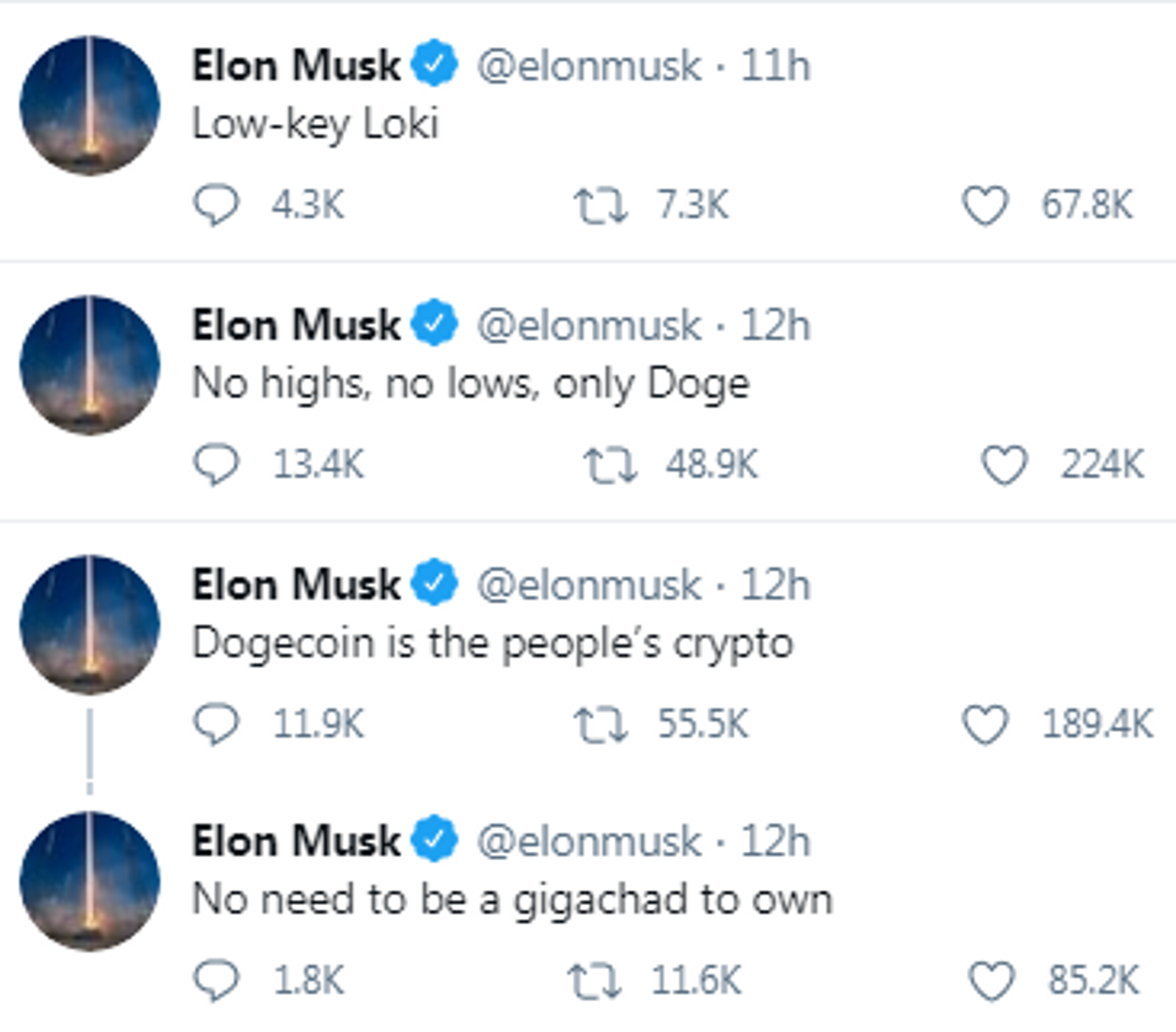

A compilation of Elon Musk's tweets on $DOGE

The "viral" era of information means that even a single influential post (e.g. Elon Musk's tweets on $DOGE) can disproportionately impact market behavior. Remember Gamestop?

The Interplay of Factors

What makes crypto market volatility truly intricate is the interplay of these factors. Regulatory changes might coincide with technological upgrades, amplifying the market's response. These shifts in market conditions can intersect with online narratives, creating a web of influences that challenge even the most seasoned market analysts.

Impact of Volatility

This volatility isn't just a numbers game; it profoundly affects traders, investors, and overall market sentiment. High volatility can lead to significant price fluctuations and risk, making informed decisions difficult for participants.

Market stability guides traders and investors to safer shores. This allows participants to focus on long-term goals rather than getting swept away by short-term market currents.

And who helps create this stability? Market makers.

The Role of Crypto Market Makers

Crypto market makers are individuals or groups that facilitate trading through continuous buy and sell orders for a blockchain project. Their primary function is to enhance liquidity and narrow bid-ask spreads, making it easier for traders to execute orders, and enter and exit positions without moving the market in either direction.

Legitimate market makers are NOT market manipulators. They don't wash trade. Their goal is to create an efficient market and make sure prices align across all venues where the asset is being traded.

More about crypto market makers vs wash traders on an infographic at the end of this blog.

Liquidity provision is the backbone of a stable market environment. So how exactly do market makers provide liquidity in ever-dynamic cryptocurrency markets? Here are the ways:

Automated Market-Making

Market makers employ sophisticated algorithms and automation in efforts to narrow bid-ask spreads and increase liquidity. These tools enable quick responses to market changes, adjusting buy and sell orders in real-time to prevent large price swings.

Here’s a video that illustrates how automation in crypto market-making works.

Statistical Arbitrage

Statistical arbitrage is a key tool in a market maker’s arsenal. This data-driven strategy involves identifying and narrowing price discrepancies between related assets. By analyzing historical data, correlation patterns, and statistical models, they can execute trades that capitalize on short-term pricing inefficiencies.

Riding Trends and Market Momentum

This strategy capitalizes on market momentum. Market makers monitor and ride prevailing trends, aligning their positions with the broader market sentiment. By doing so, they not only contribute to liquidity but also act as stabilizing forces during upward or downward trends.

Diversified Assets

Market makers implement a diversified mix of assets and positions, aiming to neutralize the impact of broader market trends. This approach seeks stability by mitigating directional risk and minimizing the impact of market fluctuations on the overall portfolio.

Challenges Faced by Crypto Market Makers

Despite their vital role in the world of digital currencies, market makers also face challenges, such as market manipulation, bear market liquidity shortages, and the ever-present risk of technological glitches. These challenges add complexity to an already demanding role.

Market Manipulation

The crypto space is known for its rogue nature and lack of traditional oversight. This makes it prone to bad actors attempting to manipulate values for personal gain.

Market makers must continuously refine algorithms and monitoring systems to counteract these practices and ensure fair play in the market.

Bear Market Liquidity Shortages

Lack of liquidity and volume in a bear market poses a huge challenge for cryptocurrency exchanges.

Jens Willemen, CEO and co-founder of Kairon Labs, says “It’s extra important to provide liquidity for your native asset as the organic traders fade away and the market maker represents a larger share of the order books. It's important to instill trust by providing orderly markets as a token issuer in these low liquidity/volatility times.”

Liquidity crunches are often the result of rapid changes in market sentiment or unforeseen events that can trigger a sudden imbalance between buyers and sellers.

Technological Glitches

The risk of technological glitches is ever-present in the blockchain era. Even the most minor technical hiccups can have significant consequences.

Market makers must invest heavily in robust technological infrastructures and comprehensive risk management protocols to minimize the impact.

Ethical Brand of Market-Making

Ethical market-making involves conducting fair and responsible market-making activities and adhering to ethical standards and principles. The well-being of all market participants is the prime focus. Key aspects of ethical market-making include:

- Fair practices

- No conflicts of interest

- Protection of market stability

- Customer Protection

- Transparency, most of all

On the topic of ethical market-making, Willemen is firm in his goal for Kairon Labs, “We are founder and project-centric and are not looking to purely deploy market-making to generate profits for ourselves. Our business model ensures that we win together with the project.”

The Importance of Transparency in Market-Making

“Too many founders don’t understand the complicated deal structures proposed by some of our colleagues. We want to simplify things so all parties truly understand and are aligned in the best way possible.

Create transparency and trust towards the community so they know we are not working against them.”

—Jens Willemen

Transparency serves as a powerful tool for building trust among market participants. When market makers openly disclose their methods, traders and investors gain confidence in the fairness of the market.

Operating with transparency not only builds trust among market participants but also enhances overall market integrity. It also…

- Facilitates informed decision-making for traders and investors,

- Mitigates information asymmetry,

- Encourages market innovation,

- And ensures compliance.

A Balancing Act in Crypto

In facing these challenges head-on, market makers demonstrate their commitment to maintaining stability and trust in these volatile markets. From employing decentralized finance (DeFi) solutions to advanced risk management tools, market makers like Kairon Labs are your protectors in the crypto space.

Stability is a collaborative effort, in which market makers play a huge role. But it’s also every market participant’s responsibility.

Understanding the dynamics of market-making can empower traders and investors to sail unforgiving crypto waters with confidence and turn market volatility into opportunities for success.

Crypto Market-Making vs. Wash Trading (An Infographic)

Disclaimer: This article is for informational purposes only and should not be taken as financial advice. Always conduct your own research and consult with financial experts before making investment decisions.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide