Weekly Crypto Market Update – February 20, 2023

Last Week Recap

- U.S. Jan CPI is up 0.5% MoM and 6.4% YoY, slightly higher than the expected 0.4% and 6.2%

- SEC issued Wells notice to Paxos, and Paxos is ordered by the New York Department of Financial Services to stop issuing BUSD

- Shanghai upgrade will be launched on the Sepolia test network on February 28

- BLUR token was listed on all major CEXs except Binance

- Platypus Finance’s stablecoin USP was hacked and suffered a $9M loss

- Filecoin will launch smart contracts in Mar 2023 and become a fully-fledged L1

- SEC charges Do Kwon with fraud

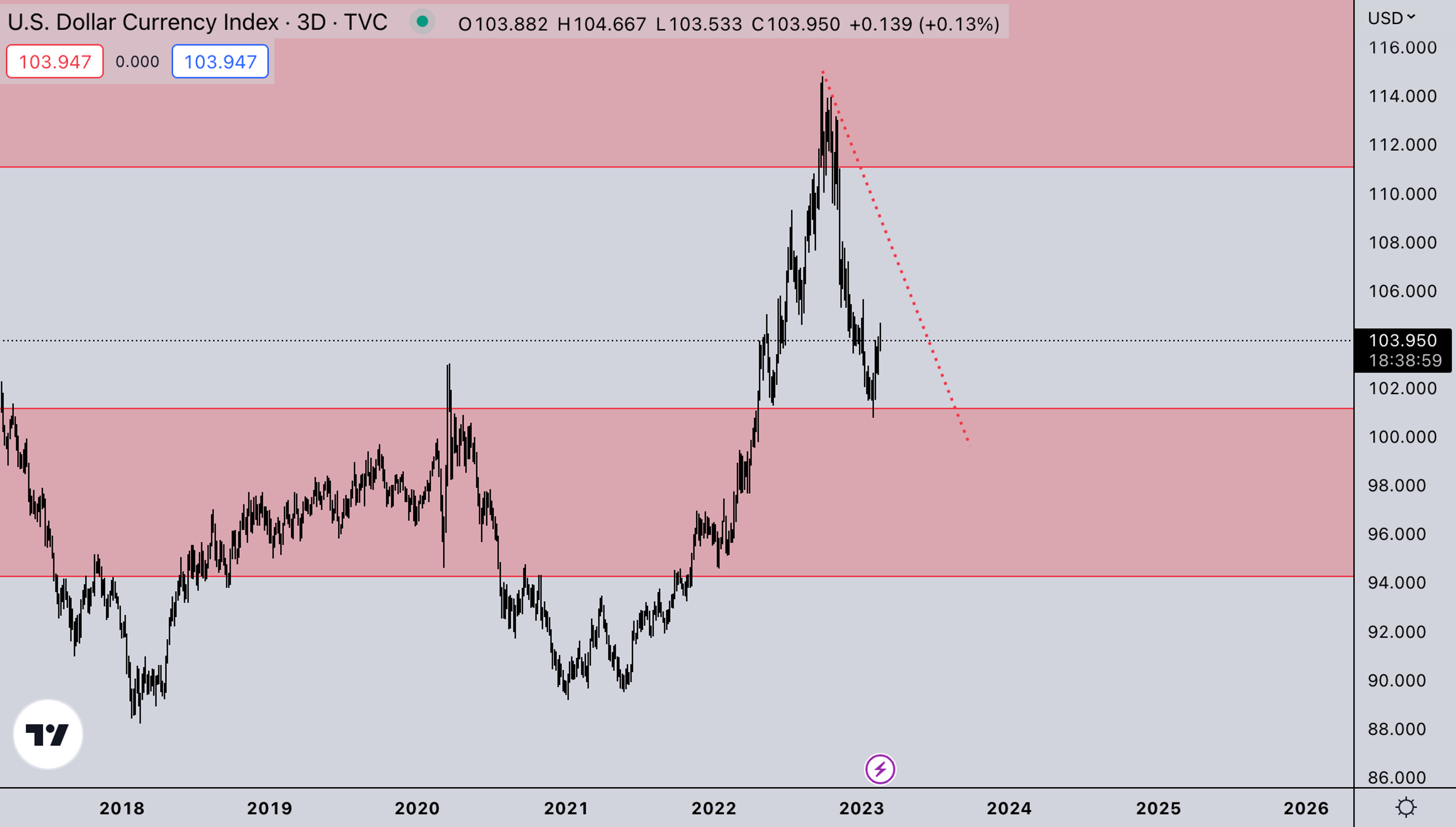

Legacy Markets – DXY

Last week we discussed the new CPI calculation method. Even with the new method, CPI still came in showing over expectations - signaling that inflation is picking up again. DXY saw a little reversal so far, despite being at technically higher timeframe support, and fundamentals picking up (FED needs more tightening to pressure inflation). However, higher timeframe moves do take time to structure out before moving. If DXY trades above 105, we’d expect more pressure on tech & crypto. At above 108, it would likely start a stronger downward move.

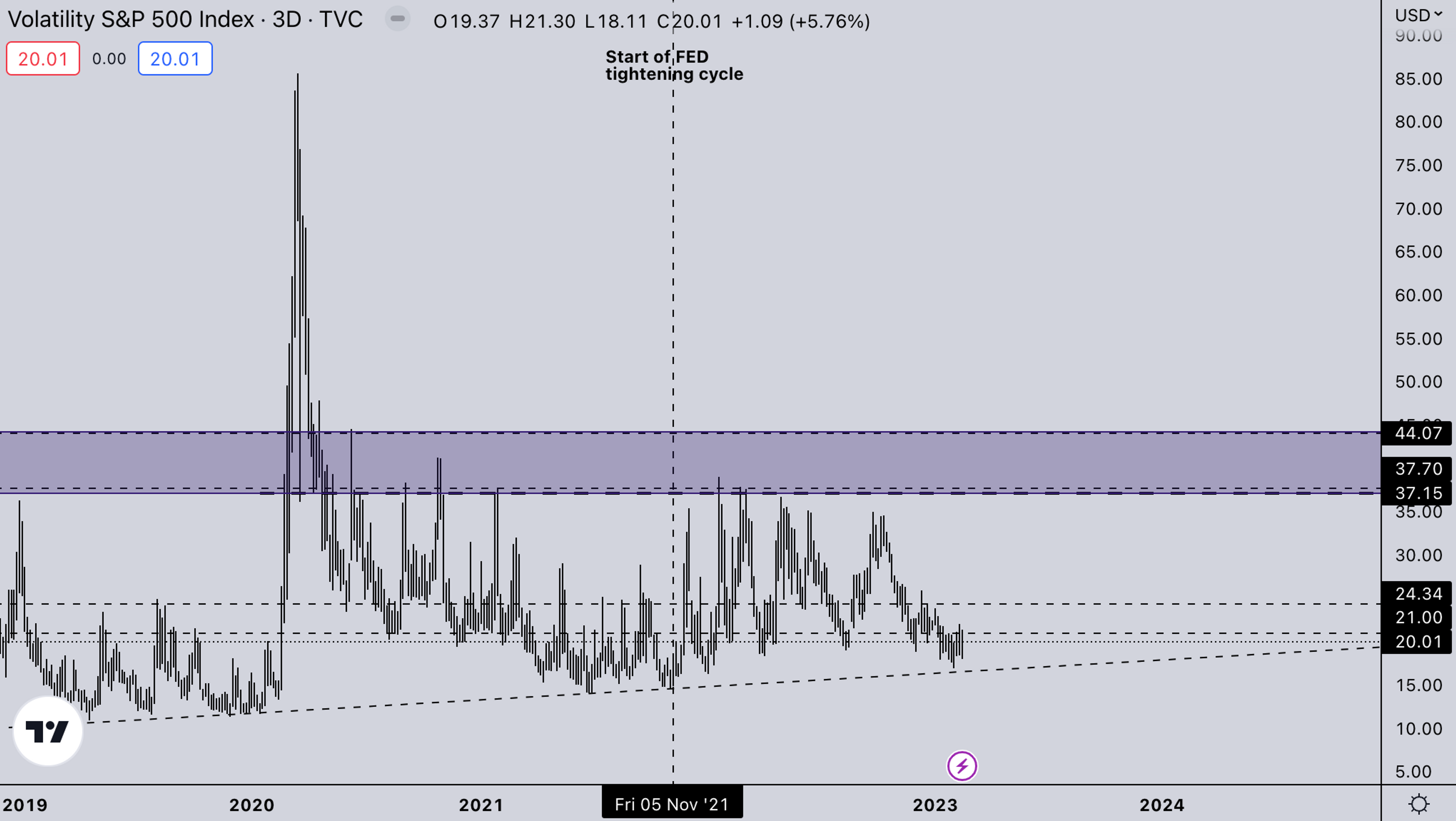

Legacy Markets – VIX

VIX has been poking 21s, but it hasn’t been able to get above and hold. As long as VIX stays sub-21 the correlation between assets will be low. Giving crypto a room to “decorrelate”, as some may call it from equities. As long as VIX stays sub-21, it’s a good environment for crypto to keep running.

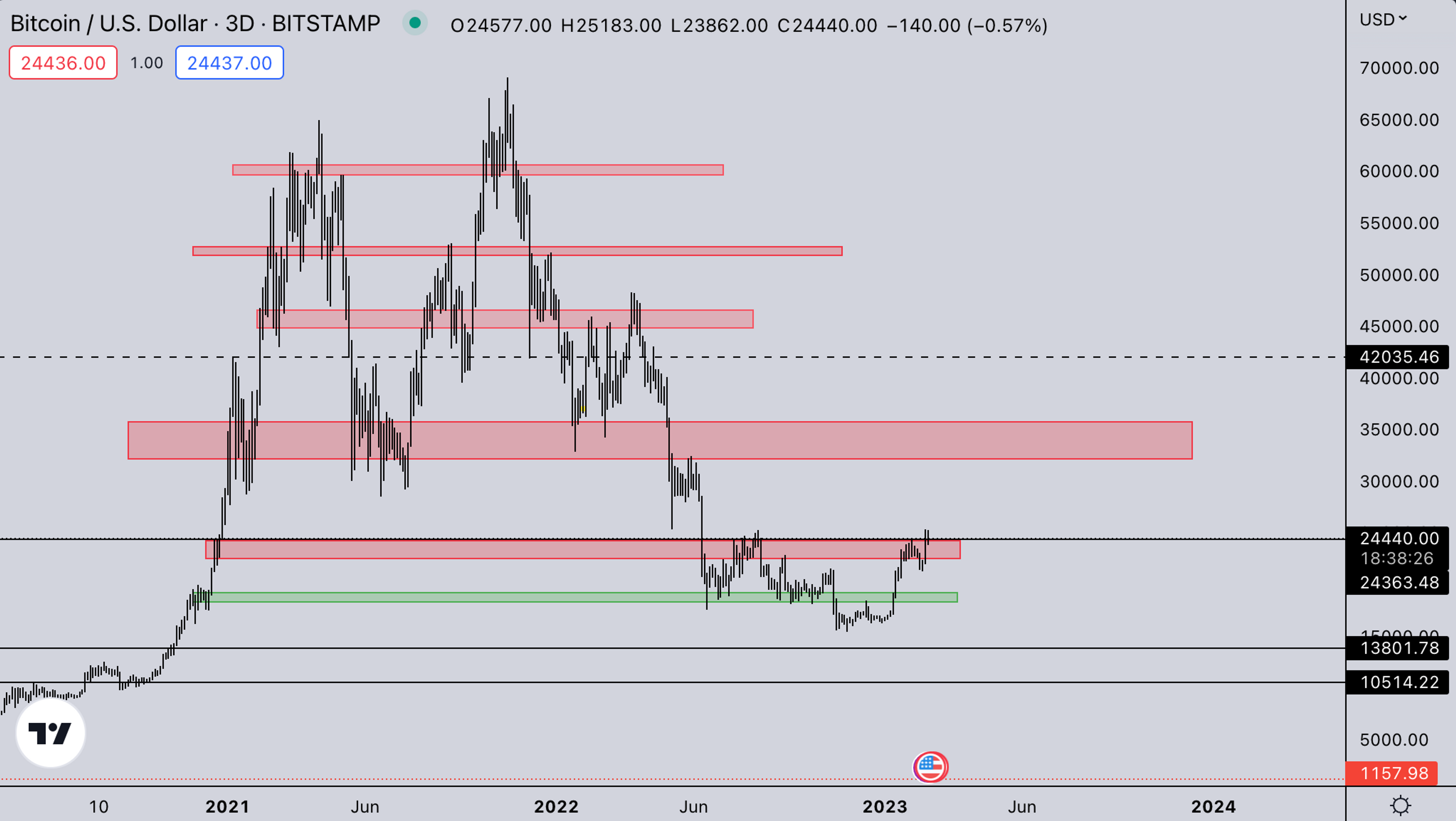

BTC Weekly View

BTC last week has been resilient, with it recovering from the post-CPI dip fairly quickly. Since then, it hasn’t really moved anymore and has mainly been chopping up breakout traders.That said BTC is still consolidating in the 24-25k zone, this gives a high probability of continuation. The only thing that possibly derails crypto at this point, would be a large down move in equities/tech (It is fairly extended but distribution can take time before the trend changes). Else it seems almost a given that BTC retests the 30k zone.

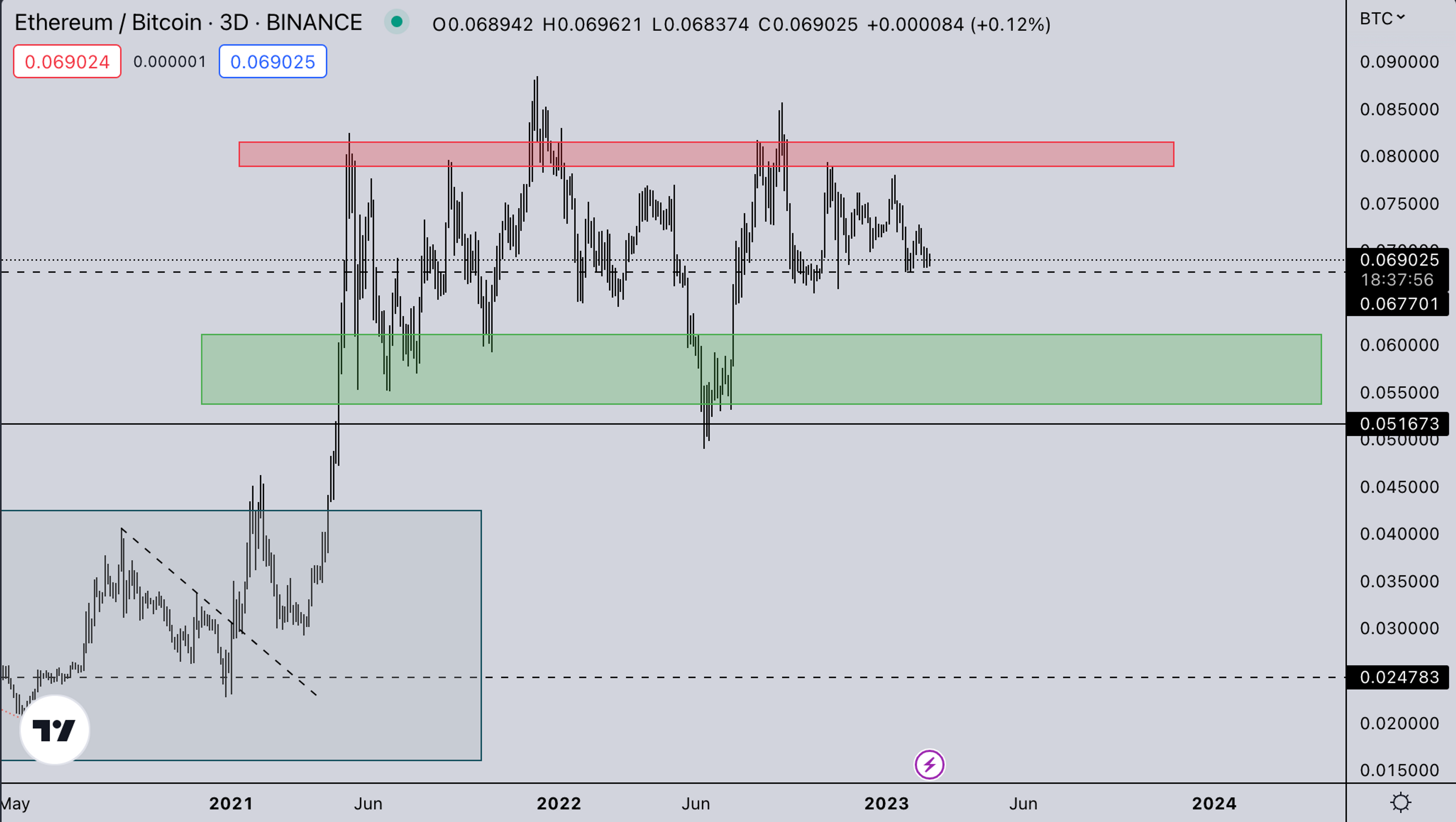

ETH Weekly View

ETH is still stuck at the 2021 support. With the perceived risk of shanghai unlocks, we think it’ll be hard for ETH to break this and expect further weakness in ETH/BTC going into the event. However, given that BTC still has some room till it runs into 2021 support (30K zone) - we could see ETH going to ±2K if ETH/BTC doesn’t weaken even more.

ETH/BTC

ETH/BTC is still weak consolidating right on the mid-range. If it gets under .067, it’ll likely see more downward acceleration. This will dampen the possible upside in USD value.

TOTAL2 – USD Market Strength

TOTAL2 shows the same picture as ETH, right on the 2021 support. This likely only breaks through if majors & ETH can get through this zone. Meanwhile, small caps and mid-caps have been showing different signs, with some trading close to ATHs.

TOTAL2BTC – BTC Market Strength

TOTAL2/BTC is reflecting the same thing we’re noticing in ETH/BTC. Meaning that BTC dominance is picking up more and more. This is generally not something you’d like to see. Especially if you want altcoin continuation. That said, TOTAL2 being fairly flat for now also shows that most runs currently are just rotations from one coin into the other. We’re not really seeing fresh capital flowing in. It’s more sidelined capital that’s slowly joining in.

Summary

- Crypto decorrelating from equities for now with DXY structuring out and a lower VIX environment.

- The market is closed in the US on Monday.

- Coinbase earnings on Tuesday after the bell.

- Eyes on BTC if it can run into 30k & the reaction altcoins will have to this.

- Crypto options update.

- ETH 60-day 25 deltas R/R same neutral level as a week ago. Very tepid moves in 2023 LTD.

- ETH 60-day ATM vol continues range-bound in Feb23 MTD.

- Seeking to close long, put leg from our ETH 31Mar23 Straddle Position on price softness. Overall profitable LTD

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Most Anticipated Retrodrops and Airdrops in 2024

Understanding Market-Making Models in Crypto

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide