Crypto Macro Market Update - January 30, 2023

Last Week Summary

- CME's share of total open interest on BTC is near an all-time high.

- Tesla did not sell bitcoin transactions in Q4 and still held about 9,720 bitcoins.

- APT prices surged to an all-time high, part of the reason is due to high buying activities from Korean communities.

- Aave V3 is live on Ethereum, focusing on mitigating risk and increasing capital efficiency

- The proposal of deploying Uniswap V3 on the BNB chain has been approved.

- BYBIT launched a new unified trading account (UTA), allowing users to trade across multiple markets from one account and share margins.

- Deribit is planning to relocate to Dubai.

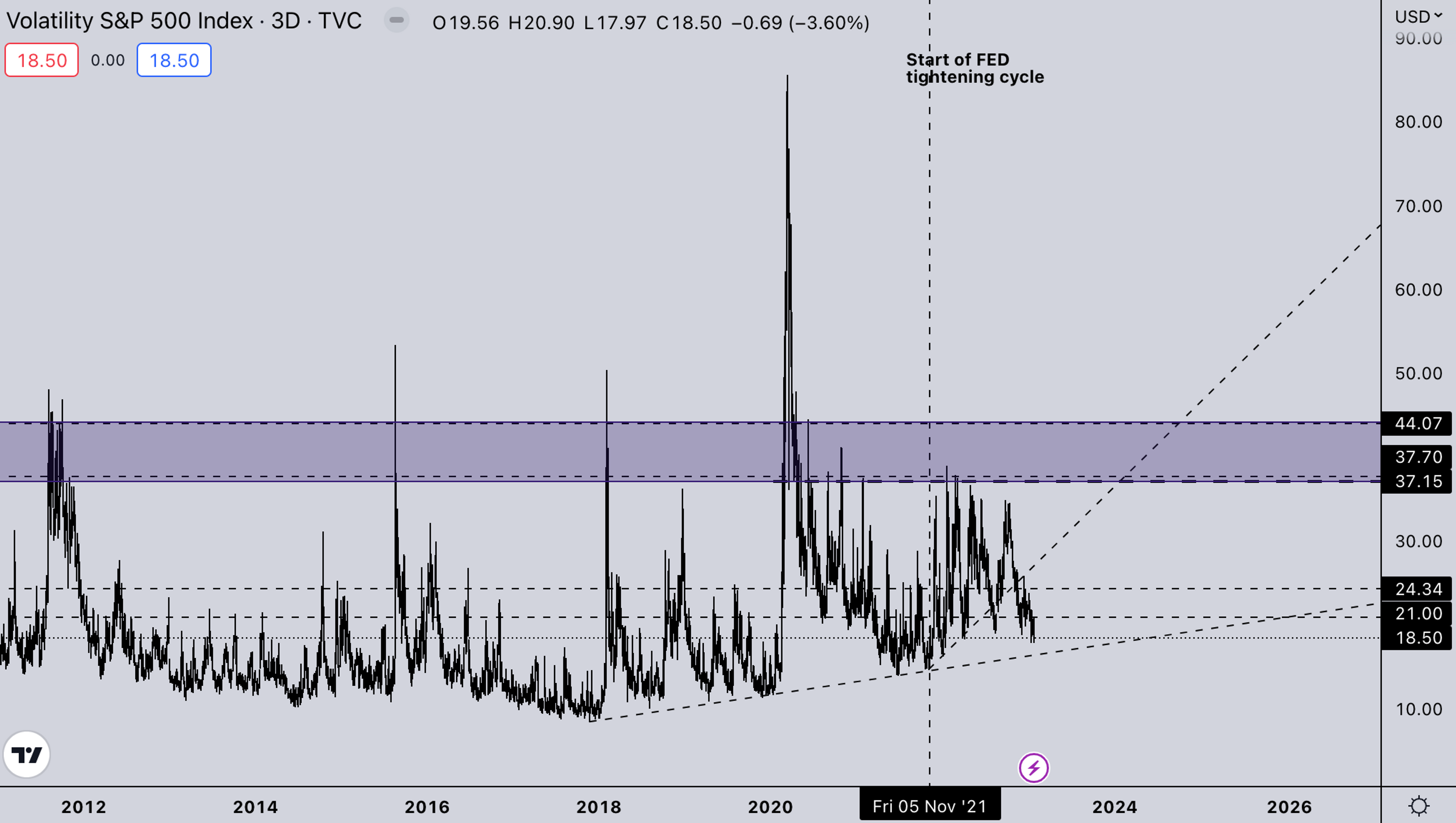

Legacy Markets – VIX

VIX is still trading sub 21 and we can see that everything is flying. Tech in legacy saw one of its best weeks in recent memory and in crypto, a wide array of alts did multiples from the low. As long as VIX stays low equities & crypto can keep running. However, expect some turbulence this week with FOMC.

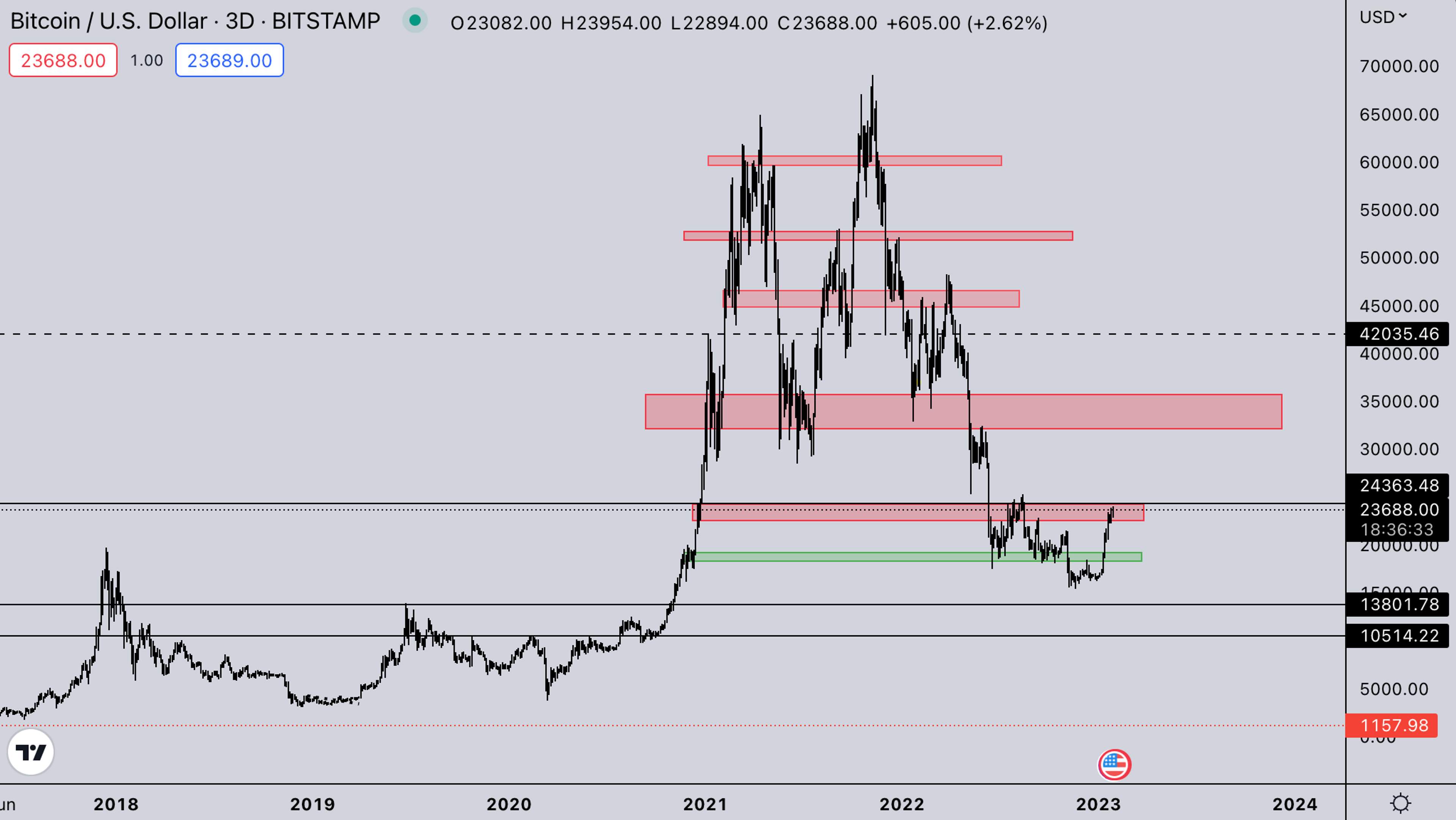

BTC Weekly View

BTC hasn’t really done much last week as most of the action was in altcoins. One thing to note was the underperformance on Friday. Were equities saw a huge squeeze crypto barely moved & also didn’t follow over the weekend. If BTC can get over 24-25k it can accelerate fast to the 28-32k region. For the bear case, this week with FOMC depending on the outcome a retest of 19-20k would be a huge buying opportunity for the current rally

ETH Weekly View

ETH shows the same picture as BTC. ETH has been suffering from severe underperformance though. It seems a lot of players were heavily positioned in ETH and under-positioned in other alts & BTC. We think this is the main reason for its underperformance so far.

ETH/BTC

ETH/BTC as mentioned in the previous section ETH is weak relative to the market and to BTC. As seen with how strong the underperformance has been, we’d expect it to continue and most likely go all the way down to the green support zone. Ideally, we see a strong reaction there.

TOTAL2 – USD Market Strength

TOTAL2 is slowly pushing up and grinding over the trendline. There are a lot of small and midcap alts that have done multiples since the rally began but these have less impact on TOTAL2. For this to really move we need to see a strong push in high caps.

TOTAL2BTC – BTC Market Strength

TOTAL2/BTC is showing the same picture as ETH/BTC. There’s structural underperformance of a lot of high-cap alts relative to BTC. The clue here really is to only focus on the outperformers in USD and BTC terms.

Summary

- FOMC is coming week. The market expectation is around 25bps.

- Big tech earnings AAPL GOOGL & AMZN all report.

- Crypto options update:

- ETH 60-day 25 delta R/R has been gyrating around a neutral level for the past week after breaking down into bullish territory mid-month.

- ETH 60-day ATM vols slowly tracking higher after coming off from the mid-month spike.

- Deribit ETH Call OI (Open Interest) far outstripping Put OI ~ 3.5x.

- We earlier profitably closed our downside short leg of our Bear Put Spread on declining vols, spot moved higher.

- In the DeFi option space, we again noted interesting IV moves around last Friday’s Ribbon auction.

- The market is currently trading on the pivot narrative. Need to monitor CPI & FED data. We think the only way a new bear wave based on macro is if we see an uptick in CPI.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide