Crypto Market Pulse - May 12, 2025

LAST WEEK RECAP:

- US S&P Services PMI 50.8 vs 51.4 expected

- China Caixin Services PMI 50.7 vs 51.7 expected

- FOMC holds rates at 4.25-4.5% as expected

- BOE holds rates at 4.25% as expected

- Canada unemployment rate at 6.9% vs 6.8% expected

- US and China meet in Geneva for trade negotiations, citing "substantial progress”

BTC WEEKLY VIEW

BTC has broken out of last week's consolidation range and continued to climb steadily. We anticipate that BTC could break through its all-time high at any moment.

ETH WEEKLY VIEW

Although ETH is still far from its previous all-time high, its performance last week was undeniably impressive. If this momentum continues, we could very well see ETH pushing above $3,000.

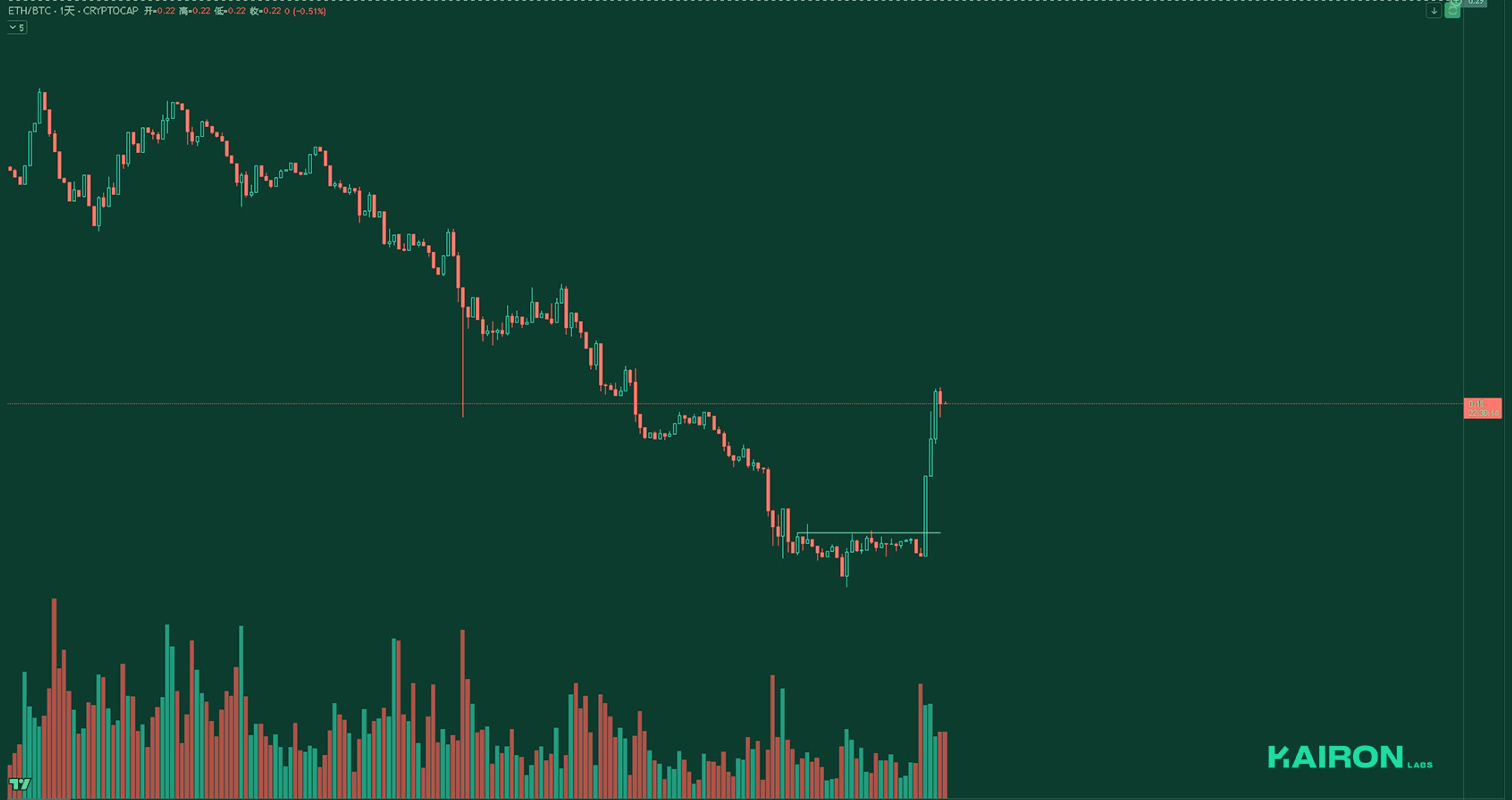

ETH/BTC

ETH/BTC has performed just as we expected last week, with the price making a strong rebound from the bottom. We anticipate that this momentum will continue.

TOTAL3 USD MARKET STRENGTH

TOTAL3 was supported within the demand zone we marked and has since broken upward toward the previous high at the support-resistance flip level. The current consolidation appears to be a buildup of strength in preparation for the next breakout.

TOTAL3 BTC MARKET STRENGTH

TOTAL3/BTC may not show significant upside movement yet, but the noticeable increase in volume at the bottom is a positive sign. Overall, altcoins might need some more time to consolidate before outperforming BTC. That said, the fact that we've seen a bottoming and a rebound is already an encouraging signal.

MARKET LEVERAGE RATIO

The market leverage ratio has also surged significantly, showing a breakout increase with no signs of slowing down or reversing. This suggests that the market hasn't started taking profit yet.

BTC OPEN INTEREST

OI spiked with the strong rally in price, then slightly decreased as price settled along the same price, likely with futures traders closing out positions.

BTC PERPS FUNDING

Funding is now elevated with the rally in price. With funding at more than 0.01, traditionally a bullish indicator- market sentiment is positive, the most bullish it has been in weeks.

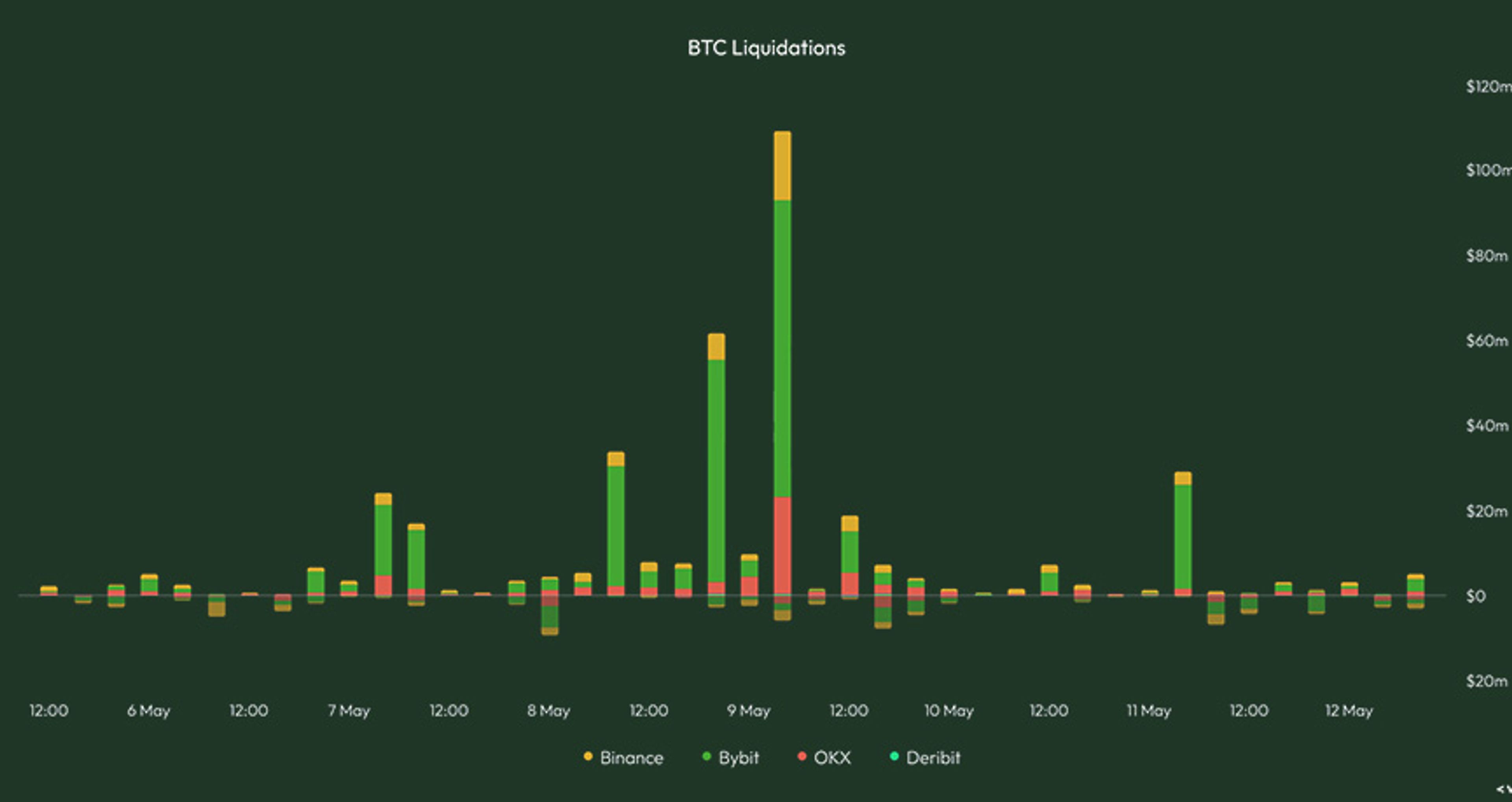

BTC LIQUIDATIONS

We saw a record number of liquidations as BTC rallied from 94k to 104k, with Bybit seeing the largest number compared to the other 3 exchanges that were tracked.

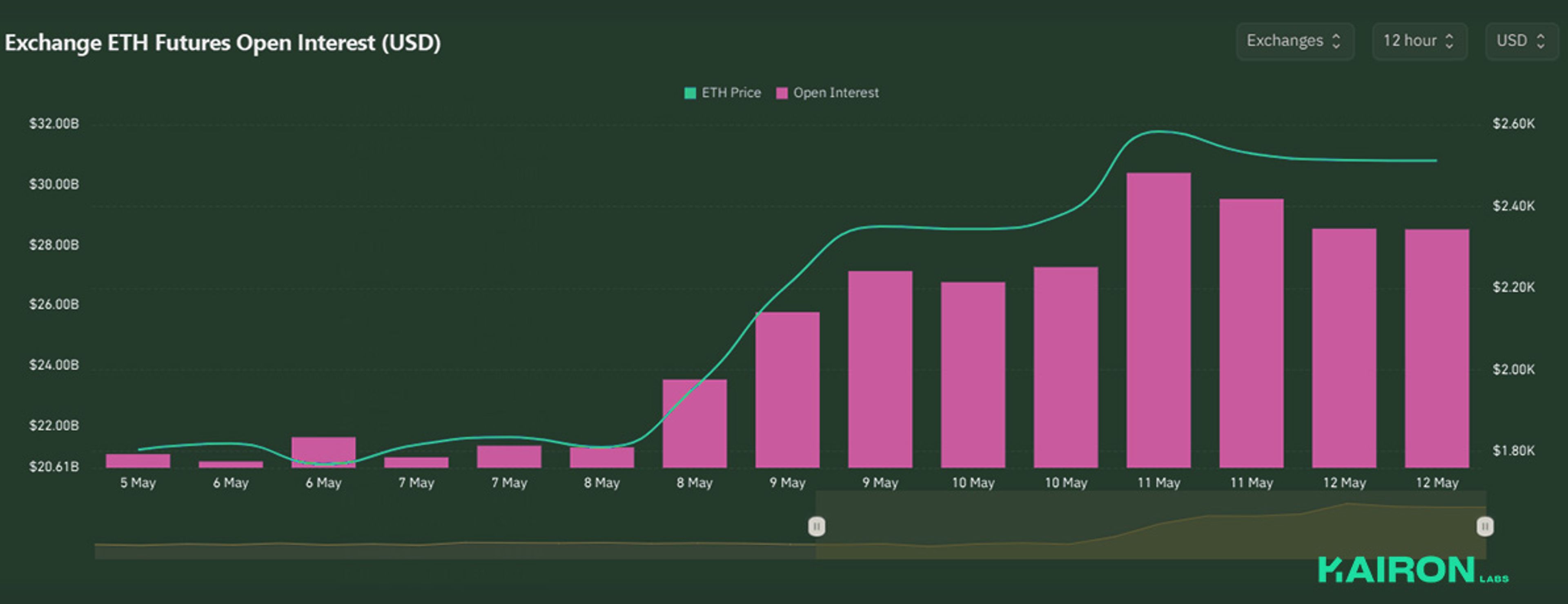

ETH OPEN INTEREST

Massive spike in OI following the huge rally in ETH price- OI remains elevated, marking a sizeable shift in sentiment.

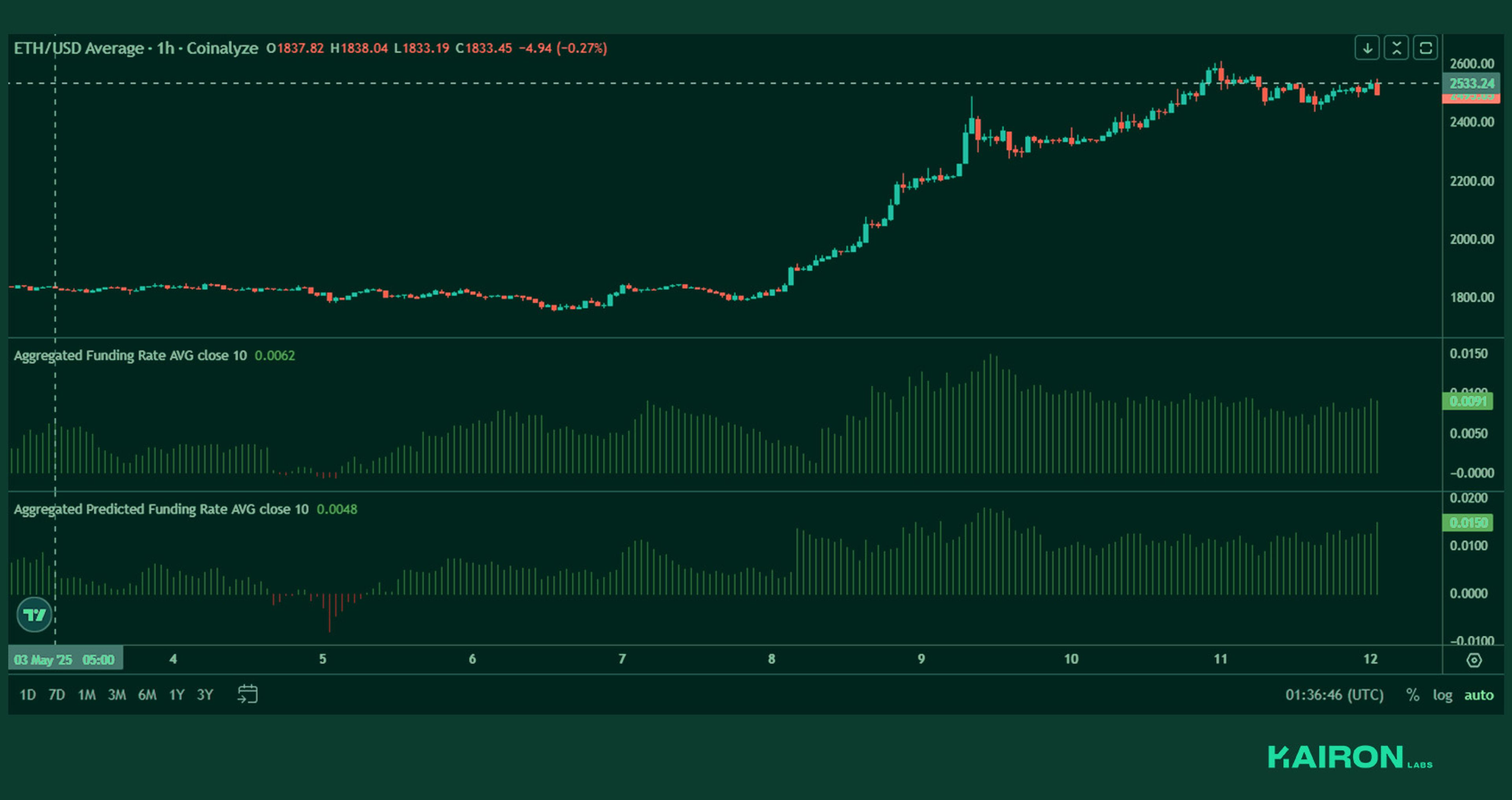

ETH PERPS FUNDING

ETH funding continues its positive momentum, and with the rally in price, has seen a significant increase to levels above 0.01- marking an outright shift to bullishness.

Whilst it has retraced slightly, it still hovers near the 0.01 mark.

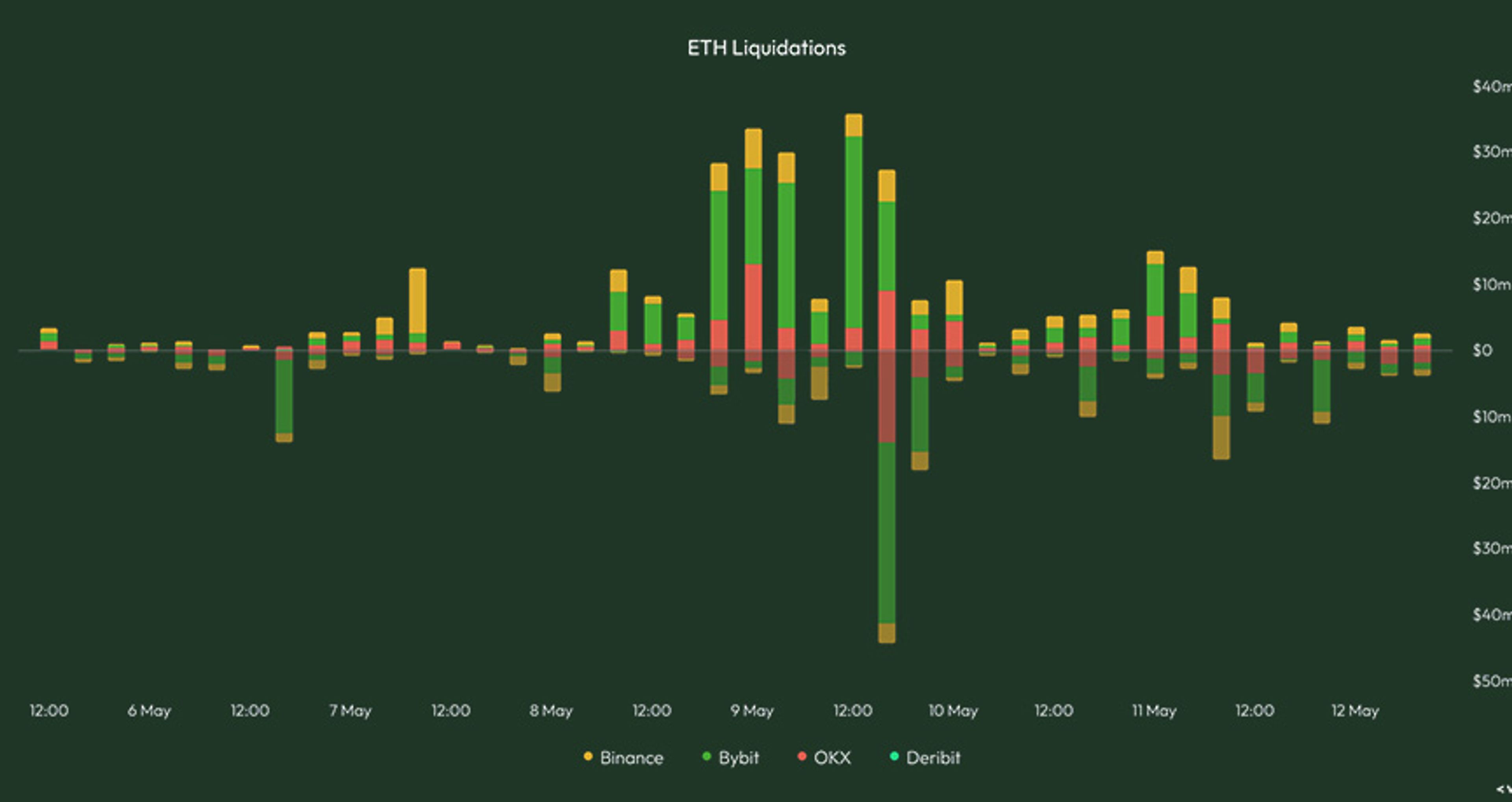

ETH LIQUIDATIONS

Similarly, ETH saw a huge liquidation event in the rally last week that caught most of the market off-sides

SUMMARY

- Markets saw a dramatic shift in sentiment last week, starting with a cautious tone following the Fed’s decision to hold rates steady and Chair Powell’s hawkish comments on the inflationary impact of tariffs. However, optimism returned swiftly after news of a surprise U.S.-UK trade deal, coupled with anticipation around the upcoming U.S.-China trade talks in Geneva.

- Crypto markets led the rally, with Bitcoin surging past $100K and Ethereum jumping to $2,500, while altcoins followed with strong momentum.

- Equities posted more modest gains, with the S&P 500 up 2%. The week underscored how sensitive risk assets remain to trade headlines, with this week’s developments likely to determine whether the rally has legs.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

This post was prepared by Kairon Labs Trader Patrick Li, Travis Su, and Kenny Lee.

Edited by: Marianne Dasal

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Cointelegraph: Kairon Labs Sheds Light on What Real Market Makers Do

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide