Crypto Market Pulse - September 30, 2024

LAST WEEK RECAP:

- U.S. PCE increased 0.1% MoM in August, the same as estimated. The annual rate is 2.2%, lower than the 2.3% estimated, and is the lowest since Feb 2021.

- U.S. Core PCE increased by 0.1% MoM, lower than the estimated 0.2%; the annual rate is 2.7%, which is the same as expected.

- China’s central bank announced its largest stimulus measures since the pandemic, and the Chinese stock market rallied.

- US GDP grew at a 3% annualized pace in Q2, the same as estimates and the previous value.

- US BTC ETFs recorded seven consecutive days of inflows.

- CZ was officially released and mentioned that he will continue to invest in blockchain, decentralized technology, artificial intelligence (AI), and biotech.

- Ethena Labs announced that the new fiat stablecoin product, UStb, will be fully backed by Blackrock’s BUIDL in partnership with Securitize.

- Binance launched a pre-market spot trading service.

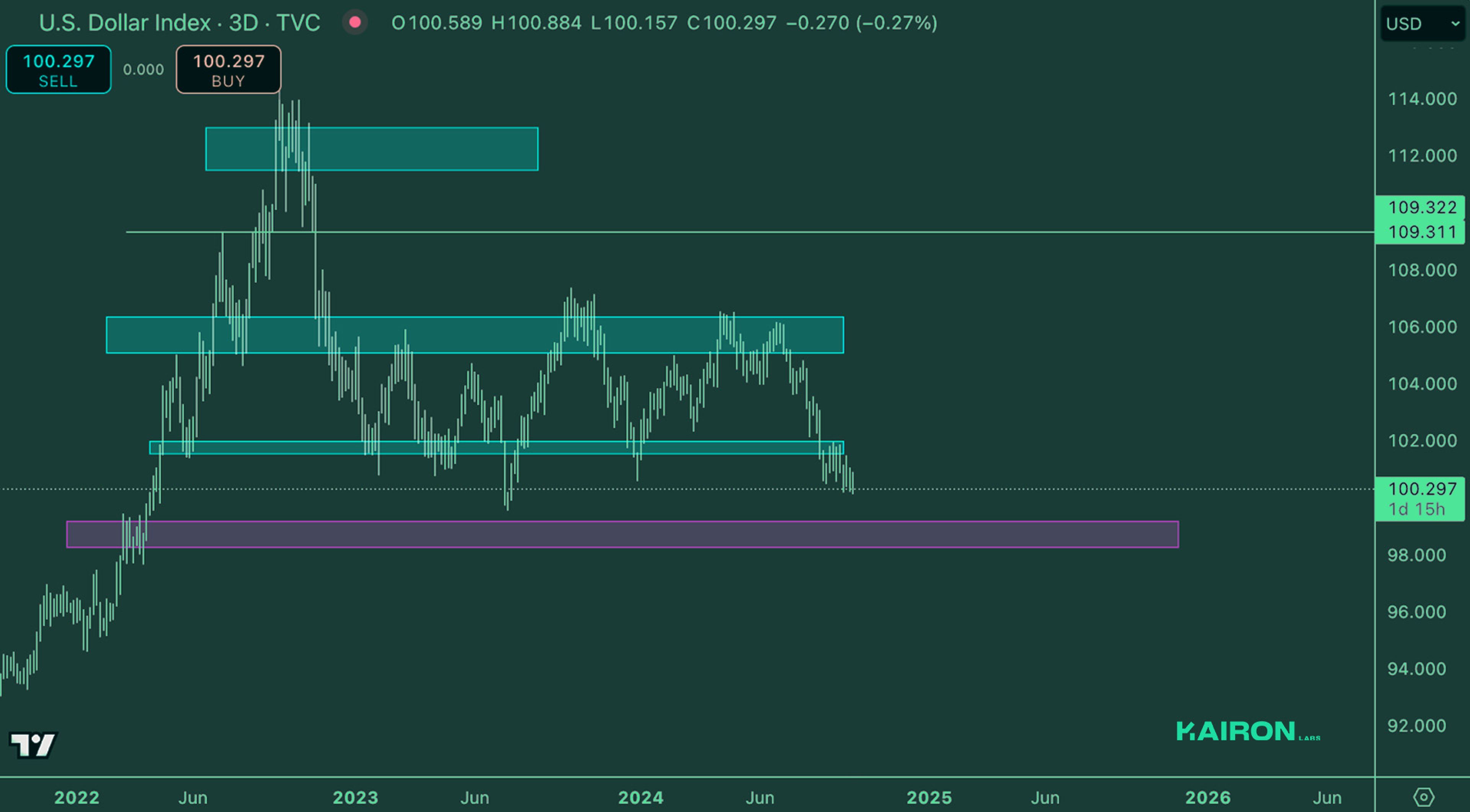

LEGACY MARKETS – DXY

DXY is still consolidating on a range low, slowly grinding lower. For now, as long as DXY stays in this area, further upside for risk assets should be possible.

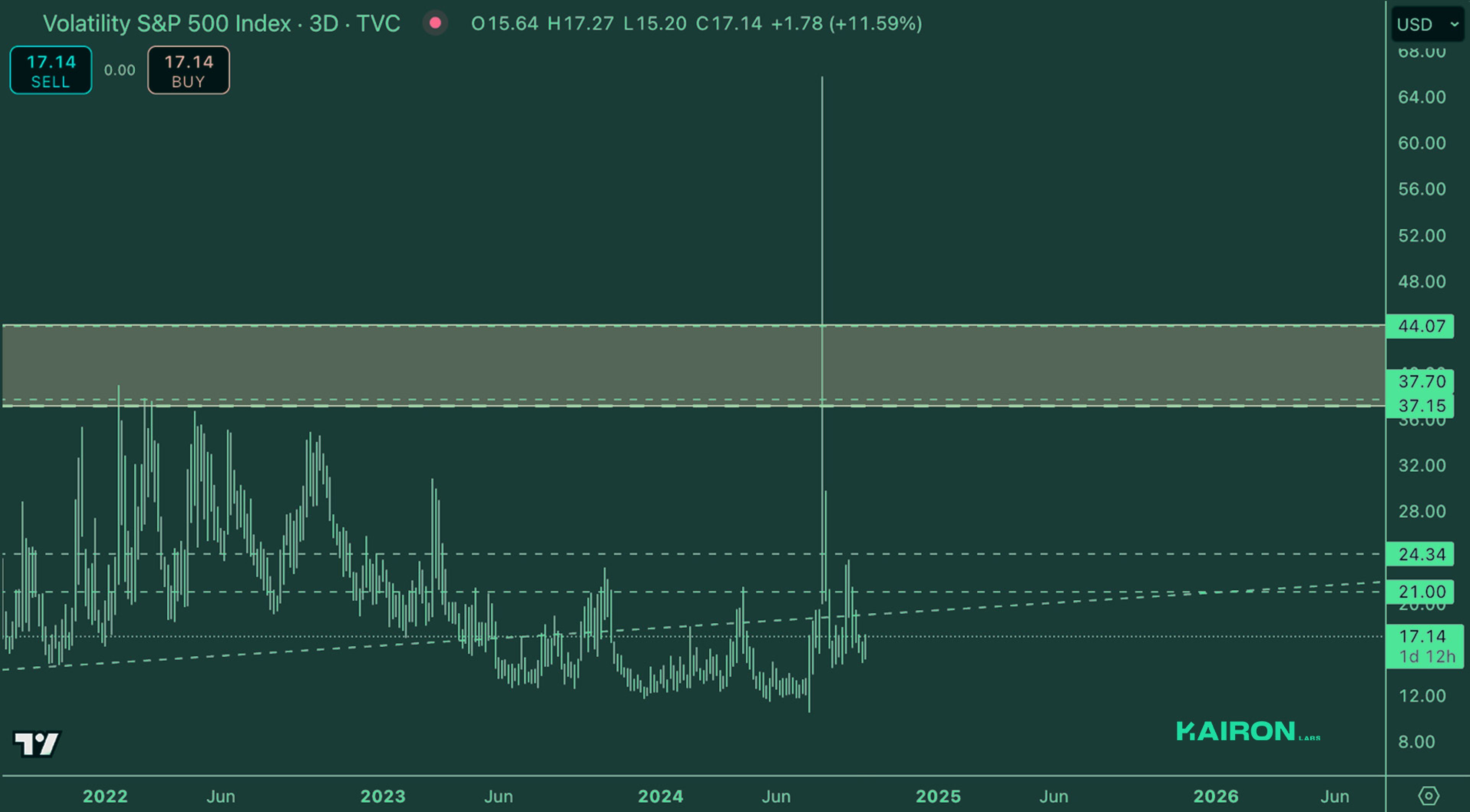

LEGACY MARKETS – VIX

VIX is lingering at lower levels but fails to fully fall back in the 12-14 zone. As long as it doesn’t fully fall back in range, assets can be somewhat choppy with small intermediate dips in this initial rotation.

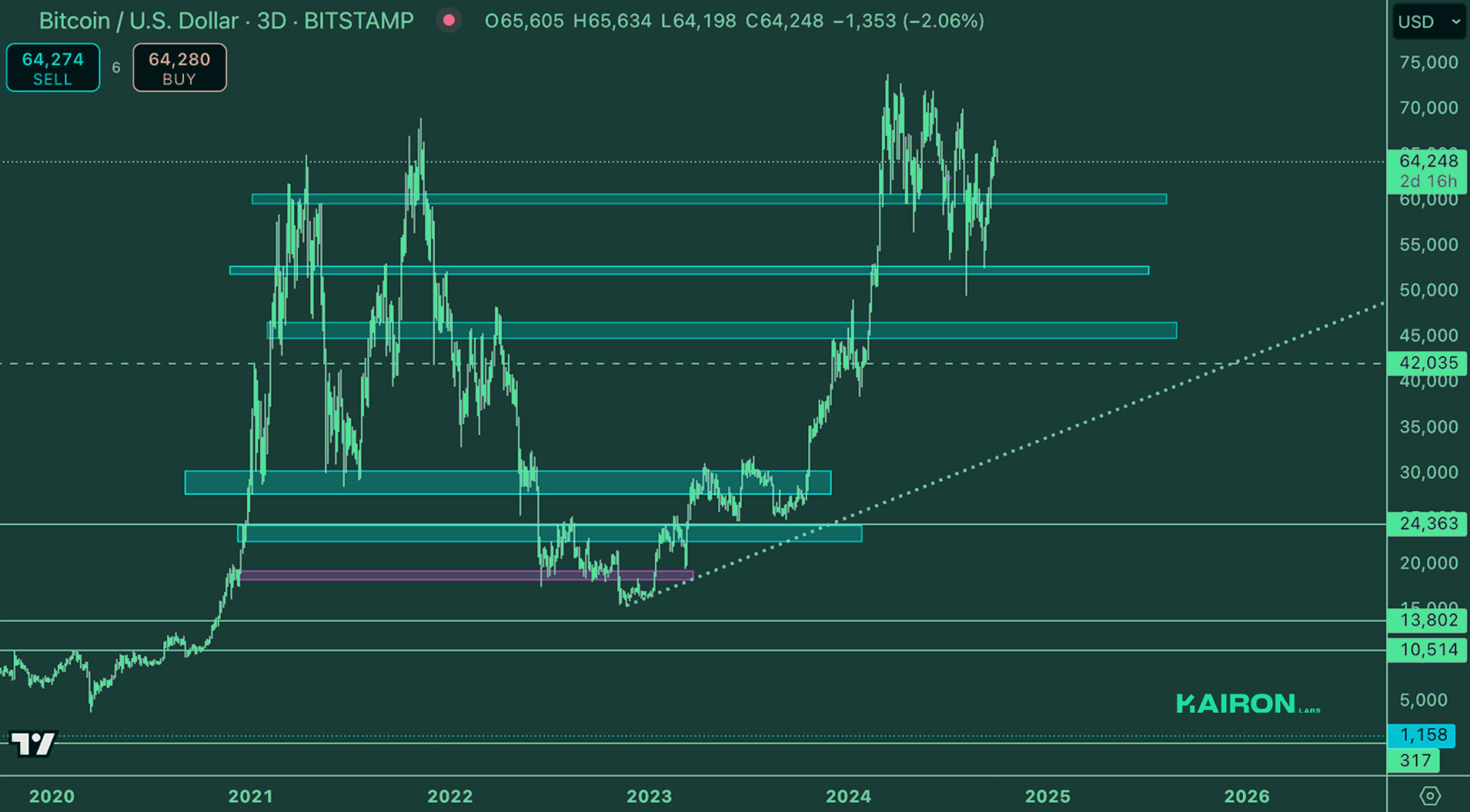

BTC WEEKLY VIEW

BTC is consolidating on the macro market structure break level 64.5 - 65.2k. With the level already broken, though briefly, the market structure is broken, and a trend reversal should be fully confirmed once BTC puts in a higher low. The question is, if it goes higher first before forming a higher low. One thing is sure: the summer slump is definitely over.

ETH WEEKLY VIEW

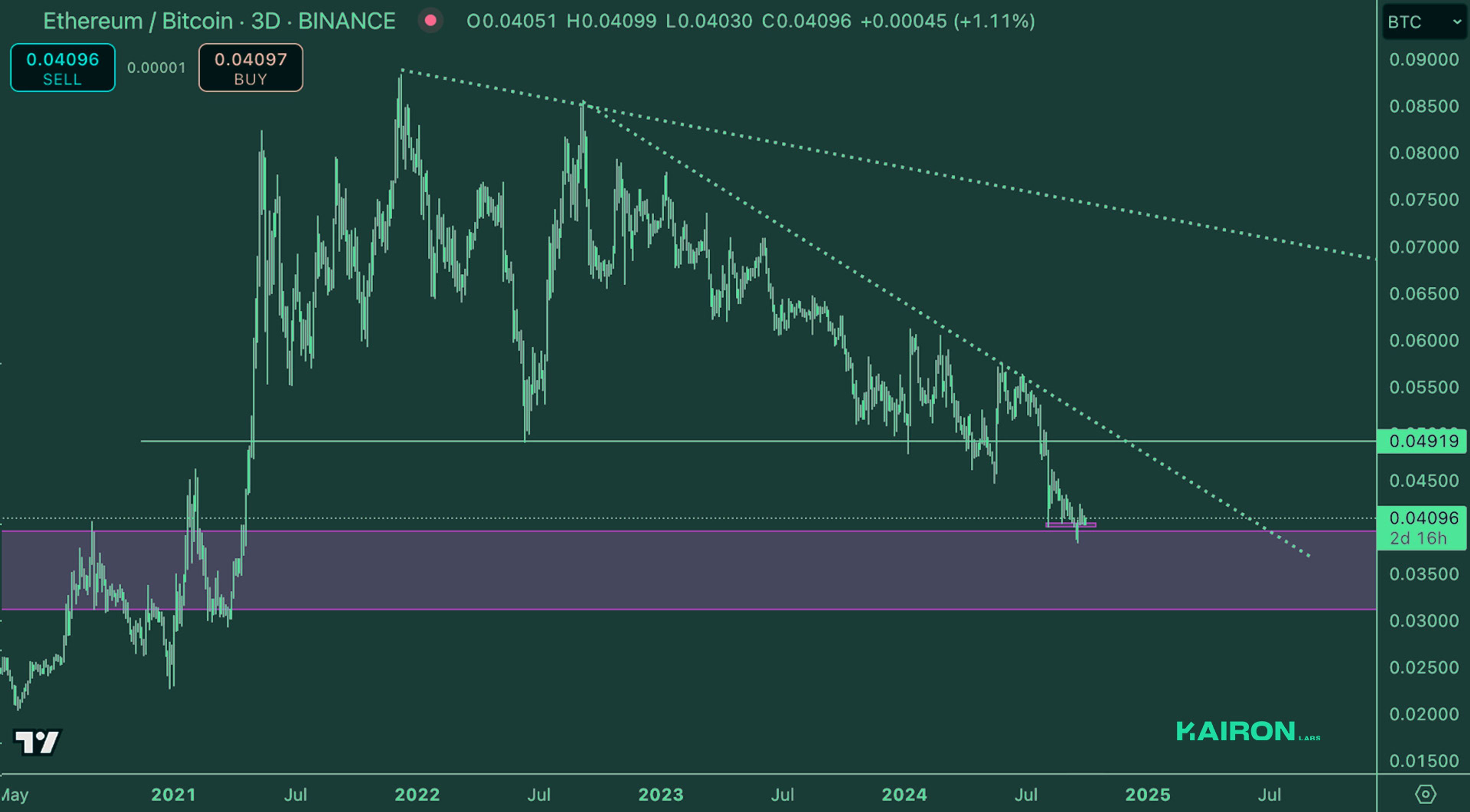

ETH is finally finding some strength. The ETH/BTC ratio is also finally showing some relative strength and trying to build a reversal. It's early days, but if the ratio reverses, ETH should trade up towards 3.2-3.5k fast.

ETH/BTC

ETH/BTC is starting to build a small reversal. If the relative strength is real, a swift move towards 0.049-0.05 should take place.

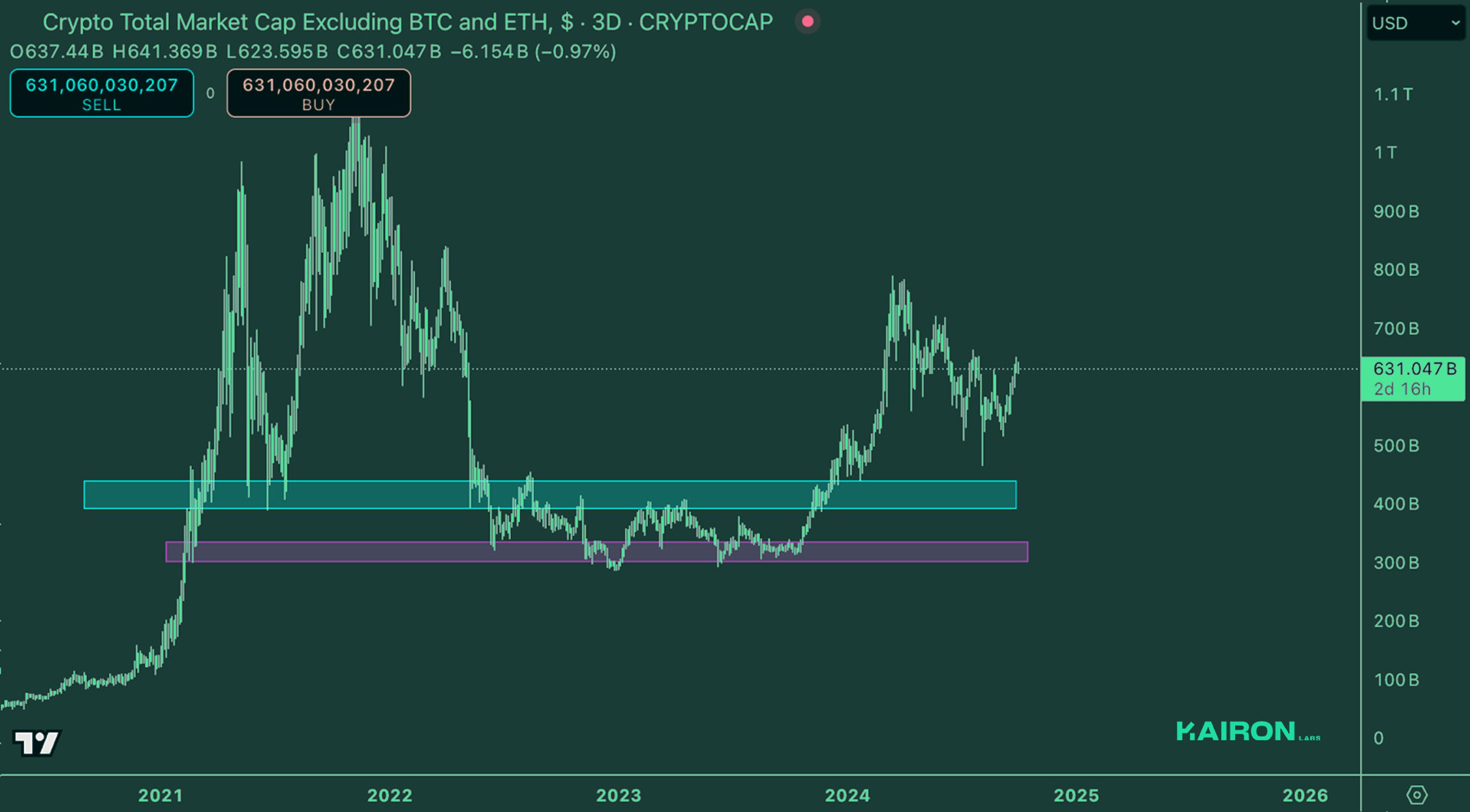

TOTAL3 USD MARKET STRENGTH

Alts are at the same spot as BTC, consolidating on the previous high for a market structure break.

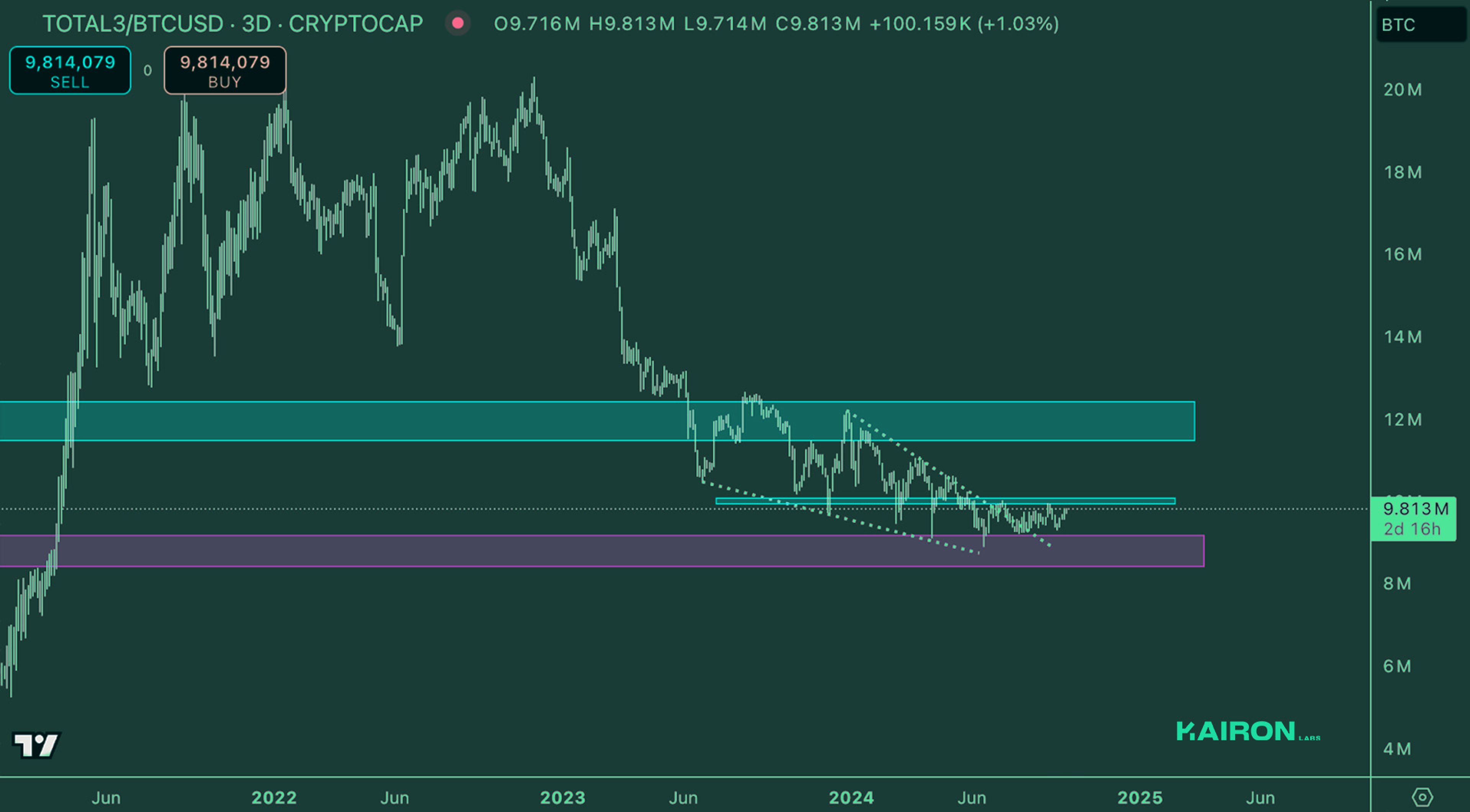

TOTAL3 BTC MARKET STRENGTH

TOTAL3/BTC is trying to break out of the compressed range again. Its complete structure has been building since November 2023; if this finally breaks upwards, the real alt season will likely happen.

SUMMARY

- ALT/BTC continues to show strength, with TOTAL3/BTC being on the brink of a macro reversal.

- ETH ETF inflows are finally picking up fast after the first rate cut. So far, the price is also slowly picking up with it, but there is no real acceleration yet.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

This post was prepared by Kairon Labs Trader Patrick Li and Joshua Van de Kerckhove.

Edited by: Marianne Dasal

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Cointelegraph: Kairon Labs Sheds Light on What Real Market Makers Do

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide