Crypto Macro Market Update – January 16, 2023

Last Week Summary

- Crypto continued to rally since the job report with US CPI cooling down as expected.

- AVAX partnered with AWS to accelerate the adoption of blockchain.

- SEC Charges Genesis and Gemini for the Unregistered Offer and Sale of Crypto Asset Securities through the Gemini Earn Lending Program.

- According to Kaiko, Binance's market share increased from 37% in 2020 to 57% in 2022.

- Ondo Finance launches tokenized US treasuries and bonds.

- Société Générale mints $7 million DAI from MakerDAO with home loans as collateral.

- Coinbase and Kraken leave/reduce the Japan-based businesses.

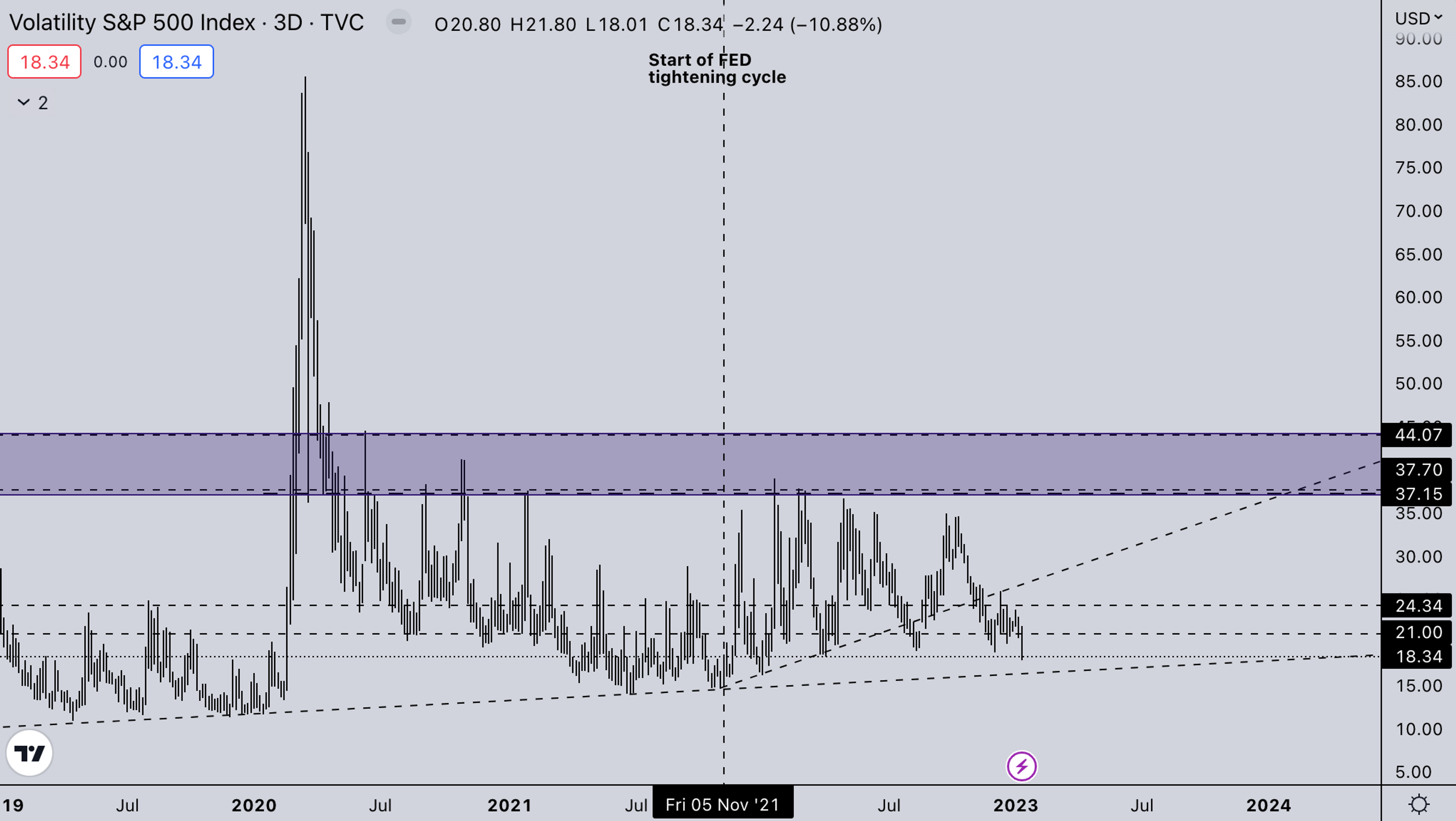

Legacy Markets - VIX

Last week VIX fell back below 21. in sub 21 environment which fuels risk on behavior. This is pretty apparent in stocks and crypto. As long as VIX is in this environment we can see decor-related upside movement in stocks and crypto.

Legacy Markets - DXY

The DXY is in the monthly support zone at the moment. The price action is weak. This is adding further fuel to the fire in risk assets. However, we are on the look in this area for potential fake breakdown or rotational strength back to the dollar which would cause pressure back on risk assets.

BTC Weekly View

BTC saw one of the biggest squeezes in recent memory, accelerating from the lows back over 20k; and in the process reclaiming the June lows and thus erasing the entire FTX selloff. With the sheer magnitude of the move on BTC, we’d expect some retests on support or at least some consolidation before it goes higher. In the meantime, altcoins will most likely keep rallying.

ETH Weekly View

ETH also had a big push upwards. Surprisingly ETH was actually weaker on the initial push-up than BTC. With both now running into high-volume areas, it seems likely they stall this week while altcoins rally further in the consolidation. We fast dip into 1400 - meaning it would all be buying opportunities on both ETH and select stronger alts.

ETH/BTC

ETH/BTC as mentioned in the previous section was actually weaker during the initial trust up from BTC. With ETH/BTC still being in this range, we don’t expect ETH to outperform just yet. The real fuel for ETH will come once we break out above .08-.082.

TOTAL2 - USD Market Strength

TOTAL2 surprisingly outperformed both ETH and BTC as we saw a further continuation of strong alts like LDO, SOL, and APT. It seems that the market was generally leading with coins that were heavily shorted at the EOY selloff. Because all these coins are highly perp-driven it’s important to see follow-through PA once the momentum dies down/ how the deleveraging will go. For now, TOTAL2 is at a technical resistance, but the momentum is quite high so we’d expect alts to continue to rotate and rally this week.

TOTAL2/BTC - BTC Market Strength

TOTAL2/BTC saw the same reaction as ETH/BTC. With only a couple of alts outperforming BTC. This week BTC will likely see more consolidation/chop price action. This should give altcoins the room to run against it.

Summary

- The market is in a firm bear rally. The best performers are the most shorted coins.

- Earnings season kicking off in equities, Two crypto banks announced on Tuesday (SI & SBNY). Silvergate will announce on Tuesday 17 January. This will give quite a bit of insight after their internal bank run during the FTX collapse.

- DXY on multi-month support. It is important to check for fake breakdown price action, as currently, it is still weak.

- Crypto options KL prop space. Rlzd pnl on T/D 30Dec22 long ETH 1200 31Mar23 straddle call leg on spot/IV moves, the strategy now transformed into bear put spread. LTD rlzd pnl (unannualized): 8.6%.

- Likely further alt squeeze in lower caps if BTC & ETH start ranging price action.

- Possible heavy Japanese regulations coming for crypto with Kraken closing office & Coinbase reducing.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide