Crypto Macro Market Update - January 2, 2023

Happy New Year! Crypto ended the year with the same trend as November 2022, as the collapse of FTX still taking a huge toll on the overall market. To give you a quick recap of 2022 and what we can expect from 2023, Kairon Labs created an e-book discussing the future of the market based on our inside trader's perspective. You can get the FREE ebook through this link: https://blog.kaironlabs.com/crypto-market-predictions-2023/ This ebook contains the following topics: 2022 Review, 2023 Forecast, Bitcoin Analysis + Forecast, Ethereum Analysis, Alternative layer1/2 analysis, A Closer Look at DeFi, What to Expect from Defi, Crypto Derivatives Market, The Future of NFTs, POW & Dino Coins Analysis, Institutional Playbook and Kairon Labs Trader Predictions for 2023. Get the latest copy here today!

Last Week Summary

- Blackrock lends money to bankrupt mining firm Core scientific.

- Valkyrie unveils proposal to help/takeover troubled firm Grayscale.

- Michael Saylor sold BTC and MSTR stock and re-bought BTC worth about $45M in December.

- BMW partners with Binance for a loyalty program on BSC.

- Fidelity aims to offer NFT & crypto trading services.

- MTGOX payment details deadline nears (10th of January) with the expectation that payment will follow soon after.

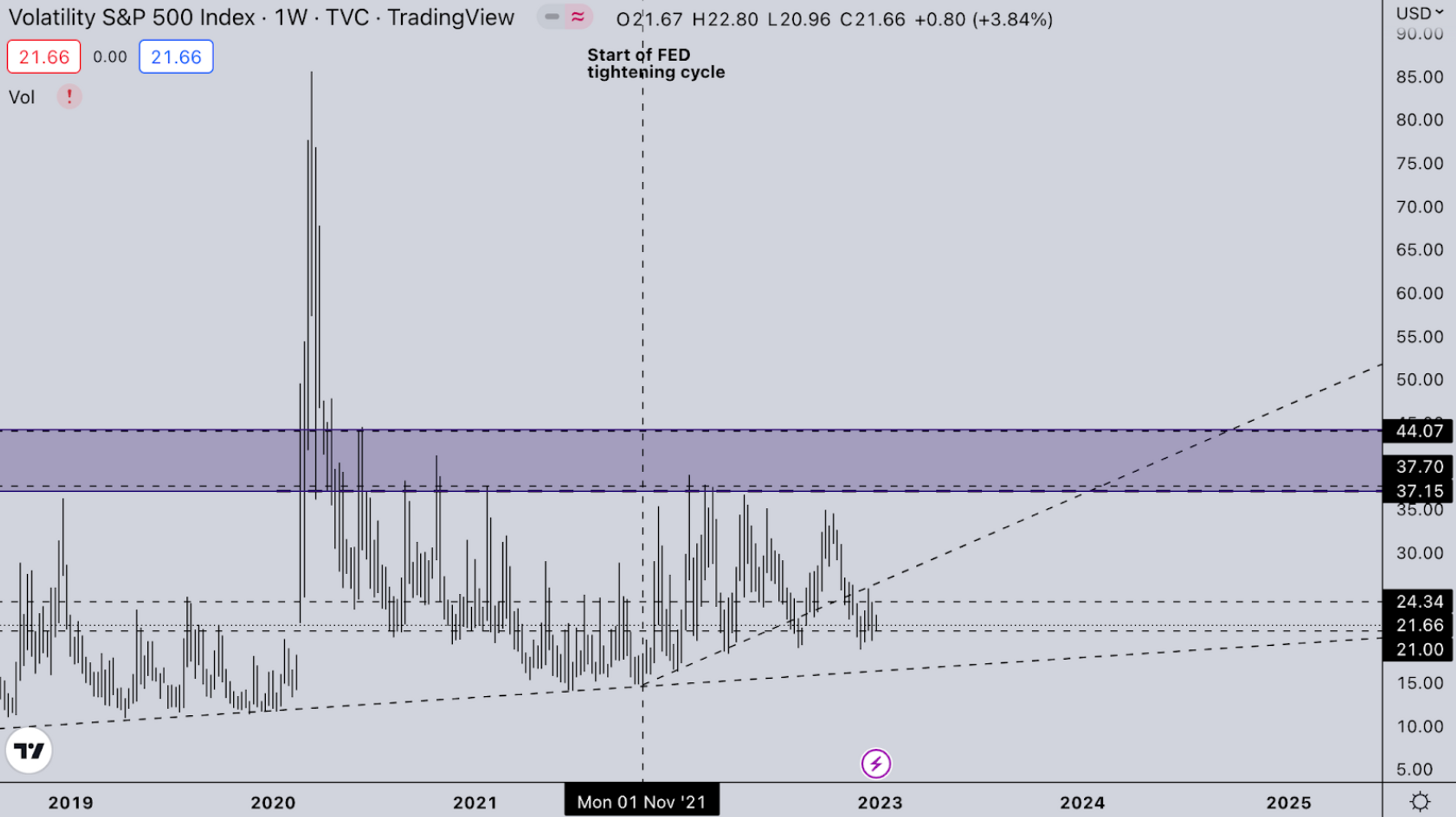

Legacy Markets - VIX

VIX is still consolidating around 21. 21 has been a clear pivotal level with the market derisking quickly above and seeing relief quickly below. With this being fairly compressed as in every market out there, we can expect that volatility will pick up sooner than later.

Legacy Markets - DXY

DXY had a stunning rally last year with the FED rates hiking while other continents did not. Around October, DXY was slowly starting to top out. This did give relief to the entire board of risk assets most seeing a typical bear market rally. This became a quick shortcut because of the FTX fraud. Coming into the new year after the large rally and large drawdown, we’d expect DXY to take quite some time to base and/or slowly regain its trend. So there still is a time window for risk assets to run.

BTC Weekly View

Going into the new year BTC has been consolidating quite a bit below the 3AC bottom from June. Price has so far failed in any downside continuation with most being just consolidation. In January the MTGox creditor payout is happening so the market will likely see some fud about this. However, most claims have long been sold to bigger entities, so it’s unlikely this will actually create massive sell pressure from the repayments themselves.

ETH Weekly View

ETH is showing quite the compression. With volatility hitting historical lows on both ETH and BTC, compressions like this have led to massive moves before, with the immediate threats of the FTX fraud being frozen in legal strings. There doesn’t seem to be a clear crypto-specific catalyst that could send this lower. (Other than macro QT and big tech being on a cliff AAPL, AMZN…). In March, ETH will have the Shanghai upgrade. We think staking will be a popular narrative in the future for institutional investors & maybe even companies. But it is still unknown if those are gonna pull the trigger in the current macro environment.

ETH/BTC

ETH/BTC is one big inception away from a giant consolidation into a micro consolidation, showing signs that it is ready for a massive move. With BTC getting quite a bit of “perceived” overhead from MTGox (Note the perceived!). We think ETH/BTC is primed for the breakout in 2023 and forward. As ETH has all the innovation going from NFTs to Defi to DEX ecosystems. If it can break to the upside, our expectation would be, it runs to ATHs on the ratio.

TOTAL2 – USD Market Strength

TOTAL2 is still weak. With only a select few coins having some strength going. All the rest are bleeding and money flowing from these back into ETH & BTC as investors are trying to flee back into safety. We think this is a theme that will play out for quite a while in 2023. BTC and ETH will first need to trade at acceptable higher levels before retail flow comes back in to speculate on lower-tier coins.

TOTAL2BTC - BTC Market Strength

TOTAL2/BTC reflects our thoughts of TOTAL2 rejecting ATHs again and now looking quite a bit weaker than ever. This is currently being carried by ETH and some other high caps (like LTC, and XMR…) that have relative strength.

Summary

- MTGox payouts in January.

- The deadline to give payment info for creditors is on 10-Jan-23.

- Wall Street is starting to show interest in distressed crypto companies.

- Valkyrie and Blackrock is already trying to make moves.

- Volatility is at historical lows, so a larger expansion forecast is expected for January.

- We are prop positioning via long ETH ATM 3m straddles.

- CPI is on 12-Jan-23.

- No FOMC this month.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide