Macro Market Update July 11th, 2022

Last Week Recap

- Major relief bounces across risk assets, with S&P500 pushing higher.

- Celsius pays down all debt in the maker vault and sends tranches of wBTC to exchanges. (Source: https://twitter.com/DeFiyst/status/1545002784197574656 & https://twitter.com/lightcrypto/status/1546010567500042241 )

- Sam Bankman-Fried hints that the worst of leverage unwindings has happened. (Source: https://twitter.com/RealVision/status/1545409942110224388 )

- EUR/USD closing in on parity for the first time in 20 years. DXY strength is still causing major pressure on all risk assets.

- Voyager Digital files for bankruptcy. (Source: https://www.reuters.com/technology/crypto-lender-voyager-files-bankruptcy-2022-07-06/ )

- US Treasury yields inverts plus oil price drop promoting recession narratives but mitigated by stronger-than-expected US job report.

Legacy Markets

- Last week VIX closed at its lowest in quite a while, under 25. This morning it gapped up over 26, which was quite expected with BTC selling off to the low 20s over the weekend as an early indicator for risk asset weakness.

- With the energy crisis becoming more apparent and news reports of multiple EU countries starting to save on gas and electricity for winter with supply being shortened by Russia.

- Last we still have the FED that’s trying to tame inflation. The problem is that inflation isn’t driven by anything under the control of the FED (mainly oil, and energy…). These are all driven by supply getting scarcer because of Russia, while the fed only has control over demand.

Open Interest & Funding Rates

Last week's rally from 20k to 22k was mainly futures driven. With an aggregate of more than 2B in OI being opened. One can speculate if this OI was short / long being opened. But seeing A bit of OI closing on the current drop, it seems it was dominantly too long. With the lack of a catalyst to see crypto trending in the current reversionary PA, the expectation is to keep seeing reversionary price action. There’s also still the Celsius excess BTC (See recap slide). Of course, this could change if crypto gets a strong catalyst or tech stocks rally higher.

BTC Weekly View

- Suppose the worst part of the deleveraging is behind us. In that case, we can expect an accumulation range forming at current prices as long as several lending firms are selling out their collateral.

- For sustained upside, several factors need to align. That said, after all the idiosyncratic events that played out in crypto, there’s a possibility that the market can still midterm undo some damage with ETH inching closer to the merge. This could drag the entire market higher.

- While the macro is still dominated by the FED, eyes should be on job reports and growth in that segment. The market is looking for bad employment/job numbers, so recession fears start. This way, the FED will be forced to ease on tightening and support the labor market.

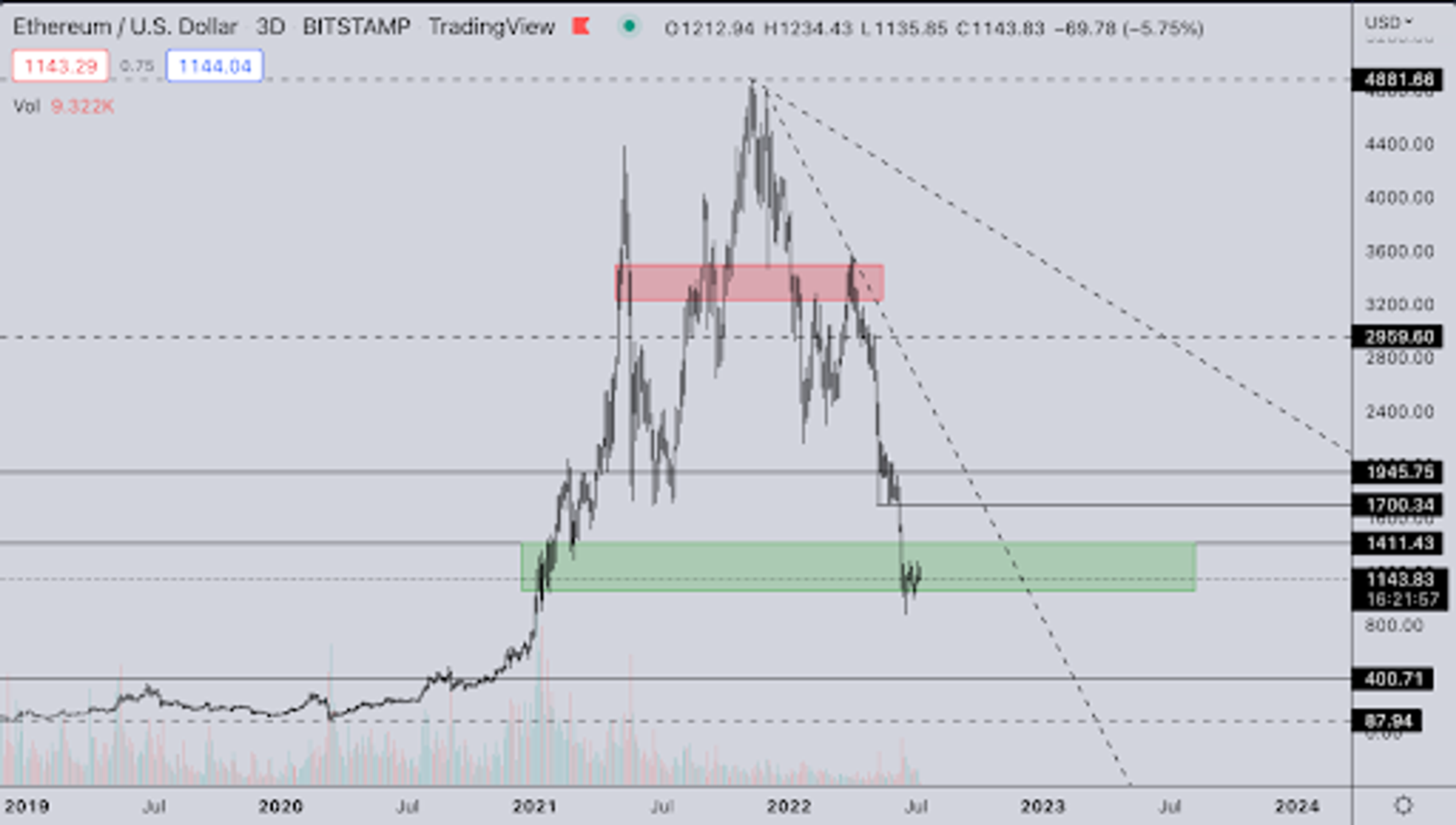

ETH Weekly View

- With ETH trading below its 2017 ATH, a first bullish retest would be the previous ATH. There are some fundamental catalysts looming for ETH (The merge). But just like BTC halving the real supply dynamic of the merge won’t be seen immediately other than a speculative rally for the event. Longer-term, this dynamic will be much more apparent.

- Currently, ETH also still has the Celsius supply overhead of 410k stETH (see linked tweets in recap slide). The market is definitely in a freeze mode in terms of upside no one wants to exit liquidity to give them higher exit prices. The probability that the market can see more upside if they find a suitable OTC counterparty is high.

ETH/BTC

- ETHBTC is still following the expected path. With the merge coming up and underlying strength in NFT’s which are holding ETH valuations fairly strong and some even seeing strong upwards pushes.

- With the duration of the 2019-2021 accumulation zone and also the current 2021-2022 consolidation, a trust upwards could see ETHBTC going multiples higher.

TOTAL2 - USD Market Strength

TOTAL2 resembles the same picture as everything else. Currently consolidating on 2017 ATH. With ETH and BTC still being caught up in possible unwinding, it makes sense for some alts to rally vs ETH & BTC. We’ve seen these effects initially with coins like SOL, MATIC… gaining more than 50% against both.

TOTAL2BTC - BTC Market Strength

- After the BTC implosion, TOTAL2BTC has shown initially surprising strength. But with it never breaking the 2017 ATH at peak valuations, it could make sense that it goes for new highs at current BTC valuations while excess BTC collateral gets distributed into the market.

- This means that alt’s probably won’t see immediate new USD ATH, but they could push pretty hard on their BTC or ETH pairings. Historically has been a good trade if the assumption is that long-term BTC and ETH go higher, they’re the perfect vehicle to accumulate more of both.

SH*TPERP/ALTPERP

SH*TPERP is also showing relative strength against higher caps. This shows that our assumption of a possible underlying alt strength might have legs against BTC and ETH.*SH*TPERP/ALTPERP is a measure of speculative risk. When SH*TPERP outperforms ALTPERP, it shows a measure of speculation in the market, which shows how much risk people are willing to take at a certain time.

Summary

- ALTBTC or ALTETH is still a trade to pursue.

- Celsius cleaning up the ship, closing down debt, and sending BTC to multiple exchanges.

- ETH merge inching closer. 14th of July, there’s another ETH dev meeting the expectation is that goerli testnet will be merged next. After that, the mainnet merge.

- CPI numbers on Wednesday. The market could see a push if we have a lower CPI print.

- With there being hints from industry giants that the worst is behind us, crypto is in a state of needing a small catalyst that could push the market swiftly.

DISCLAIMER The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide