Weekly Crypto Market Update - June 26, 2023

Last Week Recap

- U.K. inflation was 8.7% in May, higher than the expected 8.4%.

- Powell said “payments on stablecoins as a form of money” and “crypto has staying power” during the hearing.

- Bitwise/WisdomTree/Invesco/Valkyrie Funds also filed a spot BTC - ETH application.

- Crypto exchange EDX Markets backed by Citadel Securities, Fidelity, and Charles Schwab went live.

- BNB chain launched layer 2 network opBNB on test net.

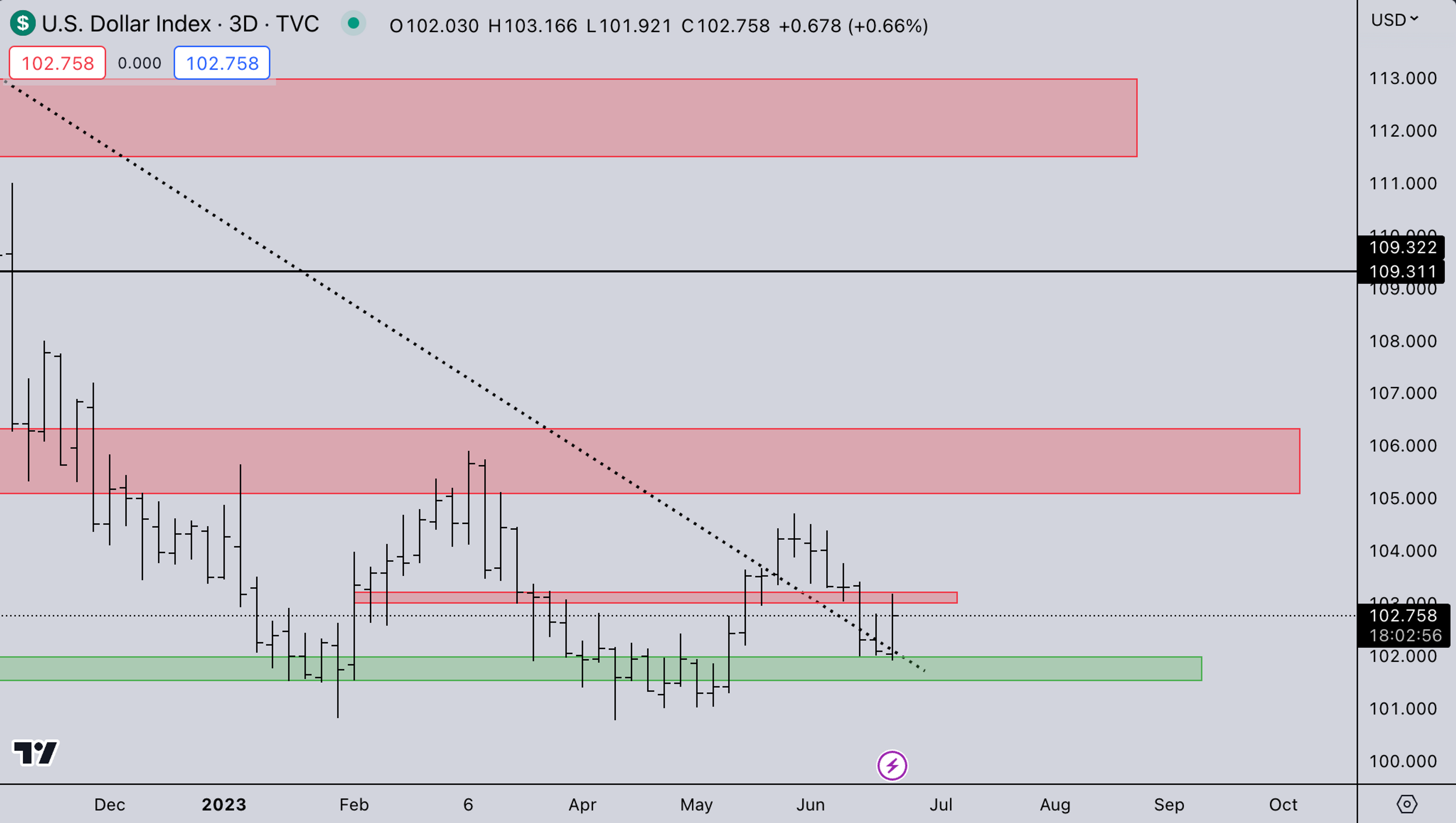

Legacy Markets - DXY

DXY is still in the larger range between 100 - 106. As long as it trades in between, we don’t expect significant movement from it in either direction. This should give move assets room to run.

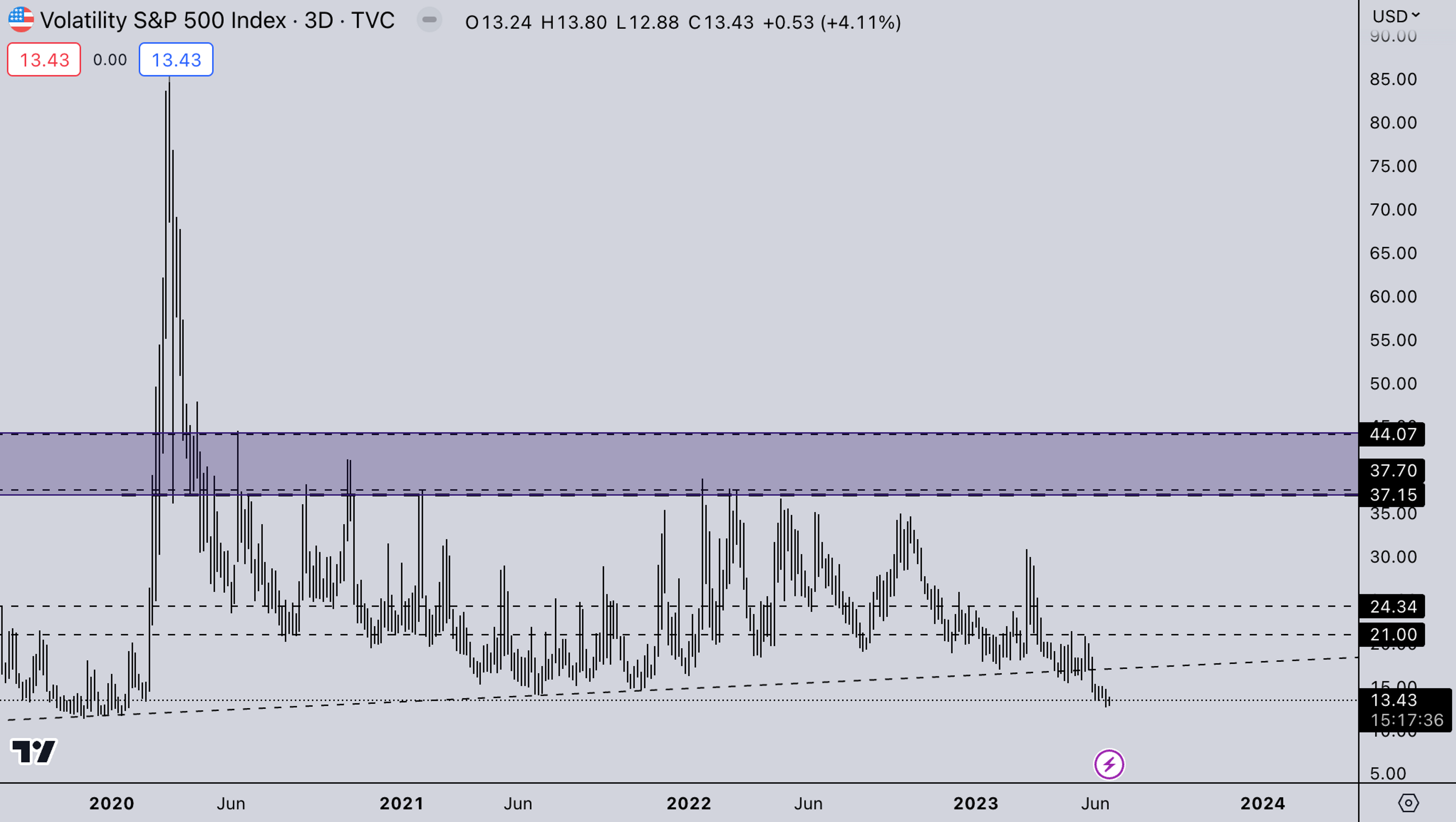

Legacy Markets - VIX

VIX broke lows and has made its lowest reading since 2020. At this point, it’s been quite a while since we’ve seen any spike in the VIX. After some large moves in stocks like NVDA, AAPL, TSLA, etc. we also see crypto rallying. The chances of getting some action on the VIX and some consolidation or slight down on the general market seem likely.

BTC Weekly View

Last week, we mentioned that a break upward could lead to quite an extended trend. BTC saw a strong impulse towards yearly highs. The chances are likely we see some consolidation this week, given where the VIX is at and it also is the end of the quarter. For now, though the trend is looking good for strong trends throughout the summer in crypto.

ETH Weekly View

ETH is also still consolidating. While BTC has fully rotated to yearly highs, ETH is still slightly below. However, BTC is still just reaching the 2021 support, whereas ETH has been consolidating on it or above it, for a couple of months now. It seems likely that during the incoming consolidation, ETH/BTC ratio will pick up and ETH will start trending upwards faster.

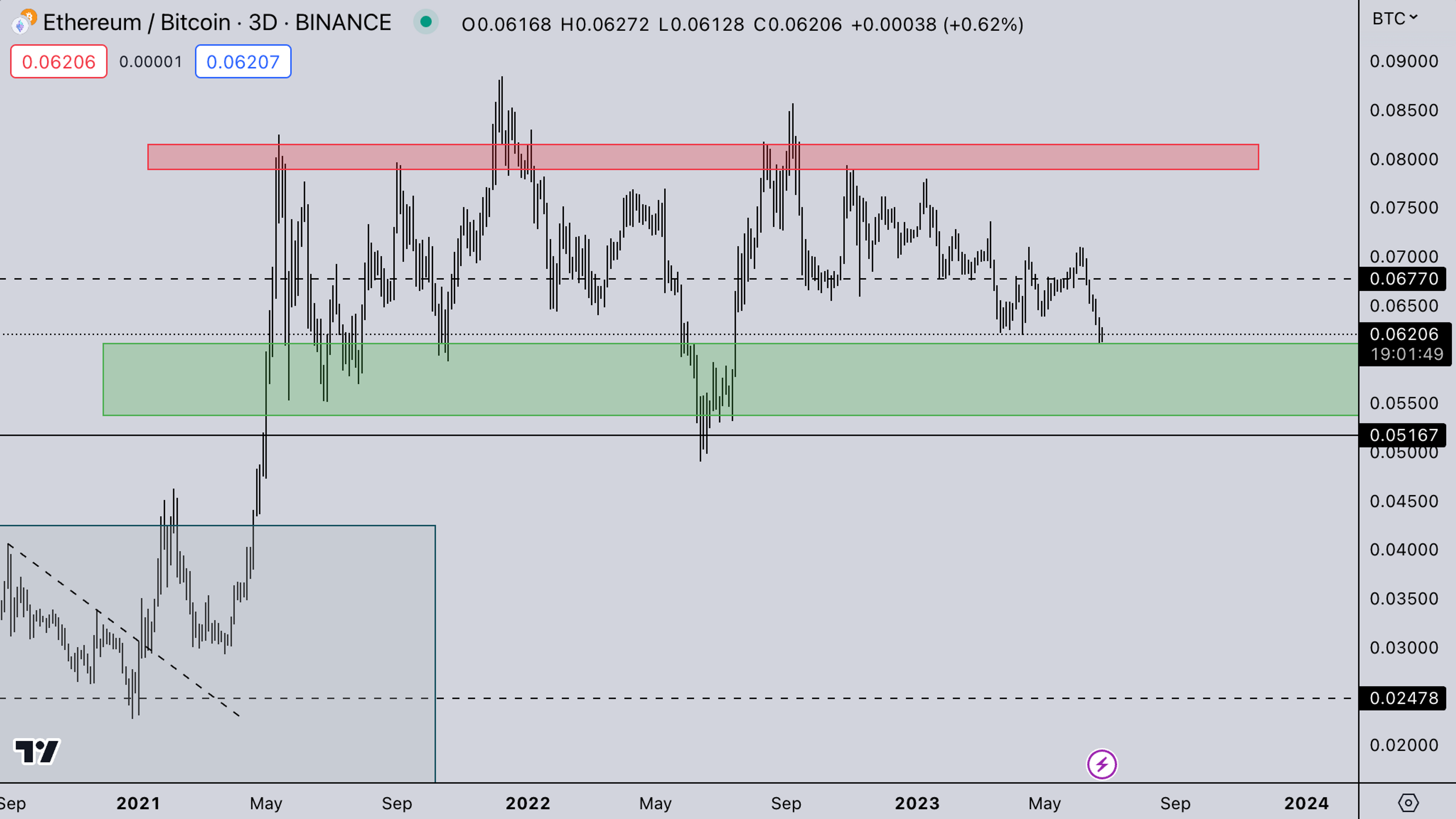

ETH/BTC

As mentioned ETH/BTC saw relative weakness. However with BTC coming into the 2021 support again. Meanwhile, with ETH/BTC reaching range-low support, it seems time for some rotation back into ETH. So we’d expect ETH outperformance. If support would fail, the BTC dominance wave is too strong.

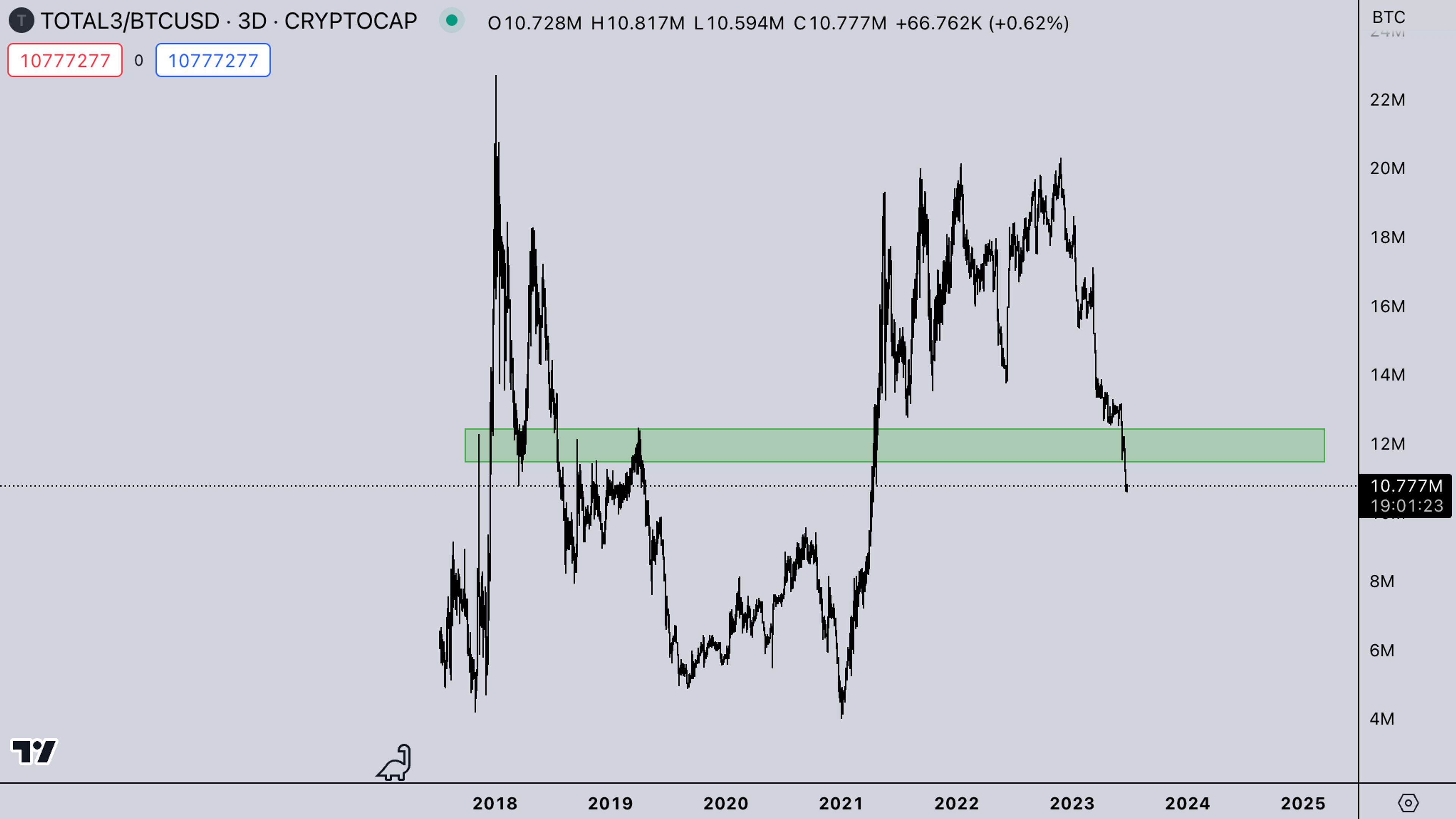

TOTAL3 - USD Market Strength

TOTAL3 is still slumping around. Some select alts saw strength over the weekend, especially older DEFI coins and also some older POW coins. However, the majority of the top 125 are still bleeding and are substantially weaker than BTC and ETH. The strength is more found on chains in lower-cap altcoins.

TOTAL3 - BTC Market Strength

TOTAL3/BTC is in a strong downtrend. As mentioned, at the moment there isn’t a ton of strength in alts relative to BTC. However the trend does seem fairly parabolic down which could lead to some mean reversion on alts if BTC consolidates for a bit.

Summary:

- Crypto saw a large move upward last week mainly led by BTC. Retracing 3 months of sideways in one week.

- The end of the quarter means we’ll see large expiry in options. And also get future contract rolls, this typically leads to some sideways price action as contracts get rolled to the next quarter.

- In the immediate short term, equities seem quite stretched. The correlation with crypto has been quite low. But a proper correction could give crypto also some extra sideways price action. If that is the case a lot of altcoins will likely catch up while BTC consolidates.

Crypto Options Update:

- ETH 30-day 25 delta R/R (P-C) moved into bullish territory last week.

- Decent pickup as well in ETH 30-day ATM vol with more room to run in our view.

- Took profit on remaining long June calls on last week’s spot ETF-related pop.

- Expected px softness this week with the CME quarterly futures expiries on Friday.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products

This post is prepared by Kairon Labs Traders: Joshua van de Kerckhove, Charles Belford, and Patrick Li

Edited by: Rizza Carla Ramos

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide