Weekly Crypto Market Update – March 13, 2023

Last Week's Recap:

- SVB (Silicon Valley Bank) and SBNY (Signature Bank New York) both blew up last week being unable to cover depositor withdrawals and taking huge losses on bonds.

- $USDC de-pegged during FUD that Circle had ~3.3B stuck in Silicon Valley Bank, but recovered to close to $1 after Circle announced that 100% of deposits from SVB are secure.

- U.S. non-farm payrolls rose by 311,000 in February, above the 225,000 estimates. The unemployment rate increased to 3.6%, above expectations.

- Binance Futures Will Launch USDⓈ-M USDC Perpetual Contract with Up to 30x Leverage.

Legacy Markets – DXY

DXY seems to be forming a larger range under 105, with it failing to break out over 105. We expect this week to have a more ranging price action, after the whole banking situation and CPI release. There will be lots of signals both ways.

Legacy Markets – VIX

VIX saw a large spike last week because of the SVB situation. With the FED (Federal Reserves) intervening, as per the latest announcement, we expect the VIX to come down quite a bit this week and possibly a good rally early in the week. With more muted price action going into CPI and quarterly option expiry in equities.

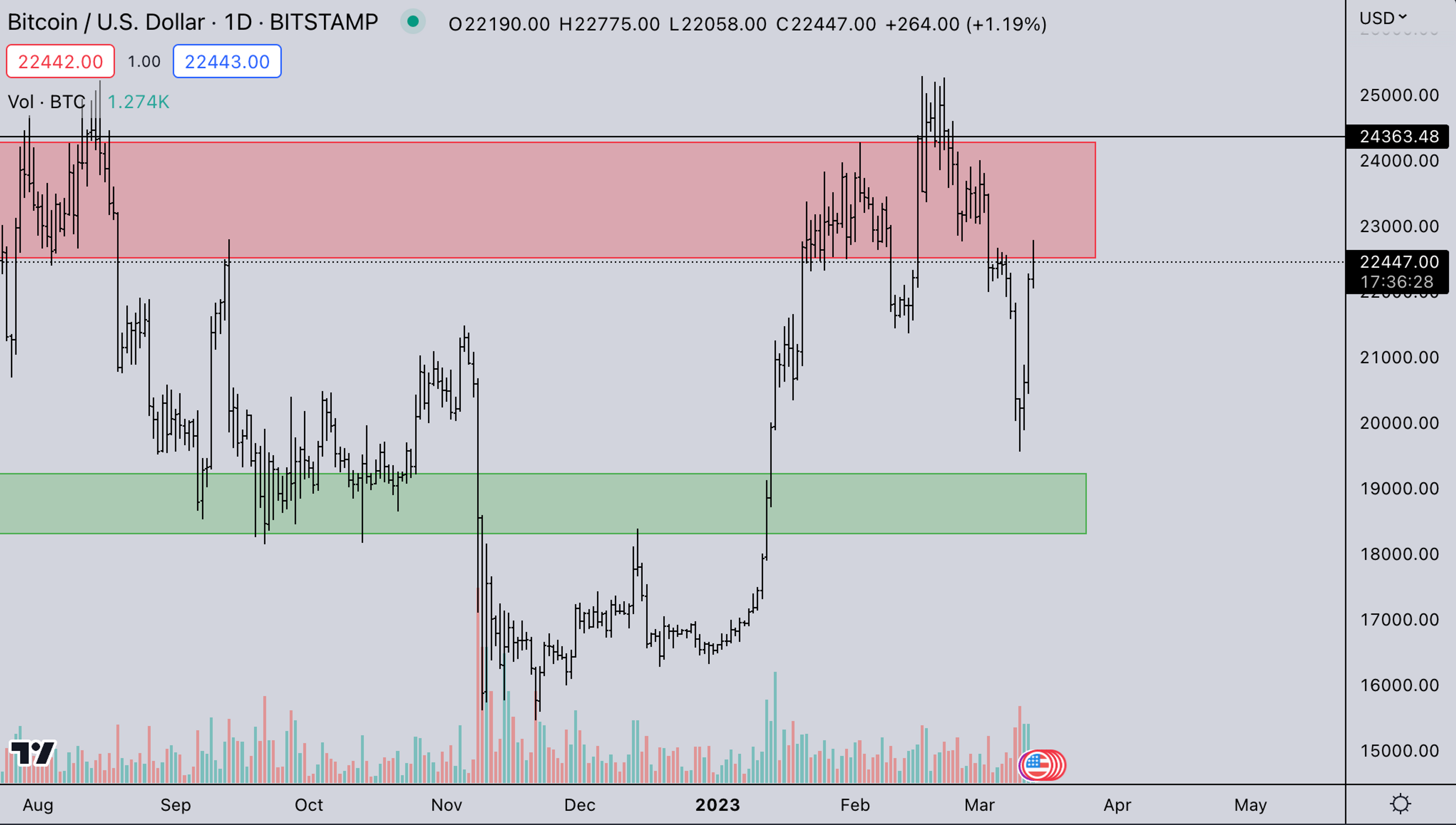

BTC Weekly View

Crypto showed major strength over the weekend. After the $USDC de-pegged in a low liquidity weekend, there was a nice flush of all positions that chased the move from January. As soon as the rumor of the FED intervening started circulating, we immediately saw crypto shooting back up. BTC is back at resistance, but with the relative strength crypto has shown - one would expect the “bear” market rally to continue upwards from here. With a first, to around 28k zone.

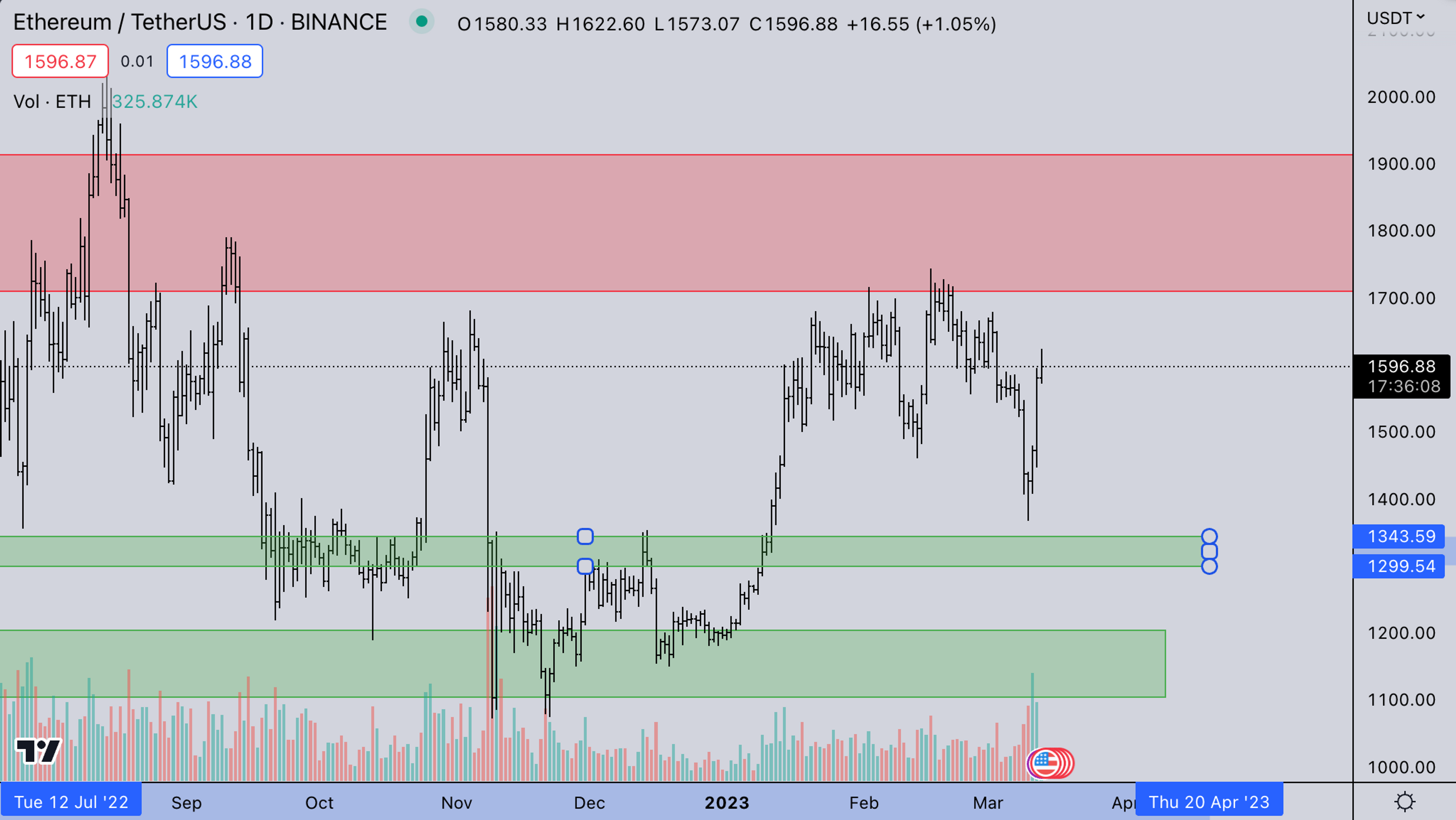

ETH Weekly View

ETH regained strength on the recovery relative to BTC and managed to close the week in green. This is quite impressive, given how deep the dip was. Crypto is still in a very big base as long as ETH doesn’t break out over 2k, so price action can be choppy and slow. Even though we do have bursts of fast movements - the true change in price behavior would be a burst that keeps it on a high momentum for several days. That said, the probability of closing the weekly green opens up the door for a run into the 2k area for ETH.

ETH/BTC

ETH/BTC spiked early on the rally, relative to BTC. It still hasn’t made a conclusive move out of the range we’ve been tracking for over 2 years. A true bull market will (in our opinion) start once ETH can break out of this range, and trend upwards. For now, with the Shanghai update right around the corner, and all liquidators from bankrupt crypto companies are selling, there is still quite a bit of uncertainty that could stall ETH/BTC.

TOTAL2 – USD Market Strength

TOTAL2 also made quite an impressive recovery. Altcoins however are still weak, relative to BTC and ETH. Seeing multiple drawdowns of over 50% from the recent highs - we’d expect alts to keep underperforming for the foreseeable future. Liquidity conditions will probably worsen after the stablecoin debacle over the weekend.

TOTAL2BTC – BTC Market Strength

TOTAL2/BTC is still weak, relative to BTC. As mentioned in the previous slide, we’d expect to see the flight to safety in quality assets remain. Meaning, liquidity will concentrate on the high caps, while small-cap altcoins keep getting more illiquid. This also means that they’ll move faster in either direction because the books will be razor-thin again.

Summary

- $USDC depeg resolves due to FED bailing out depositors of SVB.

- CPI on Tuesday this week. Expectations seem to be around 6%.

- Crypto made quite the comeback over the weekend closing for a strong week on BTC and ETH.

- With Signature Bank New York (SBNY) also being forced to close - crypto lost its 2 largest banking partners.

- Important weeks coming up! It is time to see how the market will price in the risk of banking failures, and how the FED will account for this in their rate hike path and terminal rate.

- CZ announced a 1B recovery fund to be used to buy BTC | ETH and BNB.

- Crypto options update:

- Crypto approaching quarterly expiration 31-Mar-23.

- Kairon Labs trading team monitoring market liquidity for downstream impact on position roll/close.

- ETH 30-day 25 delta R/R activity picking up, sharp move into bear territory before retracing.

- ETH 30-day ATM vol trading about 10pts higher over the week before coming off slightly.

- 13Mar23. Closed ETH 31Mar23 1500 straddle. Days Live: 6. Unannualized Return: 40.32%.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide