Weekly Crypto Market Update - November 20, 2023

LAST WEEK RECAP:

- OpenAI board ousts CEO Sam Altman; Altman to lead new Microsoft AI team.

- U.S. CPI remained steady in October, with a 3.2% YoY increase, falling below 0.1% monthly and 3.3% annual projections. Core CPI also falls short of expectations, with a 0.2% monthly and 4% yearly increase, compared to the estimated 0.3% and 4.1%.

- U.S. PPI increased by 1.3% YoY, lower than the expected 1.9%, while monthly PPI dipped to -0.5%, lower than 0.1% projection.

- BlackRock submits S-1 application for Ethereum ETF.

- South Korean crypto exchange Bithumb plans IPO in the second half of 2025.

- OKX has announced layer 2 ‘X1’ built with Polygon CDK.

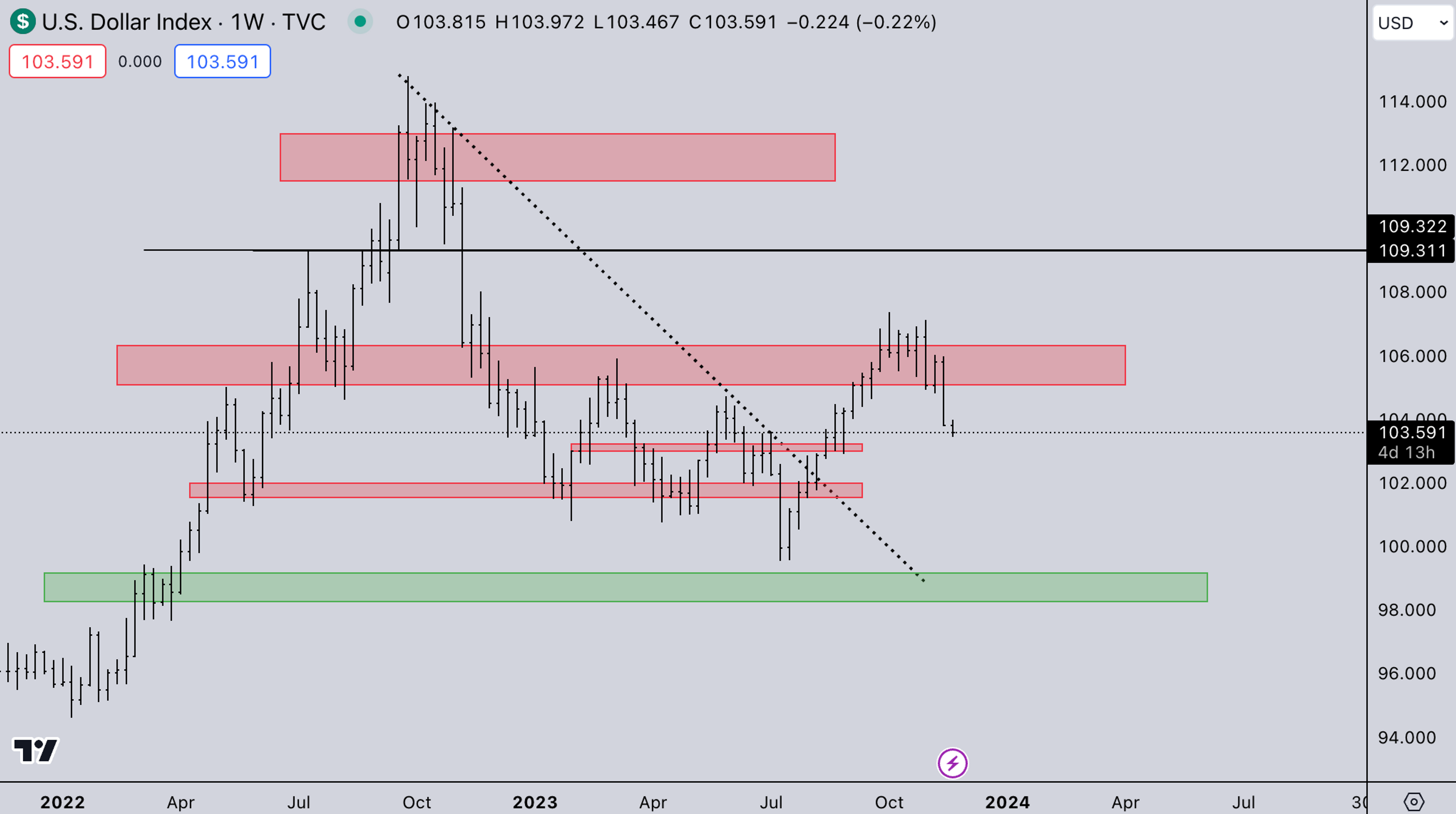

LEGACY MARKETS – DXY

DXY failed to breakout convincingly near the 106-107 level, while USDJPY stalled around 150 expecting central bank intervention. Both are very favorable for risk assets, evident in the resurgence of big tech and increasing momentum in crypto.

LEGACY MARKETS – VIX

VIX has been unable to contain any strength near 21, giving markets more room to run.

BTC WEEKLY VIEW

BTC consolidates near 37k without any decent pullbacks, seemingly setting up for a large run into 40-45k. With the ETF just around the corner, it seems like this rally still has legs.

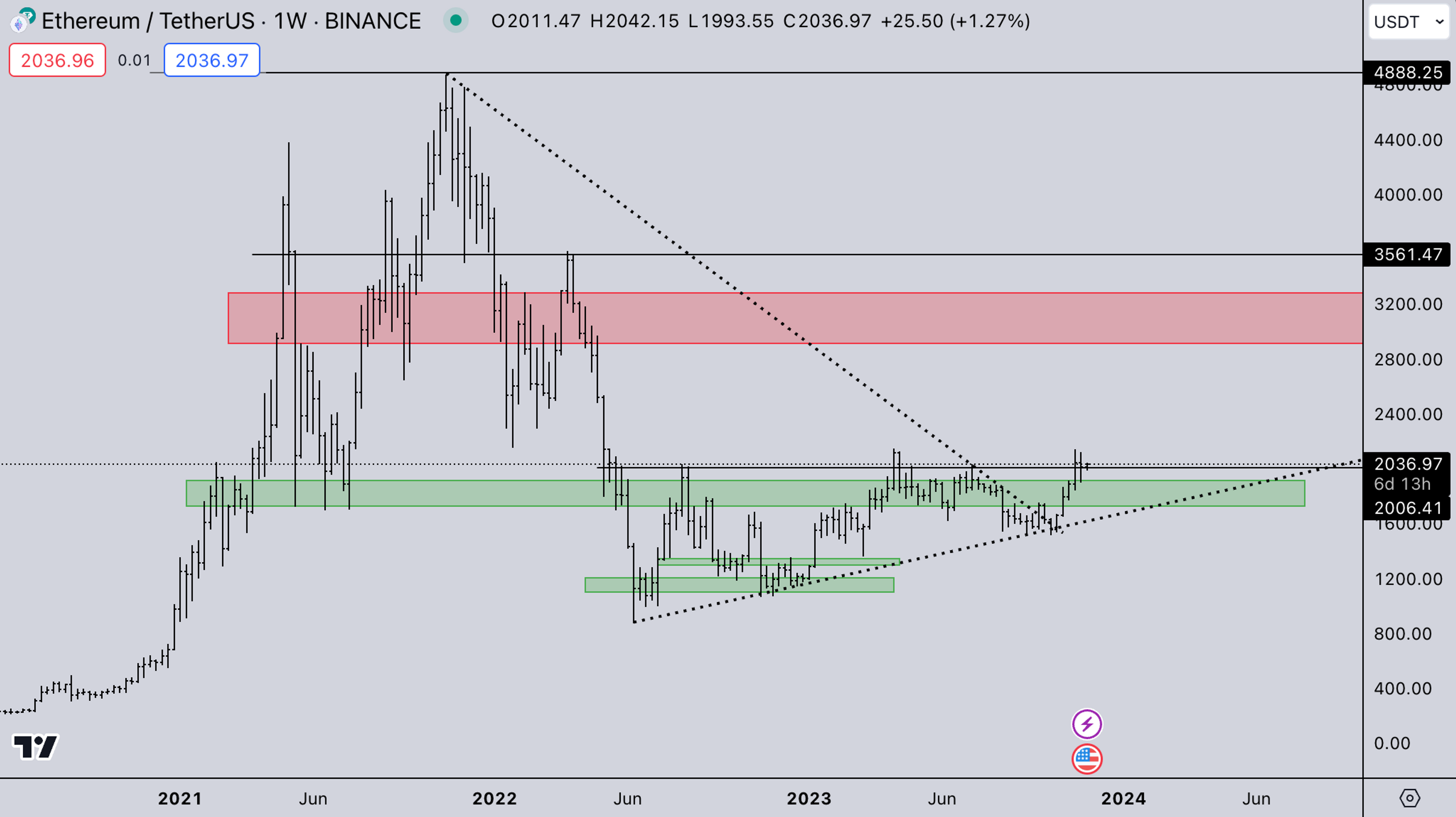

ETH WEEKLY VIEW

ETH needed sustained consolidation above ±2k for a clear path to the 2.8-3k zone. Recent market activity indicates this consolidation has taken place, with a positive retest last week confirming underlying strength in ETH.

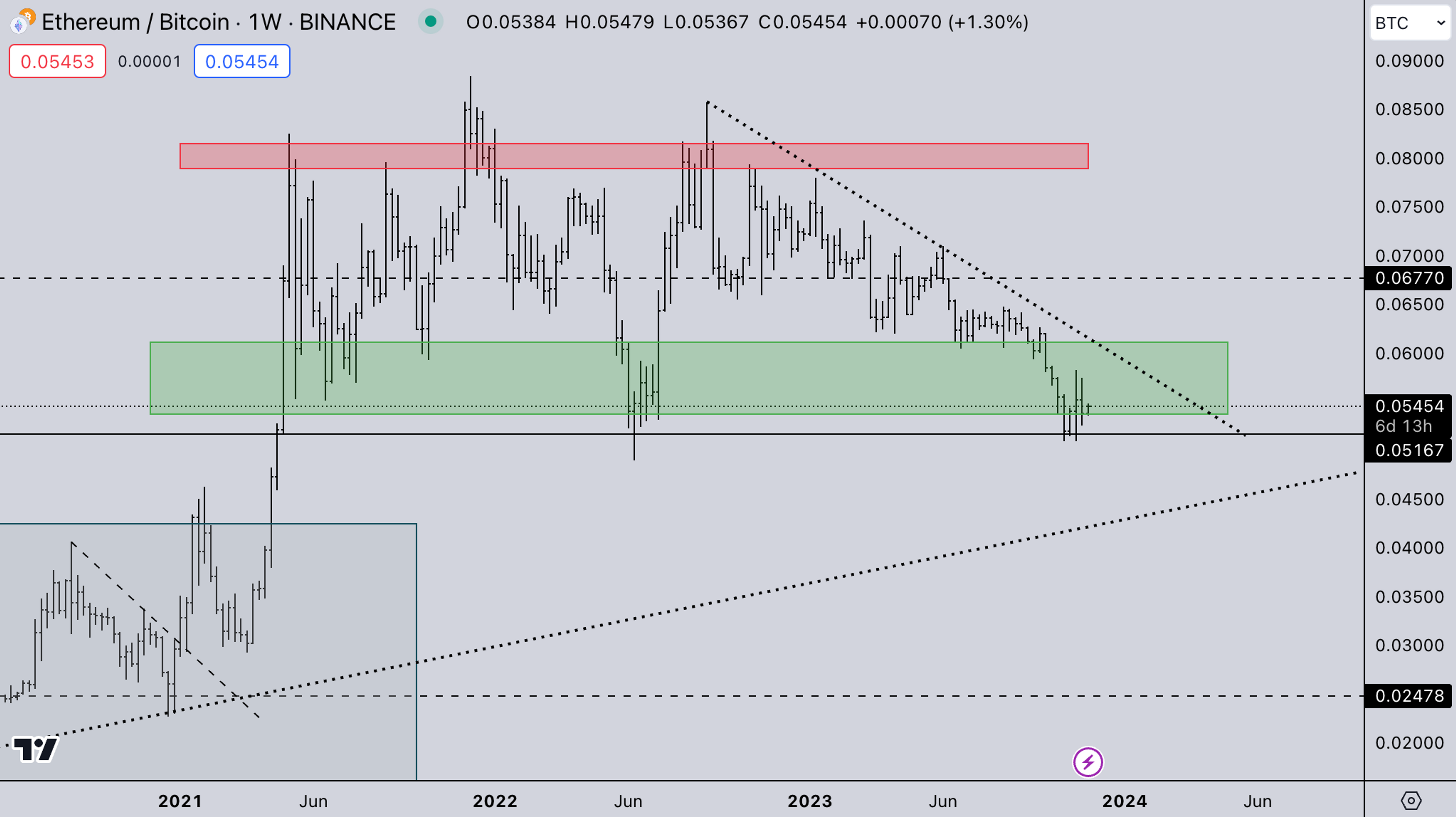

ETH/BTC

ETH/BTC is also rotating on the lows. However, it is to be noted that ETH/BTC demonstrated strength when BTC traded in a tight range last year. If BTC accelerates into the 40-45k area, ETH/BTC might experience another dip toward the long-term trendline.

TOTAL3 USD MARKET STRENGTH

TOTAL3 also seems to be consolidating in resistance. Typically, when markets consolidate below resistance, there's a tendency for a breakthrough and upward movement. For now, we’ve seen some coins outperforming the entire market.

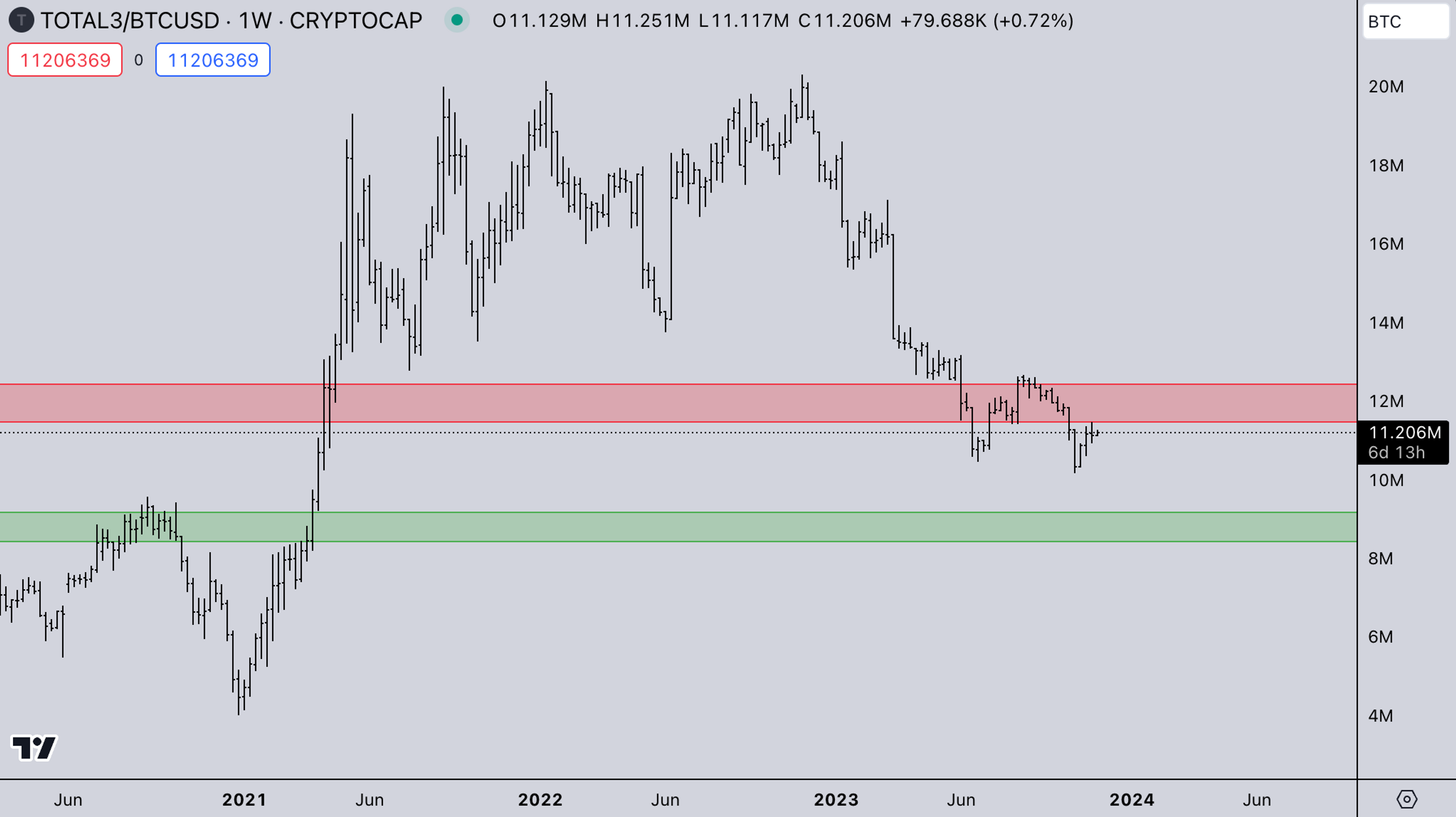

TOTAL3 BTC MARKET STRENGTH

ALT/BTC follows the same movement as ETH/BTC. If BTC starts accelerating upwards, we think the green area is likely headed for a real bottom on the BTC ratios.

SUMMARY

- Sam Altman's exit as OpenAI CEO seemingly kicks off another AI coin run.

- DYDX insurance fund got drained for $9M on YFI 50% retrace.

- ETF launch could likely become a short-term sell the news if BTC keeps rallying higher.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

This post is prepared by Kairon Labs Traders: Joshua van de Kerckhove and Patrick Li

Edited by: Marianne Dasal

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide