Weekly Crypto Market Update - September 11, 2023

LAST WEEK'S RECAP:

- U.S. jobless rates claim to have hit the lowest level since February.

- The Arbitrum community started the ‘Arbitrum Short-Term Incentive Program’ proposal, targeting to distribute up to 75M ARB of DAO-funded incentives to active Arbitrum Protocols.

- Tether holds $72.5B in US Treasury and became the 22nd largest holder in the world.

- Visa expanded the stablecoin settlement pilot to Solana.

- Crypto casino Stake.com loses $41 million due to a hot wallet hack.

- MetaMask announced a new feature: Sell, which allows users to cash out crypto for fiat currency.

- U.S. CFTC issues orders against 3 DeFi protocols offering illegal digital asset derivatives trading: ZeroEx, Opyn, and Deridex.

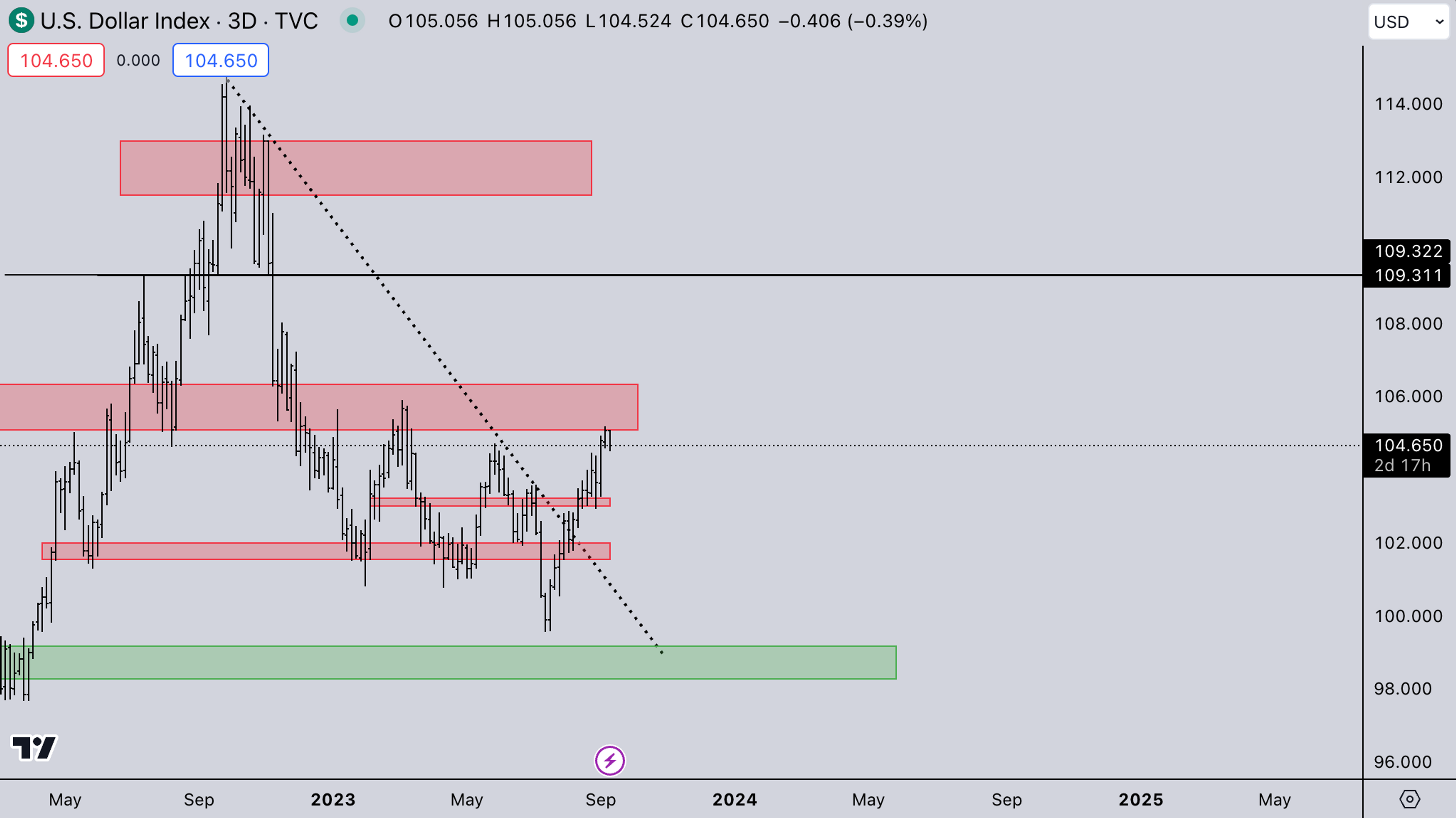

LEGACY MARKETS – DXY

As mentioned multiple times, the range for DXY is 100-106. DXY is starting to see some weakness while approaching the upper zone. JPYUSD is also at a previous central bank intervention level from last October, which markets the equities bottom at the time.

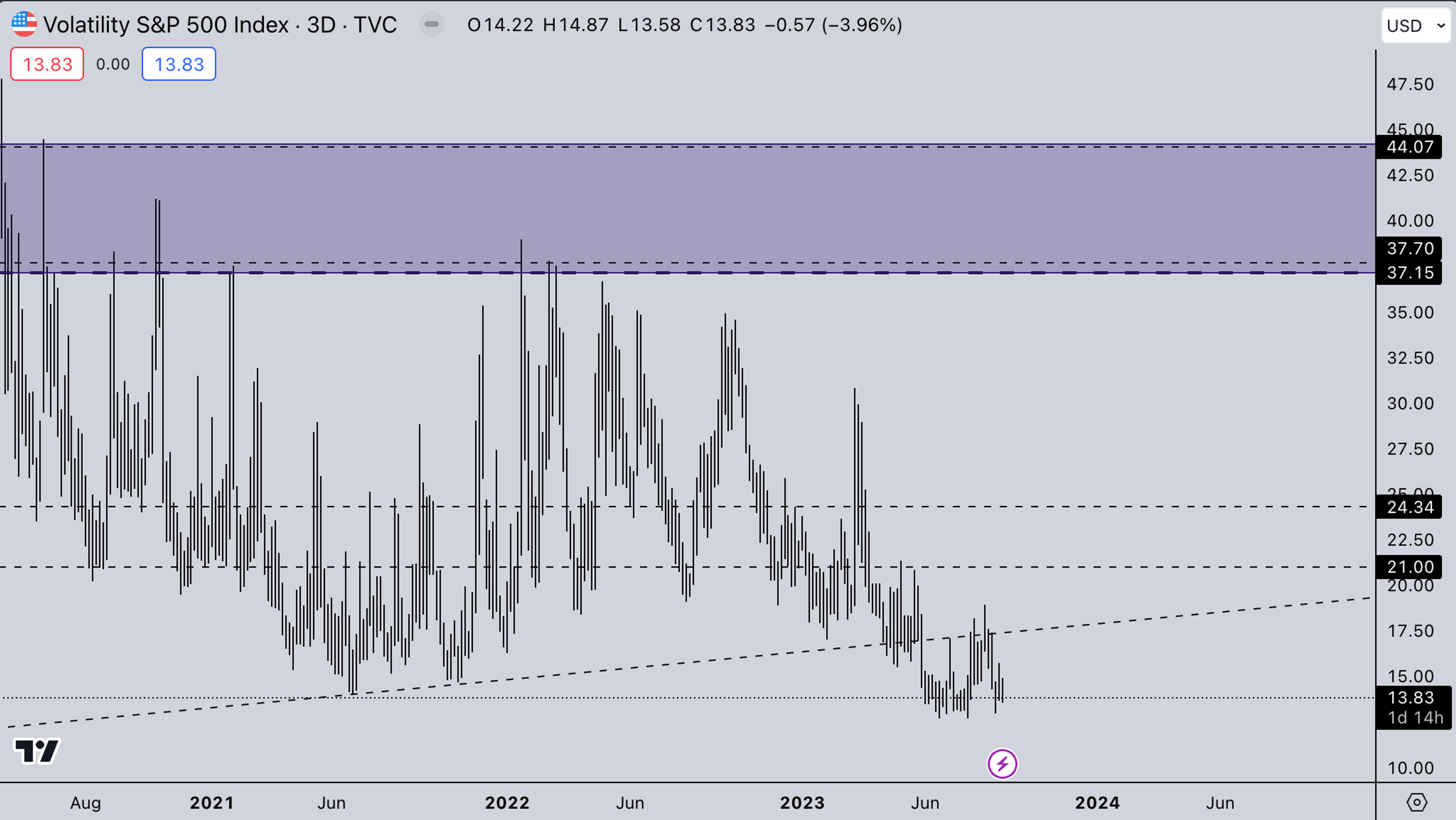

LEGACY MARKETS – VIX

VIX is still weak, giving markets room to move independently from each other (low correlation). For now, energy markets have been moving quite a lot without making headlines, with oil soaring over 30%. With CPI coming up this week, it will definitely be a point to note how that’s affecting that number.

BTC WEEKLY VIEW

BTC is still doing the single-trend-day followed by a multi-week small range. This already is the 4th week of no volatility after the drop from 30k. Q3 is also slowly ending, so the market will also start seeing quarterly roll effects from late this week onwards.

There’s also the FTX estate liquidation starting from the 13th of September, as the market continuously bleeds and altcoins are still waiting on a decision. With Galaxy Digital doing the liquidation, and crypto having attractive valuations at the moment, there’s a good chance a lot of the assets never hit the open market but get OTC’d.

To sum it up, there is some good catalyst with CPI and the FTX ruling this week for volatility.

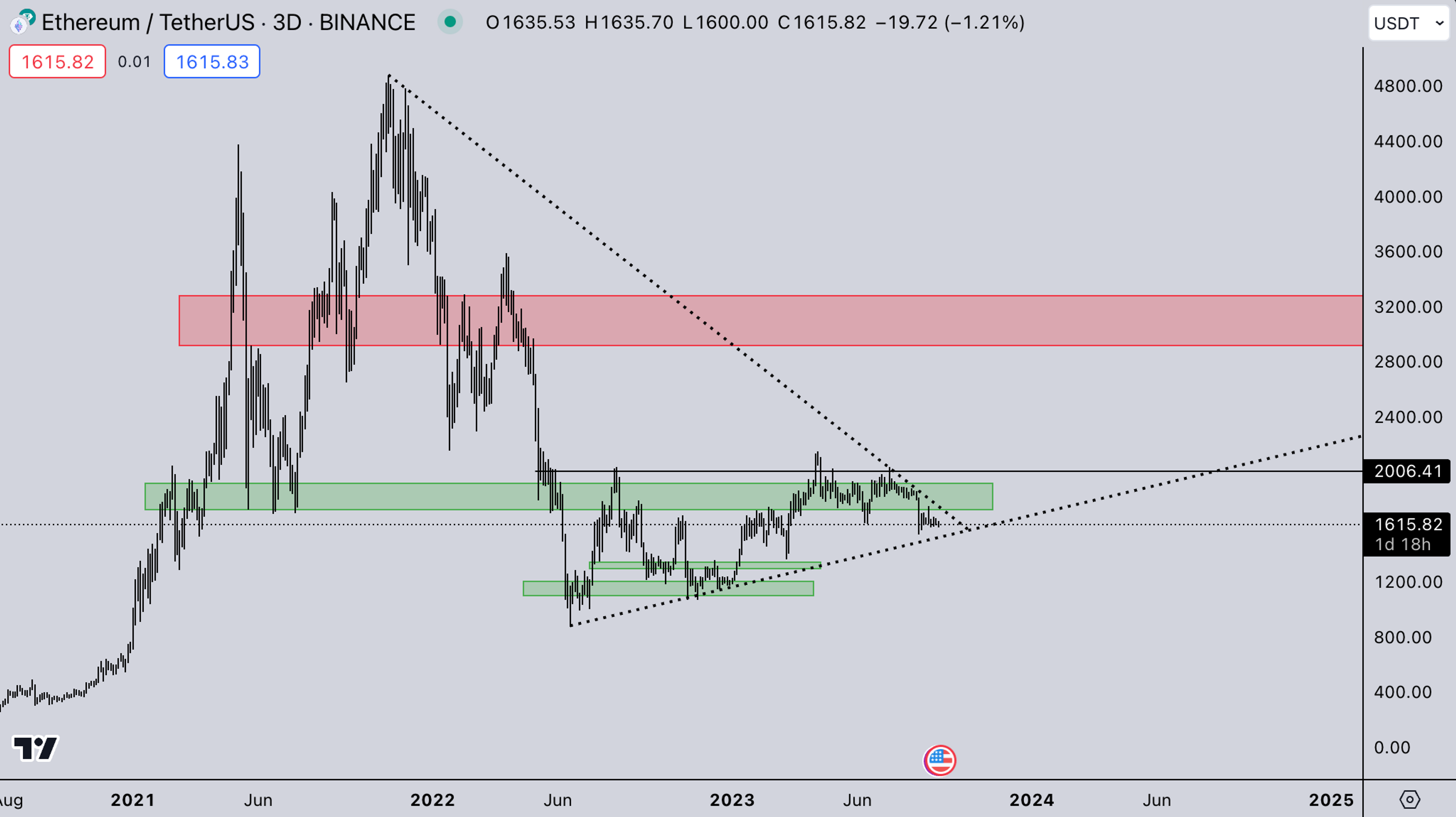

ETH WEEKLY VIEW

ETH is nearing the uptrend angle that has started the current market recovery in June 2022. Timing wise, ETH/BTC and ETH/USD both are aligning for larger movement in late September or early October. Elections next year and BTC halving in April + ETH upgrade late this year show that there are quite a few catalysts upcoming for crypto. Dips are for buying at this point if one has a horizon of 6-12 months out.

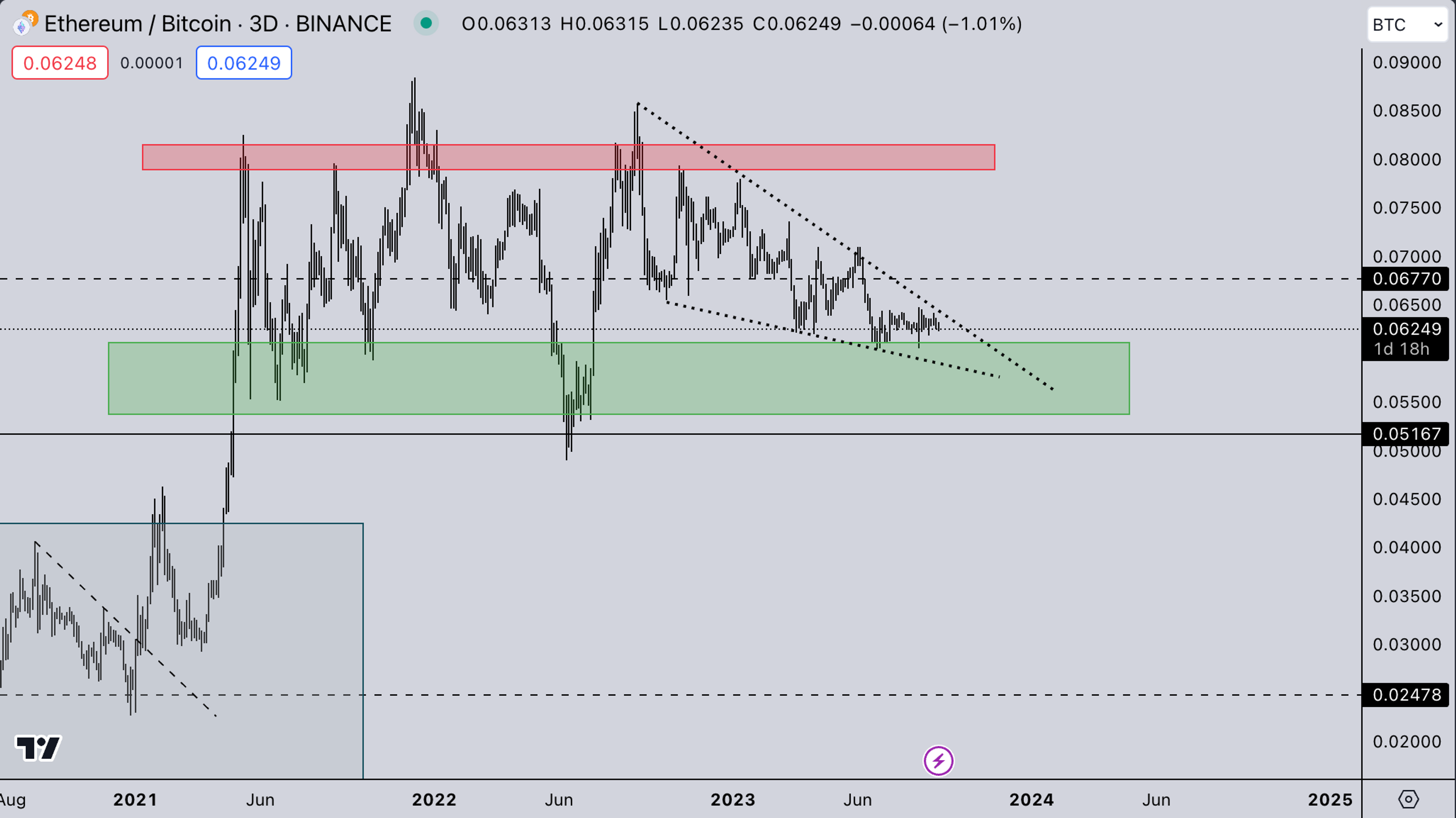

ETH/BTC

As mentioned ETH/BTC is still setting up with alignment for Q4 this year. For now, however, it’s a better option to just wait and have it clear this massive range it’s been oscillating in for almost 2 years.

TOTAL3 – USD MARKET STRENGTH

TOTAL3 is still in range. However, alts are consolidating on range lows which usually isn’t a good thing. If BTC corrects any further alts could see quite a big drop.

TOTAL3/BTC – BTC MARKET STRENGTH

ALT/BTC is still rebuilding the structure. We still think chances are likely for a BTC dominance wave relative to altcoins which has already been happening last couple of weeks with major slow bleeding relative to BTC.

SUMMARY

- FTX liquidation decision, if they can start on the 13th of September.

- FED news reporter leak shift in policy may come as inflation is dropping rapidly. (Source: https://www.wsj.com/economy/central-banking/an-important-shift-in-fed-officials-rate-stance-is-under-way-70a91f8a)

- ARK filed for ETH spot etf. Which caused quite a bit of action in ETHE / ETH.

- CPI again this coming week.

- DXY approaching previous Bank of Japan intervention levels. Some news articles already coming out about another favorable policy shift to contain JPYUSD.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

This post is prepared by Kairon Labs Traders: Joshua van de Kerckhove, and Patrick Li

Edited by: Rizza Carla Ramos

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

Understanding Market-Making Models in Crypto

Solana Staking ETFs: A Live Liquidity Stress Test for Every Founder

Launching a Token 101: Why is Liquidity Important?

Airdrops and Retrodrops Decoded: A Comprehensive Guide